The AI boom needs more than chips and giant data halls. It needs the unseen highways connecting them. ASX 300 standout Megaport Ltd (ASX: MP1) lives in that middle mile, shuttling data between clouds and networks as the AI supercycle accelerates.

AI is everywhere, data centre builds are announced daily, and there’s a new vocabulary required for the number of buzzwords.

Whether it’s Neoclouds, liquid cooling, high-density colocation or GPU clusters. However, some areas aren’t getting as much attention. Investors are increasingly debating where the value lies in internet logistics. The first mile (when data leaves your device or a server), the last mile (when data arrives at the final destination) and everything in between, the middle mile. A company like Megaport sits here. In the middle, delivering high-speed routes, moving workloads between data centres, cloud providers (AWS, Azure, Google Cloud, etc), corporate networks and SaaS platforms.

Think of it as the highway that data travels on before it arrives on your street.

What Megaport actually does

Megaport is a Network-as-a-Service (NaaS) provider.

Yes, another as-a-Service acronym to remember.

What does it mean?

In the old days, to build a network, you would sign long-term contracts with telcos and wait weeks to months for a physical circuit to be installed. You would pay a fixed monthly fee regardless of utilisation. If you wanted to scale up, it meant more hardware with greater complexity.

NaaS provides a modern-day solution.

Everything is software-defined from the customer’s point of view. No new circuits to order or manual provisioning. The underlying backbone is still physical fibre, but the way you buy and manage it is virtual and on-demand. Select what you require and only pay for that. As you increase workloads, scale up or down as needed.

Megaport now connects to more than 1,000 data centres globally and runs a private, high-speed backbone using leased dark fibre, bandwidth and subsea capacity. On top of this fabric, there are over 30,000 active services for more than 2,800 customers across ~185 cities in 26 countries. It’s deeply integrated with all major hyperscale clouds (AWS, Azure, Google Cloud, Oracle, IBM, Alibaba) and a long tail of SaaS and network partners.

A leveraged play on data centres

Megaport’s value scales with increasing data centre domination.

As workloads increase and colocation (when a business rents space, power, and cooling in a third-party data centre to host its own servers and hardware instead of keeping them on-site) and cloud facilities grow, the number of potential endpoints explodes, and so does the complexity of securely and efficiently connecting them.

In August 2025, Megaport announced it had passed 1,000 Megaport-enabled locations and now offers access from around 10% of all public data centres worldwide.

Importantly, Megaport isn’t a capital-intensive landlord. It benefits from global data centre capex as volumes scale.

4 reasons why Megaport is interesting

For growth investors, there are several reasons to consider Megaport.

- Structural data centre tailwinds without the heavy capex: Long-term growth in data-centre capacity directly expands Megaport’s opportunity, but without the capex burden of building and powering facilities. Its economics are driven by virtual ports and bandwidth, not megawatts. As new data centres come online and existing ones densify, Megaport’s addressable market expands.

- A difficult-to-replicate footprint: Megaport spent a decade building 1,000+ enabled locations and deep cloud integrations. Building strong relationships takes time. That IP built with hyperscalers, colocation operators and carriers is a significant barrier to entry. Newer NaaS players or telcos can compete on price, but matching Megaport’s global reach is an incredible challenge.

- Moving up the value chain into AI infrastructure: In November 2025 Megaport agreed to acquire Latitude.sh in a deal worth up to US$300m (~A$459m). Latitude.sh gives Megaport a way to monetise not just the movement of data but the compute that processes it, particularly for AI inference and latency-sensitive workloads that benefit from proximity to users and clouds.

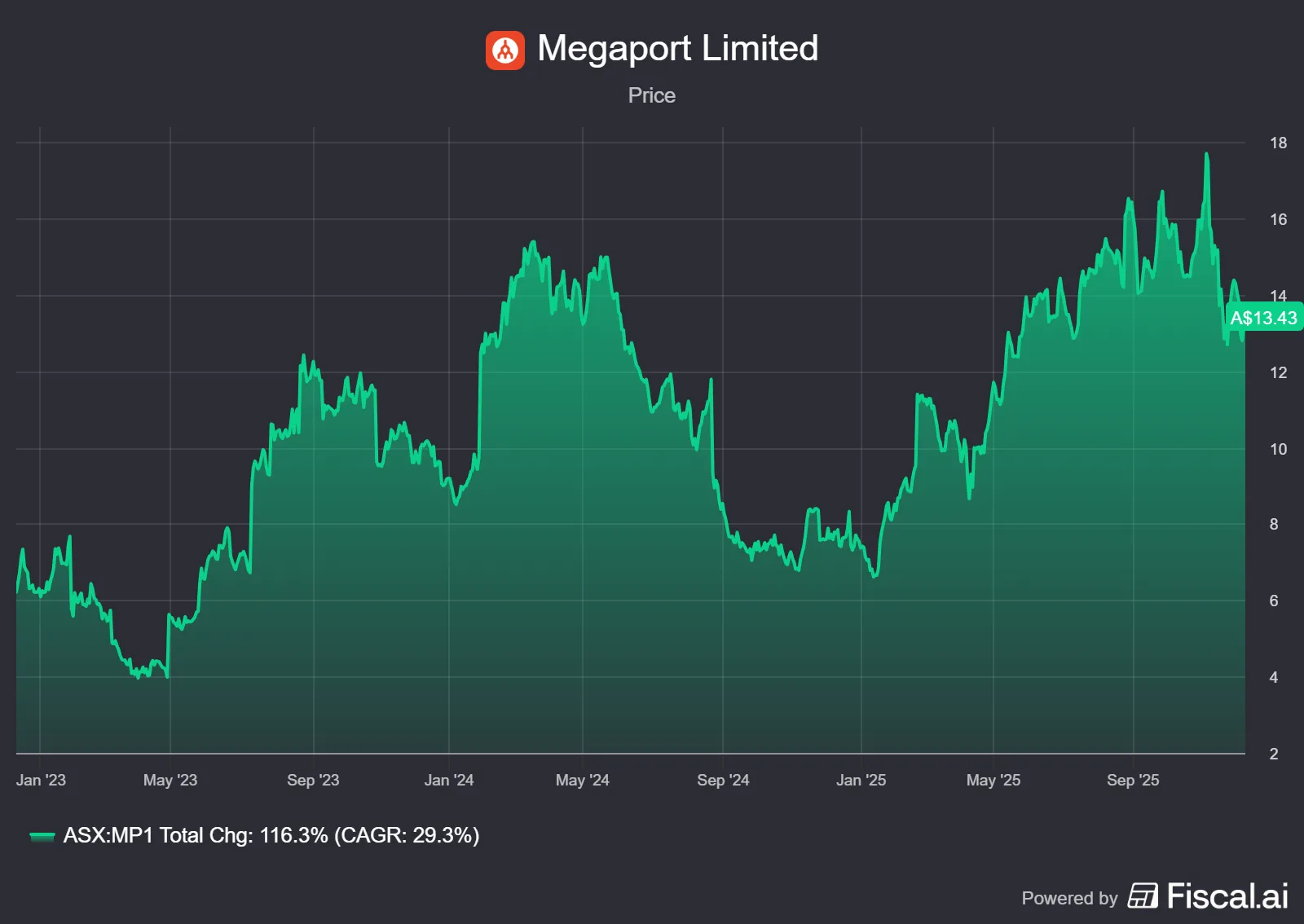

- Volatility creates entry points: Raising equity and pursuing a large acquisition create significant noise. Whether that be around dilution or integration risk, these are legitimate concerns. This uncertainty creates volatility in the share price, with the trailing 6-month share price chart looking more like a rollercoaster. For long-term investors who believe in the strategy, volatility may be an opportunity.

How Megaport is priced and how to own

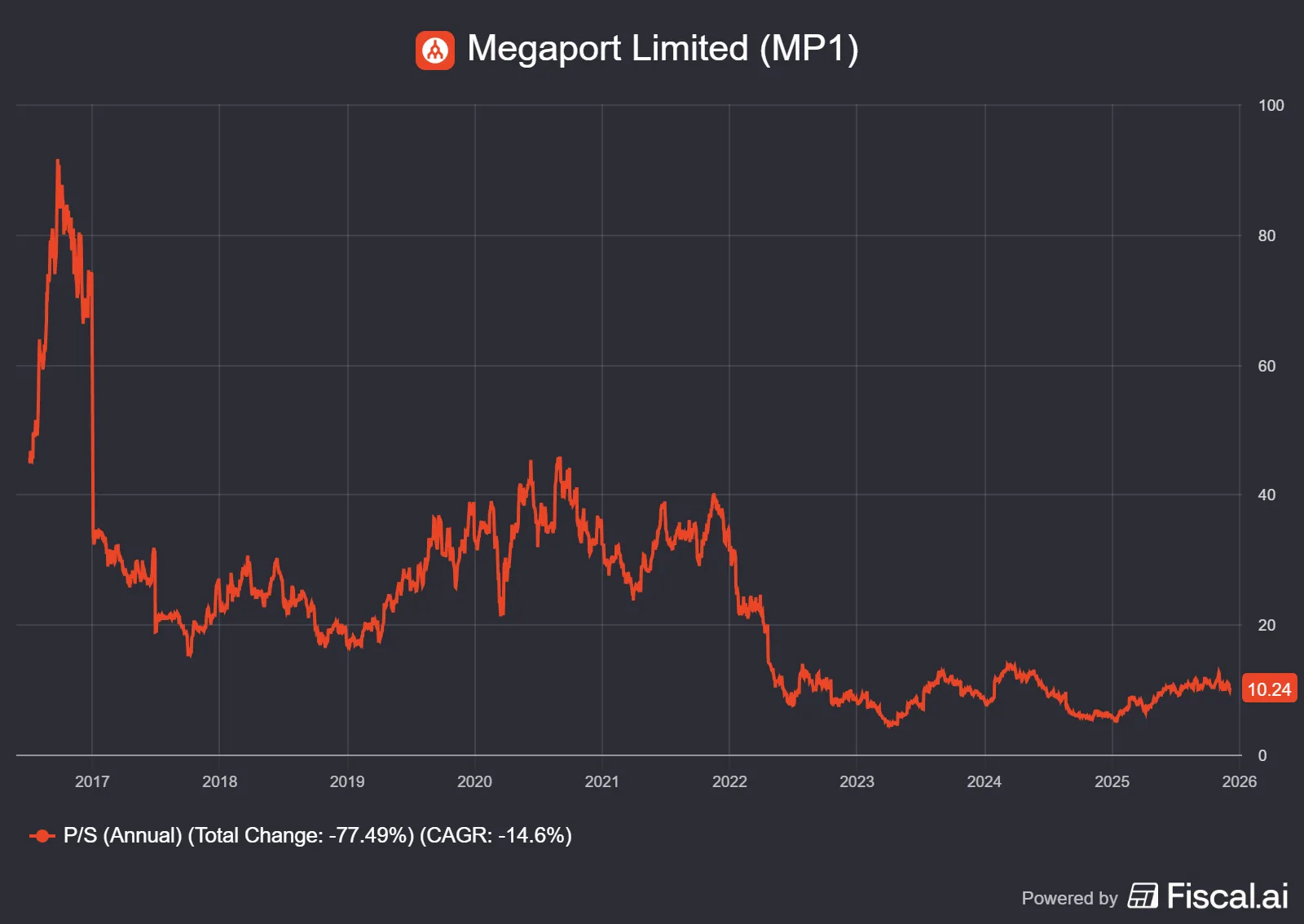

Like most ASX technology stocks, Megaport trades on lofty multiples.

Fiscal.ai estimates Megaport (with a current market cap of $2.33 billion) is trading on a price-to-sales ratio of 10.2x. Compare this to the top-tier tech of Xero (ASX: XRO) at 8.5x, Computershare (ASX: CPU) at 4.2x, and Wisetech (ASX: WTC) at 11.5x. As you can see below, though, this is down from the nosebleed section Megaport has previously traded on:

If you’re a believer in the AI and data centre revolution, companies like Megaport can provide an alternative to the heavy capex options.

With that said, Megaport is a complex business. It’s imperative that you do your due diligence and get a grasp of what makes the business tick.

Alternatively, you don’t have to hold Megaport directly. Within the Rask Invest portfolios, The major ASX technology ETF, ATEC (ASX: ATEC), includes Megaport as a top-15 holding. It is also a much smaller exposure in Vanguard’s VAS ETF (ASX: VAS).