I recently invested $100,000 into the ASX following the Trump tariff fiasco – I bought into one of the Rask Invest portfolios via our bucket company – and took a nibble of WiseTech Global Ltd (ASX: WTC) shares as a satellite position.

Needless to say, I was a little lucky on timing. And investing for just a month or two is a really poor way to allocate capital (I’ve never met anyone who can make it work). But, things are working out really well so far!

(Bear with me…)

While I was buying a little WiseTech and allocating to Rask Invest Martian, we also launched two new investment strategies for all of our community:

- Saturn – our All Growth strategy

- Mercury – our Conserative strategy

In addition, we added a range of new ETFs while markets were being punched. Amongst other things, in the past month or so we bought:

- Lakehouse Global Growth Fund (ASX: LGGF)

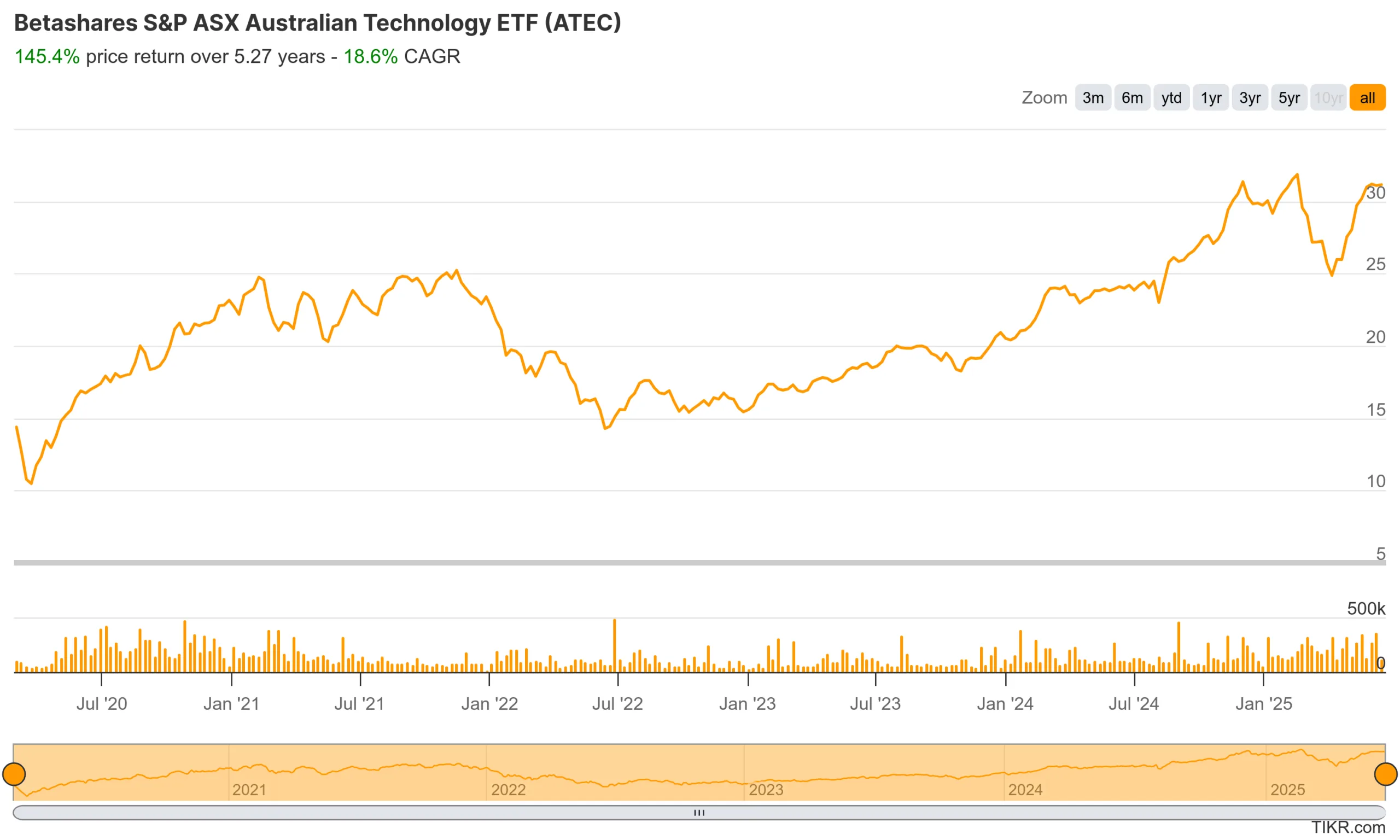

- Betashares ASX All Technology ETF (ASX: ATEC)

Source: Tikr.com

Here’s why I think you should be paying attention.

3 reasons to allocate to technology… now

Despite taking advantage of a big sell-off in Australian and global shares, there are three obvious reasons you should consider investing these types of companies and sectors.

1. ASX blue chips are slowing.

It’s no secret that most ASX blue chip shares lack growth. While Commonwealth Bank of Australia (ASX: CBA) and Macquarie Group Ltd (ASX: MQG) are standouts because they are quasi-technology businesses (I’d happily own them). However, the reality is you’ll get many more future-facing businesses further down the ASX.

2. Interest rates are falling.

With interest rates falling globally and in Australia, companies that are leveraged to increasing consumer and business spending will benefit in two ways. Firstly, they’ll do more business with customers. Second, the valuations of growth companies – like WiseTech – tend to stretch faster than slower-growing businesses – like Woolworths (ASX: WOW).

3. AI is going to dramatically enhance tech businesses.

Companies like NVIDIA (NASDAQ: NVDA) (with its chips), Amazon (NASDAQ: AMZN) (with its AWS cloud) and Microsoft (NASDAQ: MSFT) (with its 50% stake in OpenAI, creator of ChatGPT) are clear winners from AI.

However, local technology companies – such as Xero Ltd (ASX: XRO), WiseTech Global Ltd (ASX: WTC), Objective Corp Ltd (ASX: OCL) and Pro Medicus Ltd (ASX: PME) – will drastically increase their value proposition by enabling AI in their existing platforms.

We’ve already covered why we love businesses like Xero.

But, broadly, I want you to imagine a business owner using all of Xero’s accounting software with an AI assistant explaining their company’s cashflow, financials and tax position. Now, that is a AI service I would pay for!

Key takeaway

Timing the market is hard. If not impossible.

But tilting your portfolio towards the fastest growing, wide-moat businesses an sectors is a strategy that just makes sense to me.

With AI improving the value proposition and productivity of already fast-growing technology businesses, I urge you to review how your portfolio and the companies within it will benefit from AI innovation over the next 10 years.

Nothing is certain and risks persist.

But I doubt this AI genie is going back in the bottle…