Do you own, or plan to start, a business and constantly fail to reach escape velocity? In this article, I’ll introduce you to 5 ways to scale your business, without breaking the bank. These are the tools and methods I’ve used to scale Rask into what you see before you today.

If you’re a business owner and anything like me (and the business owners I know), you’ll constantly be thinking about 50 different things and wondering if you’ll actually achieve anything come Monday.

Where can I find more leads?

Is my marketing even working?

Should I start a social media strategy?

Is my business structured correctly for tax?

Everyone talks about a family trust, should I have a family trust?

Can I trust my accountant?

My tax bill is HOW MUCH?!

…

Trust me, it never ends.

However, things can often get a lot better – meaning, fewer headaches AND increasing profits – with a few simple-sounding but hard-to-do tools.

Here are 5 ways to scale your business, without breaking the bank

1. Journaling.

As a business owner of multiple businesses, keeping a journal beside my bed has been a godsend. Journalling is how I stop today’s stress bubbling over into tomorrow.

It’s a highly recommended strategy by psychologists. You don’t need anything fancy, or have to write an essay. You’ll be amazed what a few chicken scratches can do. Here’s a link to my favourite wellbeing journal.

2. Make a to-do list each day, and week.

To-do lists have their drawbacks, but they can keep you focused and fuel your momentum for a big day.

At the start of the day, and week, make a to-do list of 3-5 rocks you want to move. I do my to-do list in the Apple Notes app on my iPhone early in the morning. On Mondays, I make it a ritual and splurge on my favourite coffee for an hour as I plan the week. As I work from home quite a bit, this physical distance between the weekend (home life) and working week (work) creates a mental barrier. Game face on!

A big reason why to-do lists don’t work for some people is because they don’t take the next step. To-do lists by themselves aren’t good enough. You’ve got to…

3. Time block your calendar.

Timeboxing, or time blocking, in your calendar helps you identify which days and times you can maximise your impact.

Like money, time is precious. You invest it. And any good investment requires some planning, just like your calendar.

Once you’ve got 3-5 things on your to-do list for that day or week, add them to your calendar, with a reasonable time to complete the task.

Don’t be hard on yourself for not ticking off the task when you planned to. Just move it forward to next week until you get it done.

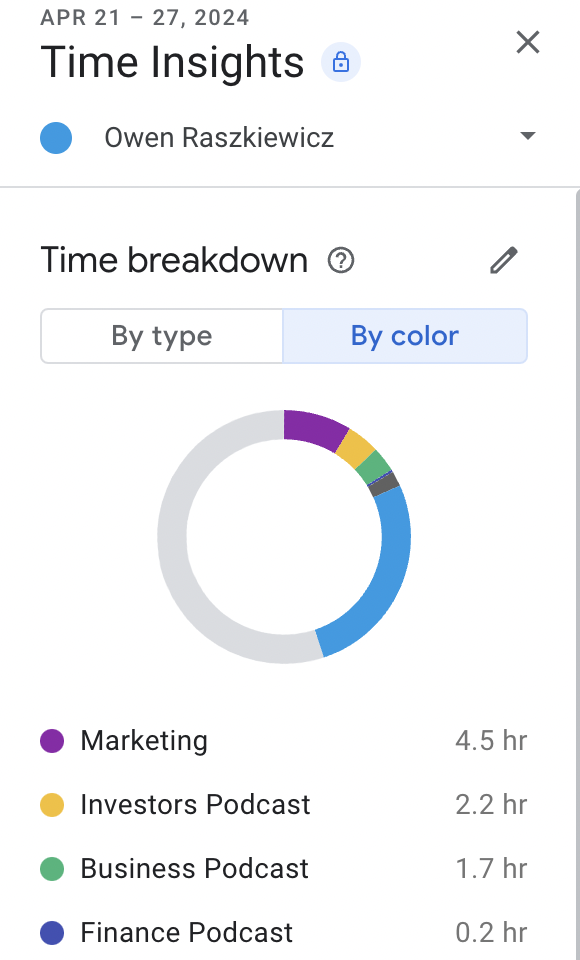

(Psst. our teams use Google Workspace, the paid version of Gmail, which allows us to label and colour code meetings and time blocks in our calendar – then it automatically tells us how we’re investing our our time each week. I label things like ‘marketing’, ‘operations’, HR, etc., so it tells me where I’m actively allocating effort.

4. Invest in a business coach (or get a mentor)

Getting a business coach or mentor who will objectively prompt you to make better decisions and challenge your ideas can be invaluable, especially for strategy and big decisions.

Some of you will know that, in addition to running Rask, I also coach business owners one-on-one, and run a business accelerator and coaching program, called Inflection.

To be clear, until Covid, I never trusted “business coaches”. They always blew up my LinkedIn feed and sent me unsolicited messages on social media. Not cool.

However, I started Inflection with Danil & Jordan (from the Australian Business Podcast) because:

- I realised how many business owners in the Rask Community were being harmed by so-called ‘experts’

- Everyone kept coming to us for guidance – and I wanted to give back, and

- I used a life/business coach during Covid, and she completely changed my business life.

If you can’t afford a coach (our program is cheaper than most, but still $5,000 per year), find 1-2 people you can call on for advice. They can be your ‘advisers’. It might be a family member who has owned a business, or a friend on the same journey.

And if you don’t know anyone like that, ask yourself, ‘what would [insert name of business owner you admire] do in this situation?’ For example, before investing, I would always ask myself ‘would Warren Buffett make this investment?’

In my podcast with Shane Parrish, we talked about his concept of a personal board of directors – when it comes time to make big decisions, just pretend you have the world’s best people on your board and they’re judging your decision or strategy. What would they say to you?

5. Read, read & read some more.

Reading a handful of top business books could change your life because you’ll learn wonderful (and sometimes expensive!) lessons from those business owners gone before you.

There’s nothing better than picking up a business book to accelerate your knowledge. But which book?

“It seems like there are at least 100,000 business books!” I hear you saying.

If I could have my time again, I would start with Traction, by Gino Wickman; The E-Myth Revisited, by Michael Gerber; and Marketing For Dummies, by Wiley.

If you prefer to listen, Audible may list these titles. Also, did you know Spotify Premium subscribers get 15 hours of free audiobooks per month? Game changer.

Join my free business owners-only newsletter

Finally, why not subscribe to my business owners-only newsletter over at Inflection? Every week, I share my best marketing, tax, technology, automation and growth hacks, tips and tricks – for free.