Overnight the US was flat with the S&P 500 and Nasdaq marginally up. For now the Middle East appears to be calming…appears to be anyway. This has seen a steadying in the oil price and markets.

- S&P 500 = +0.074%

- Nasdaq = +0.3%

- Aussie dollar up 0.3% to 65.06 US cents

- Iron down 0.3% to $92.70 US a tonne

Xero gets a new oven

Just last week we wrote a glowing piece on Xero Limited (ASX: XRO) for Rask Core members and Rask Invest investors. We highlighted three reasons why we loved Xero. We also wrote this about its endeavours to crack the US market:

The problem child for Xero has been the US. The States is dominated by rival QuickBooks (Intuit) and is fragmented from a tax compliance point of view, with each state under differing law. Xero announced a change in strategy in its half-year report for 2024 with a more streamlined approach. If it can tap this market, there’s a tremendous growth opportunity, with the region lagging in cloud accounting. It could also be a cash oven, so keep a close eye on it.

Just yesterday, Xero announced a new, expensive $4B oven. It’s the Gaggenau of corporate ovens.

In a pivot away from focusing on growing the average revenue per user, Xero’s management, led by CEO Sukhinder Singh Cassidy, is shelling out to buy Melio Payments.

Melio has 80,000 US customers but what is really appealing is the access it has to 3,500 financial institutions that services millions of small to medium businesses. Combining Melio and Xero would create a business that marries accounting and accounts payable giving it something they believe can crack Intuit Inc (NASDAQ: INTU).

All the reasons we stated we loved the Xero business make Intuit a tough nut to crack. Here’s what we wrote about the stickiness of Xero’s customers:

The recent jump in subscription prices has had little impact on the low level of churn. Even as operating your accounting software costs inches up, changing software and learning a new program would have business owners tearing their hair out.

It’s also a helluva pain to switch, both in cost and time spent.

A transformative moment

I don’t want to sound overly negative on the deal, Xero has lost ground in the US and a different approach is needed. The hesitation is the sheer size and what appears to be a significant shift in recent strategy. It’s a big play and can big plays can come with big rewards.

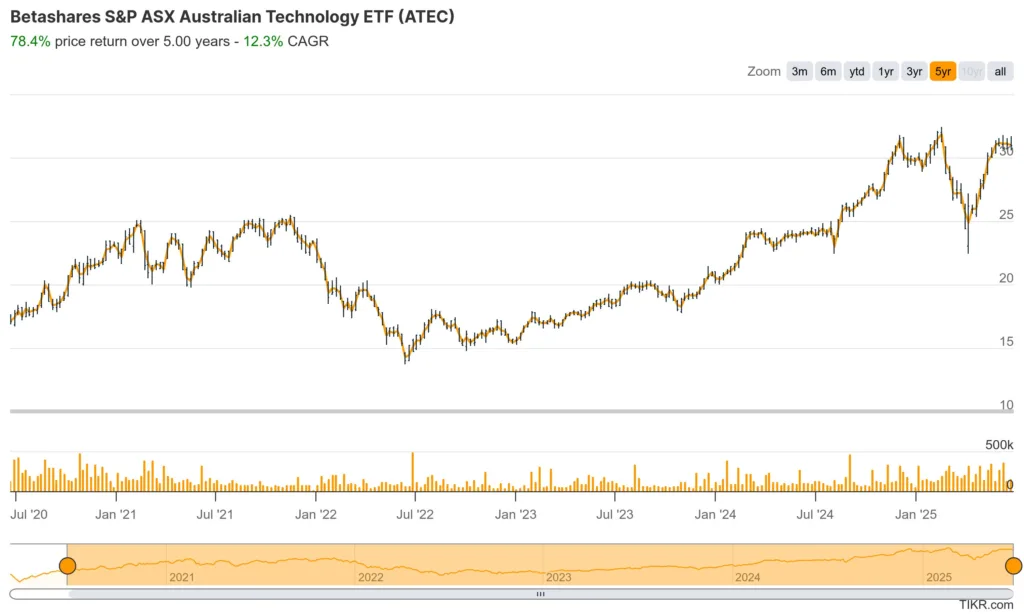

Xero is equal largest weight in the Rask Invest held, Betashares S&P/ASX Australian Technology ETF (ASX: ATEC). It represents 10% of the ETF alongside WiseTech Global Ltd (ASX: WTC) and Pro Medicus Ltd (ASX: PME).

WiseTech has also undertaken a transformative US acquisition of late. WiseTech have a history of acquisitions, completing over 50 of them in the last ten years but its acquisition of E2open dwarfed all of them. It also has the potential to unlock enormous future growth.

The immediate difference to me is the skin in the game of the leaders involved here. In WiseTech you have a founder/leader who’s entire being is wrapped up in the business. Richard White owns over 36% of the $35B logistics software business. That’s a chef who has lived off his own cooking for a long time.

On the other hand, Singh Cassidy has not put her hand in her pocket once to buy shares of Xero. Yes, she is paid very well and has a substantial amount of options at stake but they are very different to having your personal wealth on the line. If this comes off, she will exercise her options and be handsomely rewarded, if it doesn’t, she walks away and on to the next Silicon Valley project.

Needless to say, we’ll be keeping a close eye on the the Xero kitchen.