Most Australian investors have a tendency to focus on Australian and US shares, but you could be missing an opportunity. Here’s how the Fidelity Global Emerging Markets Fund (ASX: FEMX) could help your portfolio.

Home country bias

Home country bias refers to the (very common) tendency to invest heavily in your home country. Intuitively, this makes sense. Woolworths Group Ltd (ASX: WOW) and Commonwealth Bank of Australia (ASX: CBA) are familiar companies that you see everyday, so they’re the first companies many new investors think about.

More experienced investors might look to diversify their portfolio by investing in US shares, where we can still see companies we’re intimately familiar with like Apple Inc (NASDAQ: AAPL).

While this approach works for many investors, the potential problem is that you’re missing a huge chunk of the global equity market. Australian shares only make up about 2% of the global equities market and even the US is only around 40% – if you invest in both, you’re missing more than half the market!

Emerging markets

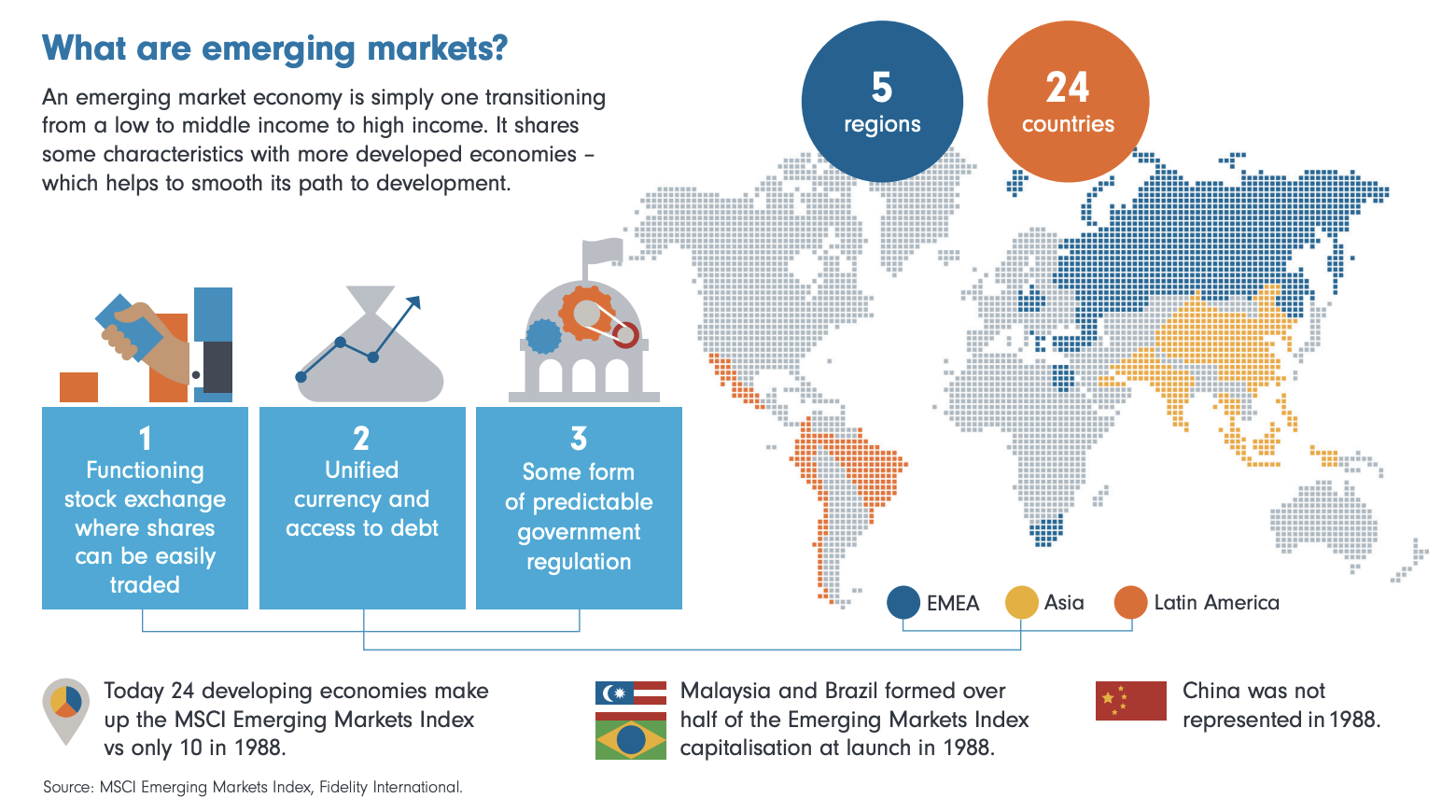

The remedy to this issue is to look at diversifying into emerging markets. Emerging markets refer to those countries that are usually middle to upper-middle income and have developing economies with increasing rates of market access and investment.

Think countries like China, India, and Brazil, which had GDP growth rates in 2022 between 2.9% and 7.2%, compared to 1.9% in the US.

Emerging markets are often characterised by high GDP growth and rapidly rising standards of living. This means they can present an interesting growth option to add to your portfolio.

How I’d invest in emerging markets

Emerging markets would generally be considered a high growth and high risk option. While these economies are experiencing rapid growth, they can also have higher rates of corruption, instability, and uncertainty.

I would be very hesitant to invest directly in companies in an emerging market. My preferred option would be to choose something like the Fidelity Global Emerging Markets Fund (ASX: FEMX) which is an ASX-listed exchange traded fund (ETF for short) that focuses on these growth opportunities.

FEMX is a bit different to many ETFs in the way that it’s managed. It’s an active ETF, meaning there’s a team of analysts behind it putting the work into picking the best 30-50 companies to invest in across more than 10 emerging markets. Rather than trying to passively track an index, they’re trying to beat it.

The benefit of FEMX is that their analysts are on the ground in these emerging markets, so they have a much more intimate knowledge of the opportunities than you or I. And if you’re willing to consider historical performance, the approach seems to work.

FEMX has beaten the index it follows since inception in 2018, returning more than 9% per year to investors compared to around 6% for the benchmark.

This is after the 0.99% per year management fee, which is more than what you should pay for a passive ETF but not unreasonable of for an active option that’s beating its benchmark.

How does this fit into my portfolio?

How you could incorporate emerging market exposure into your portfolio depends on what you’re trying to achieve, what your investment horizon is, and what you’re already invested in.

The FEMX ETF is included in the Rask Invest diversified portfolios as part of the international shares holdings. To understand more about how the ETF is used in our portfolios and how it could benefit you, you can book a free call here with our Head of Funds Management Mitch Sneddon.