Every day, ASX investors interact with a global giant they rarely think about, the company that keeps the entire system organised.

Ever feel like somebody is watching you?

If you own an ASX share in your own name, there’s a quiet company that already knows where you live, which bank account you use and how many shares you bought. It’s not a social network or a data broker, it’s Computershare (ASX: CPU), the market’s politely obsessive record-keeper.

As Australia’s dominant share registry, around 40% of ASX-listed entities and roughly two-thirds of the ASX 200 use its platform, including many of the market’s most biggest names. The $20 billion giant, began life in Abbotsford in 1978, this Melbourne start-up has gone global, reaching over 20 countries. Computershare keeps markets running, with a close eye on who owns what, where companies pay dividends, corporate actions, and the administration of employee share plans.

What does Computershare actually do?

It doesn’t sound very exciting, but many of the best businesses aren’t.

Think of Computershare as a specialist in transaction processing and records management. Yawn. It’s core components are:

- Issuer Services: share registry, corporate actions, meetings, proxy solicitation and stakeholder communications.

- Global Corporate Trust: trustee and agency services on debt securities and structured finance in the US and other markets.

- Employee Share Plans: administration platforms for equity compensation and Employee Share Purchase Plans (ESPPs) for global corporates.

- Supporting operations: mortgage and rental services, communication and utility services, and technology operations that sit around these core components.

On top of the fees it charges, Computershare earns “margin income”. Margin income is interest on the substantial client cash balances (uninvested dividends, corporate action proceeds, escrowed funds) that regulators require Computershare to hold.

Boring, but beautiful

By almost any definition, registry and trust services are dull.

They are highly regulated, volume growth is slow and the work is process-heavy. When was the last time you heard a shareholder say, “I love my share registry”?

But those same traits make the business model beautiful. The “sticky” mission-critical infrastructure locks in a listed company, bond issuer or global corporates with its administration systems. Those locked-in customers provide margin income as client balances grow. Changing is a pain, high regulation and switching costs lead to long duration contracts.

The core business doesn’t require heavy capex; it requires software, people and compliance. Rising interest rates have supercharged the margin income line, contributing materially to an FY24 result where management EBIT rose double digits and group margins expanded to ~35%. With rates now moving the other way, expect the opposite impact, and keep an eye on where rates may go in FY26 and beyond.

For long-term investors, that combination – sticky revenues, operating leverage and capital-light economics – is exactly the sort of “boring compounder” profile that can quietly outperform over time.

Scale advantages

Over four decades, Computershare has rolled up registry operations across North America, Europe and Asia, taking it from a Melbourne-focused to the transfer agent for more than half of a key subset of the market.

At this scale, every incremental account or transaction yields attractive incremental margins.

Today, Computershare employs over 12,000 people across five continents, serving tens of thousands of corporate clients and well over 100 million underlying stakeholder accounts.

The current earnings engine and outlook

Two key events have reshaped Computershare’s earnings

Simplifying the portfolio. Computershare has exited more cyclical, capital-hungry US mortgage servicing operations, locking in shareholder value and freeing up capital to focus on the core business.

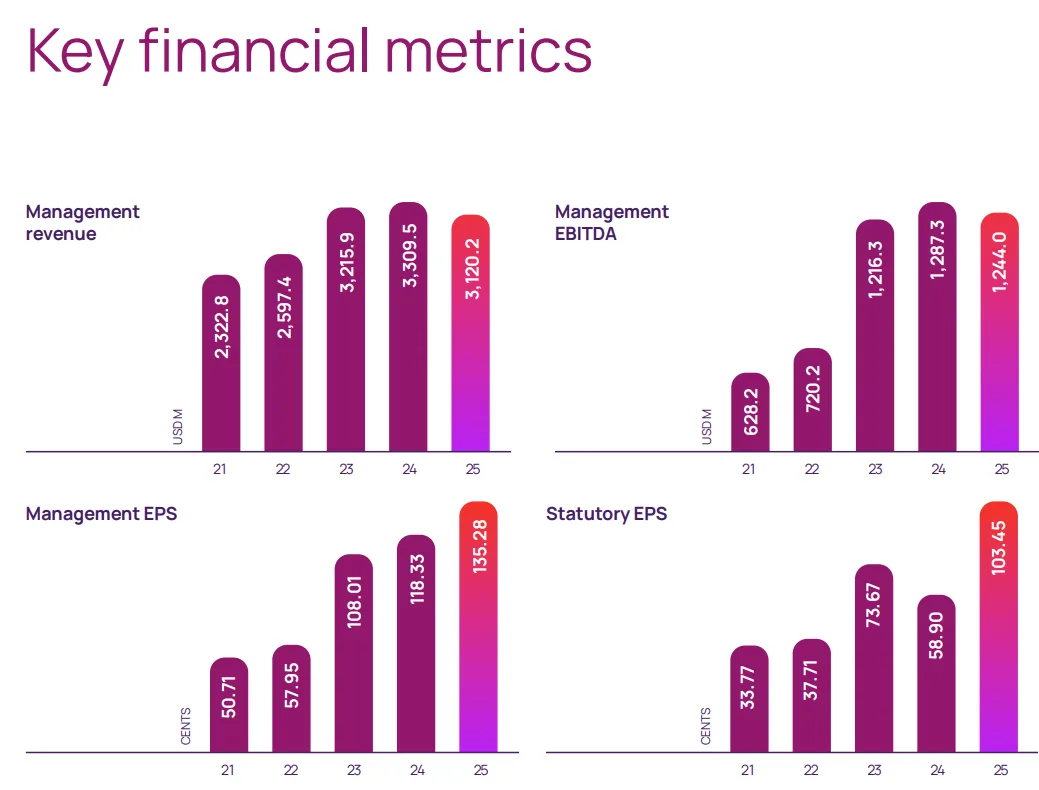

Riding the rate cycle. Higher cash rates drove higher margin income, which, combined with decent fee growth, pushed FY23 management revenue higher. As rates have eased and flirt with a rate cut cycle, management revenue growth has eased. Despite the decline in revenue, earnings per share (EPS) grew as management undertook a share buyback throughout FY25. The disposal of Computershare’s US Mortgage Services business also affects the numbers below. With lower interest rates impacting revenue, partially offset by rising balances.

Looking ahead, the key Computershare bull cases and what to be wary of

The shift towards a lower rates cycle will continue to put margin income under pressure.

Although depending on where you look, inflation seems to be making a comeback, which could lead to rates stabilising. As capital market activity grows, Computershare’s services should grow with it, leading to organic growth in fee income. Also, keep an eye on acquisitions, whether Computershare continues to grow globally.

So what could go wrong?

Increasing competition. Previously, you either logged in to Computershare or LinkMarket services (now MUFG). There’s been an increase in the number of registries popping up that provide similar products and services. Given its position in the market, it would take some move and structural change to be displaced. This could come in the form of regulatory change or technology shifts. So far, Computershare has invested ahead of the curve, experimenting in blockchain projects and digital engagement tools. If it were to see its investment drop away, it could leave it open for disruption.

How Raskals can get Computershare exposure

Computershare is not a high-growth SaaS rocket ship. But for investors willing to own “market plumbing”, it offers global diversification, recurring revenue, high switching costs and an entrenched market position.

If holding a direct position is too much, there are holdings with exposure in the Rask Invest portfolios. Computershare is the number 1 holding in ATEC with an 11.6% weighting, while Vanguard’s VAS holds around 1%.