If you are reading this, chances are you’re already above average when it comes to financial literacy. If you’ve done a course via Rask, joined the community, have a brokerage account or invest through us, there’s a good chance you are the person in your family and friendship group people come to when they have questions about money.

I’ve not known of a time when there’s been nothing to worry about, but right now it’s easy to see how some people could feel overwhelmed.

Internally at Rask, whenever it looks like markets may get even more volatile than usual, the first thing Owen says to us is “clear your calendar, be there for the community, this is the time where what we do matters most”.

I want to extend those sentiments to you too.

All your reading, podcast listening, ETF researching, and course completions, this is the time when that knowledge allows you to help both yourself and those around you.

Help yourself first

Remaining calm, rational, and sticking to your plan is the first step. As they say on a plane, ensure your life jacket is on first and then look to assist others. The Howard Marks quote on selling is something I come back to time and time again:

“…why sell something you think has a positive long-term future to prepare for a dip you expect to be temporary?”

Here’s how you can help others:

Have an understanding of stock market history

To a non-investor, this unwavering belief we have in the market can seem strange. Saying “don’t worry about it, buy more if it falls” might sound overly simplistic. But how did we get here?

We’ve studied investing history. And while history doesn’t repeat itself, it does rhyme.

The stock market and capitalism has survived wars, pandemics, terrorism, depressions, interest rate shocks, global financial crises and yet it marches on. Why?

Because the world keeps turning, populations grow, consumers consume, productivity increases and capital flows to the best risk adjusted returns.

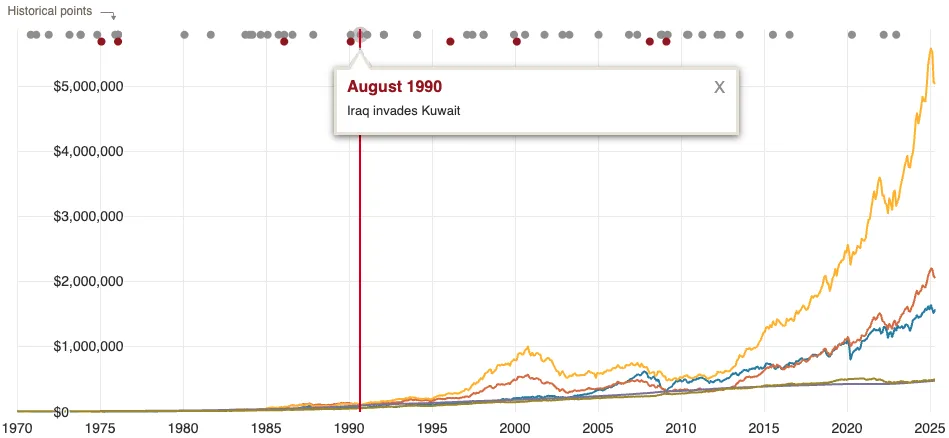

If there is one chart every investor should see – whether new or experienced – it’s the Vanguard index chart. This interactive graph is amazing at putting the issues of the day into context. The yellow line is US shares, the orange is international and the blue is Australian shares:

Understanding markets in times of conflict

In today’s environment, it’s particularly important to understand how markets behave during geopolitical conflict.

The Geopolitical Risk Index, developed by Dario Caldara and Matteo Iacoviello. tracks conflict intensity based on the number of of newspaper articles covering geopolitical events. The modern index starts in 1980, and a historical index starts in 1900.

Their work finds in the twelve months following a spike in geopolitical conflict, the median market return (as usual the market referred to is the US and in particular S&P 500) was 22.6%.

This follows a fairly common pattern: markets will decline in short term as they digest the economic uncertainty, but then continue the forward march promptly after.

We highlight this not as a signal to dive in, but to show that from negative times come recoveries. And if you want to benefit from long-term returns, you have to be in the market – through thick and thin.

Don’t plan for a specific future, plan for any

The market teaches us lessons regularly, usually every few months. It’s a constant reminder to return to first principles.

Even if you are the most aggressive person out there, it still doesn’t mean you should be 100% in one type of growth asset or have some dry powder to put to work during times of volatility.

Market pull backs are a fantastic reminder of why diversification matters. A mix of growth and defensive assets that are uncorrelated and behave differently under different conditions, helps build a portfolio that can handle a range of possible futures.

Because we can’t predict the future accurately, we need to construct portfolios designed to perform across multiple outcomes.

The best time to do this is at the start of your investing journey. But if you haven’t yet, it’s never too late to begin.

Stick to your plan

When volatility hits it’s easy to throw your plan out the window, or realise you never had one.

When I talk to people I’ll often talk about a simple one-page mental plan. For example:

- I am going to invest $x into this portfolio

- I’ll add $x per month

- I plan to be invested for x number of years

- When my portfolio drops 10% I will…

This is a form of pre-commitment and it is incredibly powerful. It reduces decision fatigue, minimises impulsive actions, and helps prevent self-sabotage.

Sometimes, you might break your plan and it feels positive. For instance, investing more after a drop. But if you overextend and need to withdraw later, or the market keeps falling and that impacts your mindset, it can become harmful.

If you know me, you know I love to refer back to the Dalbar Qualitative Analysis of Investor Behaviour. Familiarity with your own biases is essential to becoming a stronger investor.

Remember there’s people to help

Times with excessive negative news-flow can be overwhelming but also the time we can help others the most.

Remind yourself (and those around you) that mainstream and financial media aren’t designed to improve your financial outcomes, they’re designed to maximise clicks. The more extreme the headline, the more likely you are to click on it.

Instead, come on over to the Rask Community, share a podcast or share one of our free educational courses with them. They may be more responsive to it during a time of heightened concern.

I’ve also cleared my calendar for the next week and a half and am available to talk. You can book in with me via this link.