Materials, industrials and telcos led ASX returns in 2025. Here’s what drove the rally and what could shape these sectors in 2026.

For all the talk of AI bubbles and transformative technologies, it was a few ‘boring’ sectors that performed best in 2025.

Commodities, infrastructure and connectivity did the heavy lifting, driving the index higher over the year.

On the numbers, Materials led with a powerful 27% gain. Industrials delivered a solid 9%, underpinned by high-quality infrastructure and logistics names. Telecommunications rounded out the winners with 8%, combining defensive income with growth.

Materials: gold shines, and critical minerals prove just that

Firstly, materials are generally associated with the big mining names of BHP Group Ltd (ASX: BHP), Rio Tinto Limited (ASX: RIO) and Fortescue Ltd (ASX: FMG). This year, gold and critical minerals, rather than the mega-cap iron ore names, drove the Materials sector’s outperformance, providing the largest lift in ASX returns in 2025.

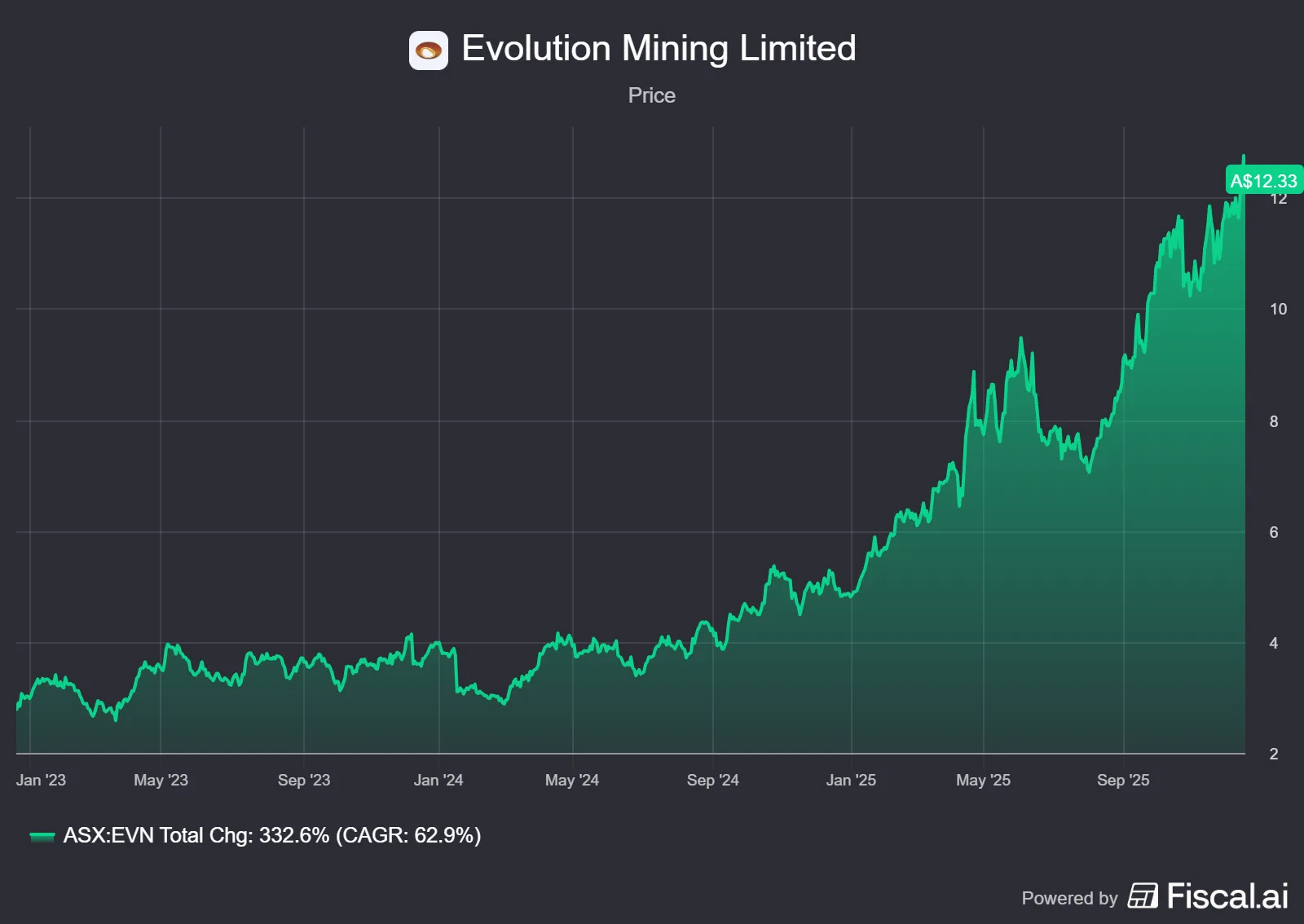

With inflation and debasement fears rife, the ‘pet rock’ price is up ~60% in 2025. Gold producers were the clear standouts as investors sought leverage to a higher gold price environment and defensiveness against macro uncertainty. Evolution Mining Ltd (ASX: EVN), up 160% year to date, was one of the market’s star performers. Newmont Corporation (ASX: NEM) delivered a similar story, climbing 149%. Its scale, global footprint and leverage to the bullion reflecting its strong performance.

In 2025, investors focused heavily on the strategic importance of rare earths and the world’s reliance on China in the supply chain. The market drove Lynas Rare Earths Ltd (ASX: LYC) up 97% as they chased exposure to rare earths’ role in defence, electrification and clean energy. Prices in rare earths remain volatile, but structural demand and a shift in security policy create a very interesting thematic.

These moves highlight a year where investors were willing to pay for exposure to tangible assets with structural tailwinds and strategic importance.

Industrials: the mixed bag performers

Without shooting the lights out, the Industrial sector provided a solid return of 9% in 2025.

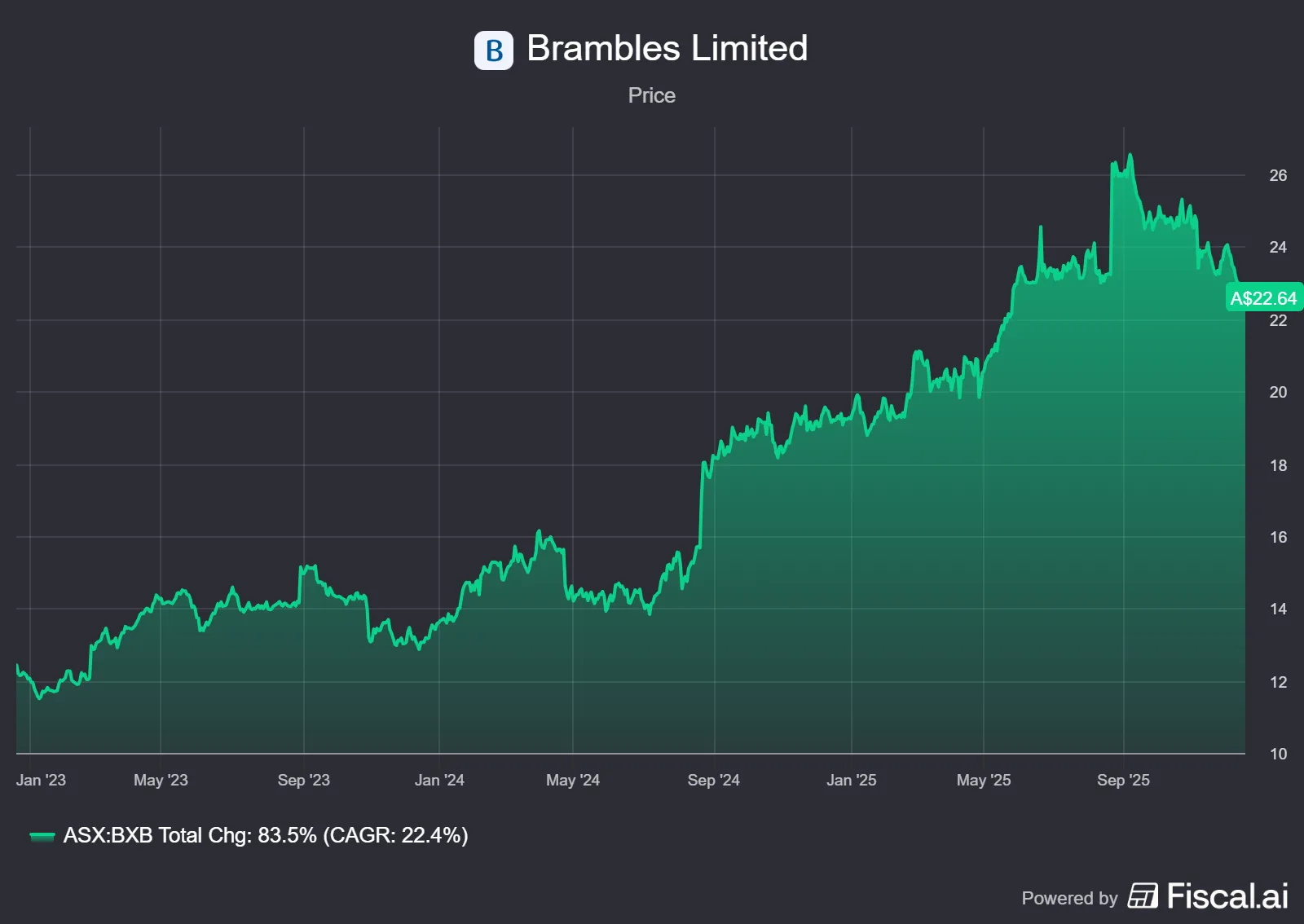

The return reflects steady compounding from some of the market’s highest-quality businesses. Transurban Group (ASX: TCL), up 9%, continued to benefit from resilient traffic volumes and inflation-linked toll escalations. Brambles Limited (ASX: BXB), gaining 18%, leveraged its global pallet pool to steady demand for consumer staples and e-commerce.

With commodity and life science exposure, ALS Ltd (ASX: ALQ) rose 44%, helped by demand for testing and inspection services across resources, environmental and life sciences markets.

Telecommunications: yield, growth and scale

This year, we saw arguably one of the more boring industries, telecommunications, combining the best of both worlds in 2025: cash generators and high-growth challengers.

At the large-cap end, Telstra Corporation Ltd (ASX: TLS) gained 21%, as management lifted prices across mobile and fixed services. With costs kept tight, Telstra’s cemented its role as the default defensive in many domestic portfolios. Its ability to pass through modest price rises in a data-hungry world helped offset cost inflation and sustain dividends.

Among the challengers, Aussie Broadband Ltd (ASX: ABB) stood out, rising +42%. Aussie Broadband grew NBN market share and expanded into enterprise and wholesale markets. Improving scale has seen the company mature beyond a niche upstart business into a national player.

Tuas Ltd (ASX: TUA), rising +11%, provided a different angle: offshore growth via Singapore. Its low-cost mobile offering has continued to gain traction. The market is increasingly recognising the value of scale in a concentrated but high-ARPU market.

Will it continue into 2026?

The million dollar question.

I’m not going to confess to be a macro expert, but ultimately, like it did in 2025, it will have an impact in 2026. Commodity prices and interest rates will continue to influence. Not to mention the impact of the United States President.

Most importantly, over the long term, disciplined investors drive their returns by owning high-quality businesses rather than by trying to trade next year’s macro swings.

Businesses that can grow earnings, reinvest at attractive returns and maintain sensible balance sheets win out. For investors with a multi-year horizon, staying disciplined on quality and valuation should matter far more than correctly guessing the next move in rates, commodities or regulation.