As technology advances, the rails and rules underlying everyday payments continue to evolve.

As a result, the players shift too.

Australia is one of the fastest movers in payments, leading the way in tap payments and instant cash transfers. While a number of the world’s most prominent payments players are based overseas, companies like Adyen (ADYEN:AMS), PayPal (NASDAQ: PYPL), Block Inc (NYSE: XYZ), Visa (NYSE: V)/Mastercard (NYSE: MA) and Wise (LON: WISE) dominate globally; there are some options locally, particularly in small and mid-cap companies. These B2B players sit behind your transaction, playing the silent role to ensure your payments go through. We take a look at 3 small-cap companies growing in the payments space:

Cuscal (ASX: CCL): a recent listing on the ASX, grabbing market share

First, the all-rounder, Cuscal provides a suite of services to banks and FinTech’s.

Cuscal, an APRA-regulated Authorised Deposit Institution (ADI), is a provider of payments infrastructure, with card issuing and access to the domestic Mastercard & Visa payment rails. It eliminates the costly option for smaller banks, credit unions, or FinTech customers who prefer to purchase a system rather than build it themselves.

Cuscal listed in November 2024 with an offer price of $2.50 per share.

With a share price of over $4 at the time of writing, Cuscal has been delivering for those who participated in the IPO. In recent news, the company purchased private payments business Indue for a cold hard $75 million in cash. Two similar companies with a long history in mutual banking, allowing Cuscal to expand its offering and drive scale once it embeds Indue.

Cuscal estimates that it will create cost synergies of $15–20 million by FY29, driving a significant increase in earnings per share of 25% or more and an over 20% return on invested capital under the combined entity.

That said, while they are some impressive numbers, these are still some years away, so be cautious and keep an eye on the commentary of the acquisition’s integration.

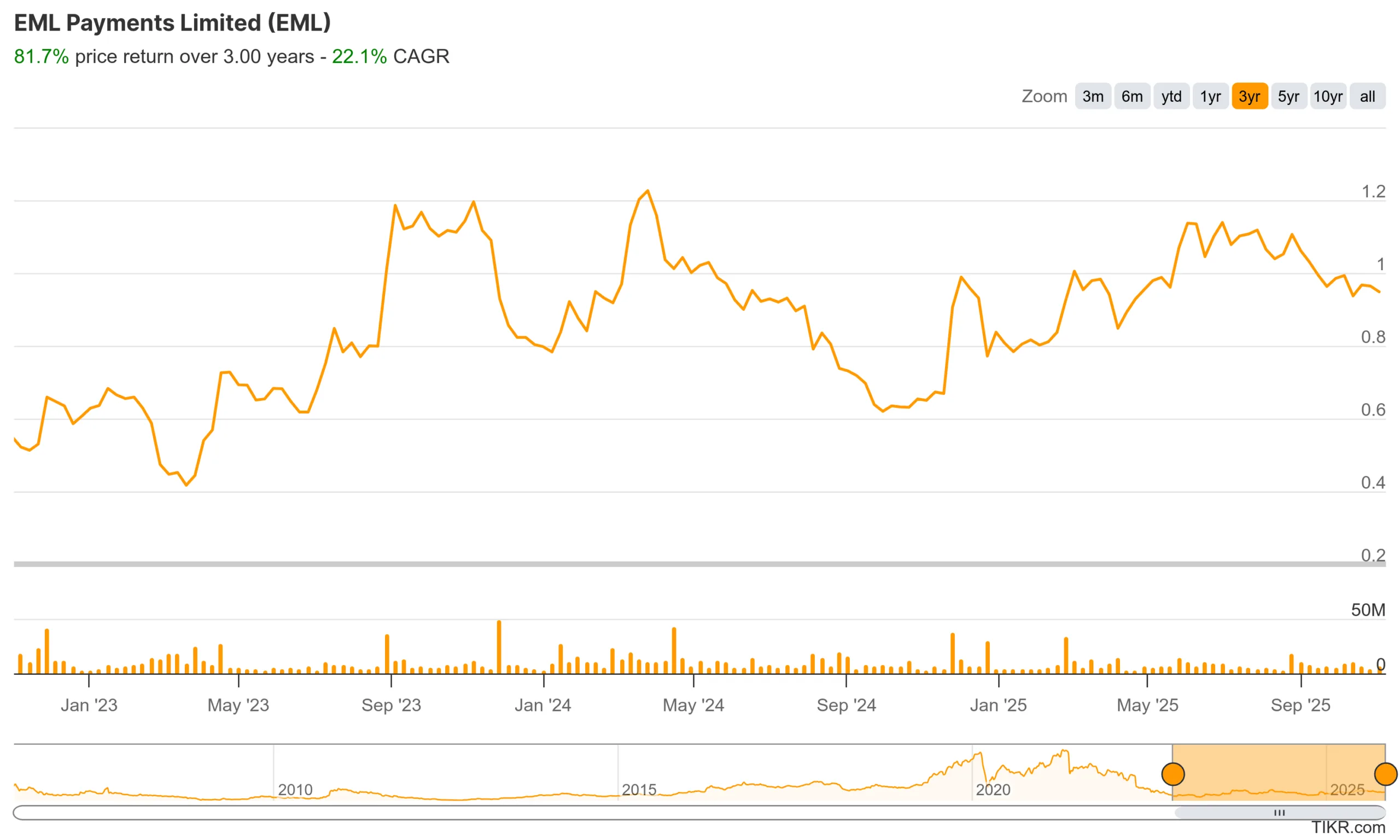

EML Payments (ASX: EML): After a poor compliance run, is it turning around?

EML sits on the card side of the payments world.

Historically, the market knows EML for its reloadable, gift and incentive cards. Once regarded as a market darling, EML’s share price tripled before Covid and returned again in the rally post, before a sharp sell-off.

EML collapsed nearly 90% from the April 2021 peak (~$6) to ~70c by early 2024

The company became acquisition-happy. It purchased Irish business Prepaid Financial Services Limited (PFS), which ultimately ran into trouble over anti-money laundering and compliance deficiencies. The Central Bank of Ireland placed a growth restriction on the company. It essentially couldn’t grow customer numbers, severely impacting its ability to generate a return for EML. Ultimately, EML wound down the Irish unit, marking a painful end to the Irish experiment.

It didn’t stop there.

EML acquired Sentenial (Nuapay) in 2021, which led to significant impairments and the assets were eventually sold to GoCardless in 2024.

So can you trust management to turn this around?

Well, it’s an entirely different team. Throughout all of the above, EML underwent several management changes as it sought to find the right fit to take them forward.

So with a lot of the crap cut, does it mean EML is ready to rocket again? With fewer programs and attractive unit economics in the right light, it can look appealing. The overhang of compliance issues may always sit over it, though, with investors likely wanting to see a continued bill of clean reporting.

EML is a complex business and should be approached with caution; fool me once, shame on me. Fool me twice….?

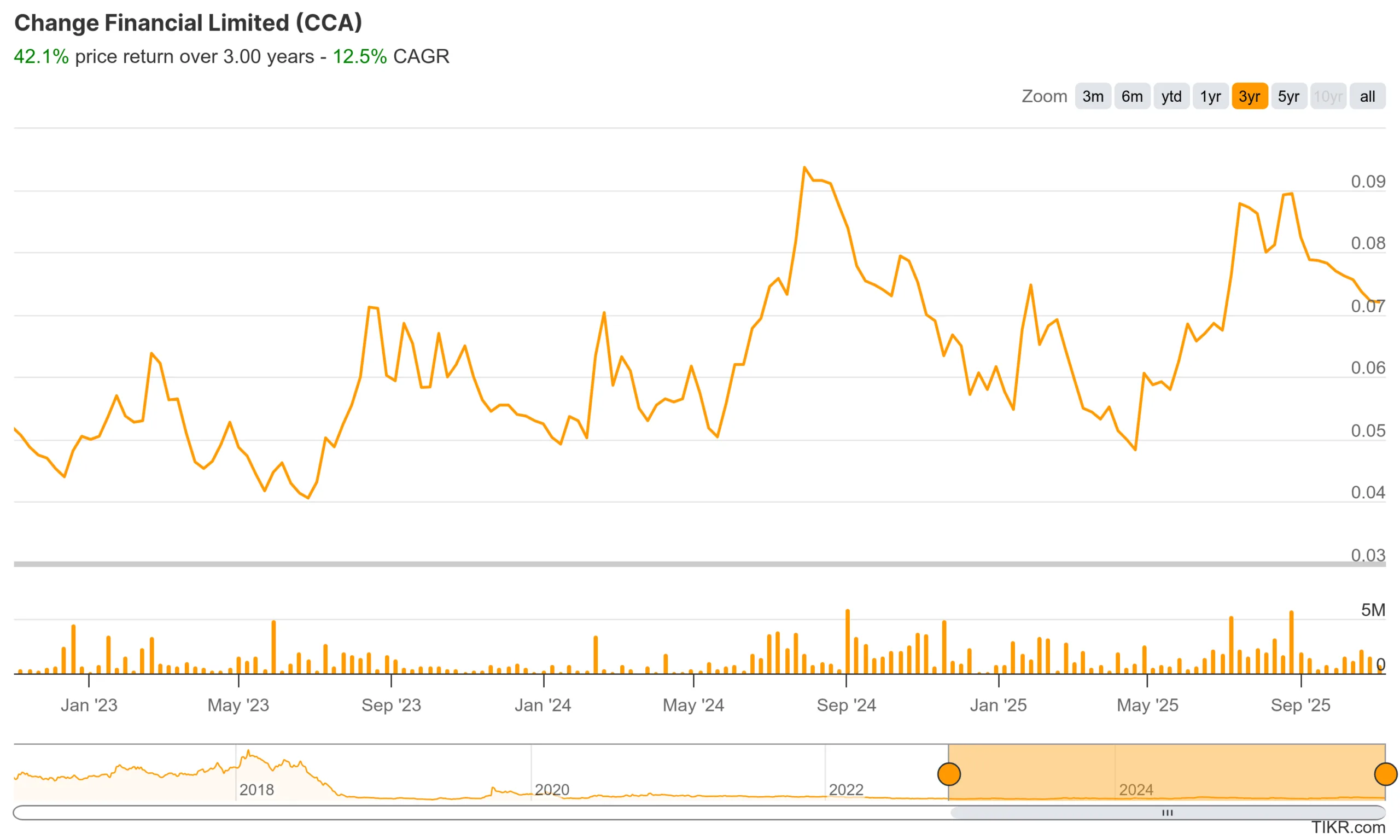

Change Financial (ASX: CCA): cards and tech

Finally, Change Financial operates at the smaller end of the market, with a market capitalisation of around $50 million.

It operates on either end of the payments cycle, issuing cards and providing compliance software for credit unions and FinTech’s. Change also provides PaySim, a testing platform that simulates end-to-end transactions for activities like ATM withdrawals and EFTPOS transactions for big banks and supermarkets, etc. It’s a must do for banks and processors to be allowed to use networks.

Having recently exited its operations in the US due to regulatory concerns, Change has removed a significant cash burn. It is now been able to focus on growth in the ANZ market. Serving the smaller end of town itself, it has managed to gain market share of customers that are too hard for bigger banks or Cuscal to look after.

While yet to make a profit, Change is forecasting a jump in revenue growth in FY26, expected to be in the range of US$16.5 million (A$25.4 million) to US$18.0 million (A$27.7 million).

The risk is in execution. Change needs to continue winning customers and continue scaling towards profitability. An exciting watch, but make sure you’ve done your due diligence!

| Company | Share

Price |

Market Cap ($m) | FY’25 Revenue ($m) | Market Cap/Revenue | FY’25 EBITDA ($m) | Market Cap/EBITDA | FY’25 Profit/(Loss) |

| Cuscal (CCL) | $4.13 | $791 | $290 | 2.7x | $52 | 15.2x | $29 |

| EML Payments (EML) | $0.92 | $356 | $221 | 1.6x | $58* | 6x* | ($52) |

| Change Financial (CCA) | $0.07 | $48 | $23 | 2.0x | $0 | N/A | ($3) |

*heavilly adjusted EBITDA watch out for these!

Portfolio approach: basket or ignore and stick with the big guys?

All levels of investing bring risk.

Beyond company specific risks, small-cap companies are often at challenging positions in their business lifecycle. Will they be able to transition from revenue growth to profitability? Or are they a missed customer away from another capital raise and further dilution? It is the risk of the smaller end of town. You could look at the three as a small-cap play on payments, taking a basket approach and holding a portion of all three.

This way reducing your risk and exposure to one story.

Outside of small company risk, there are plenty more regulatory risks lurking. Only recently, the RBA threatened changes to merchant fees, with the potential for wide-ranging impacts. Not to mention Anti-Money Laundering, Know-Your-Customer, and cyber threats.

Perhaps it’s just easier to stick to the tried and tested at the top of the market?

Whichever way you go, Rask Invest has exposure to a number of these companies through its exposure to international holdings.