We’re planning to launch Rask Invest “Custom” in the next few months and we need your help.

So tell me, what’s in your satellite?

Remember: custom Satellite holdings inside Rask Invest can’t overlap with your Core Rask Invest strategies. For example, given we hold the iShares S&P 500 ETF (ASX: IVV) inside Jupiter, we can’t make it an overlapping satellite as well. It’d just defeat the purpose of a Core & Satellite approach.

How Rask Invest custom work from here

- The team and I will research ‘best expressions’ for a given exposure

- We’ll keep exposures simple (e.g. one ETF, LIC or share)

- We’ll start with a limited menu (e.g. 5-10 exposures)

- Once available, you’ll be able to configure your exposure inside your Rask Invest dashboard

So far on our list for Rask Invest Custom, we have:

- Bitcoin exposure

- AI exposure

- Cloud compute

- Rising healthcare costs

- Cybersecurity

Will Rask launch an active strategy?

Lately, given how we’ve performed, we’ve been asked, and talked about internally, if we’ll be launching a pure active strategy of our own.

The answer is a firm ‘maybe’.

My plan is to make Saturn, our highest growth core, much more punchy in the next 12-18 months than it is today (especially if/as markets become more frothy).

You can view the methodology or ‘style’ of our Rask Invest portfolios using the strategy pages on our website.

I should also flag that we’re no longer showing our individual holdings on the website for all to see. It’s still free to see what’s inside our portfolio – but you’ll have to log-in to Rask to see the holdings – just log-in or create a free account.

This move just better protects our IP, especially if we begin to become more active in our portfolios, such as Saturn. We don’t want other brands taking our special sauce and marinating it over their services… 😉

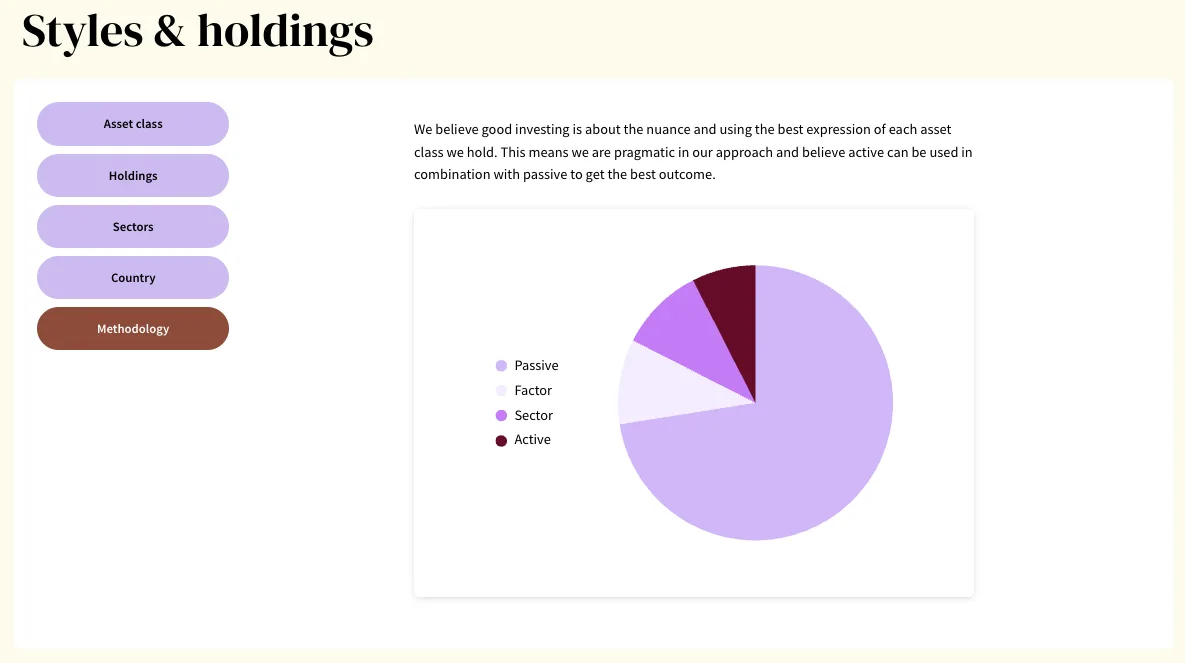

Passive + active + sector + factor

Rask Invest is what’s known as ‘style agnostic’. We don’t care if it’s an ETF, LIC, share, active, passive, growth, income, inside-out or upside-down. We follow the Best Expression principle no matter where it takes us.

The performance of Jupiter, our 90/10 strategy, is shown below. We will also have some elements of active, factor, quant or systematic exposure across all of our six strategies. But right now, Saturn is my priority for more ‘slightly more’ active tilts.

Of course, once our FUM (we’re still small-ish) and track record (maybe already taken care of) permits it, we’ll come back to the Rask community for a discussion about more bespoke portfolios. I’d love to launch an unlisted fund, especially targeting the mid-cap Australian shares sector – during the next small cap slump! But that’s mostly for my own money, since I like the terrain so well.

Let me know what’s in your Satellite via the free Rask investor community.

Owen

P.S. we already create custom portfolios for our financial advice clients.