For 20+ years, the #1 way to get big and reliable income from stocks has been through the likes of Commonwealth Bank of Australia (ASX: CBA), BHP Group (ASX: BHP) or [insert other stock with franking credits].

You find a great company (pay a fund manager to do it), buy the shares in your brokerage account, then sit back wait for the twice-yearly dividends to roll in.

Companies like CBA and BHP dominate the headlines because they are huge household names with a sublime track record for dividends.

However, there are some lesser known Australian companies that have done an even better job of combining growth + income in the past 10 years.

Companies like ARB Corp (ASX: ARB), the 4×4 bullbar maker, have managed to pay a rising dividend amount while also reinvesting some of the profit to see their business multiply over 10+ years.

It’s an investors nirvana: tax-effective income + reliable long-term growth. This combination is especially helpful for those approaching, or in, retirement (which is what many of the 200,000+ Rask users are investing for).

A better buy than CBA shares

However, as we sit here today, with multiple changes to property, Superannuation, tax rules and evolving technology, it’s worth sitting back and wondering what the next 20 years of investing will look for you.

Specifically, there are even better ways to invest for passive income?

Day in, day out. This is what I’m paid to research. As I invest for our community inside Rask Invest.

And for nearly 10 years now, I have been tracking, researching and commenting on the rise of Exchange-Traded Funds, or ETFs for short.

There are many reasons why ETFs have been growing multiple-times more quickly than managed funds like Fidelity, LICs like Argo or REITs like BWP Trust.

A few of the reasons ETFs have dominated the market for retirees and younger investors include their low fees, ease of use (you buy them just like CBA shares), full transparency (all holdings must be disclosed) and high levels of ETF regulation.

According to Blackrock, the world’s biggest investment company, a whopping $52 trillion of investors’ money was traded globally via ETFs in 2022. That’s about 26x the entire Australian stock market’s worth – adjusted for USD to AUD conversion – in one year…

But low fees, easy trading, transparency and good regulation aren’t the only reasons why ETFs have won – and will keep winning, in my opinion.

Risk matters to income investors. Here’s how you need to get instant diversification

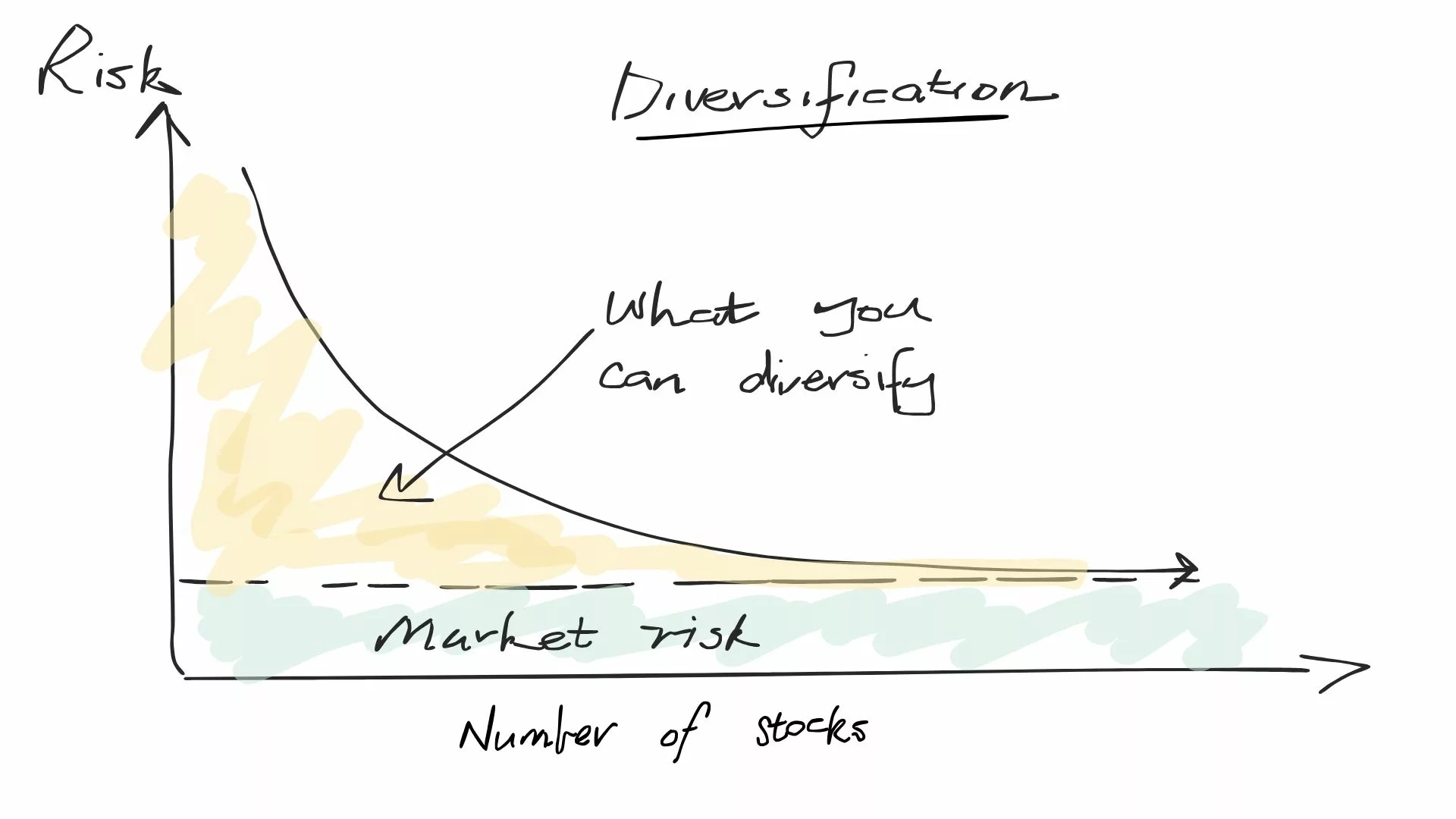

When you invest in the stock market, some risk is unavoidable. We call this ‘market risk’. Loosely speaking, it’s the difference between savings and investing. It’s the risk you can’t avoid.

For example, when interest rates rise, the stock market, as a whole, will typical slow down. This is because nearly all companies tend to be impacted by interest rates. Their debt becomes more expensive, their customers have less money to spend on their products, and so on.

For CBA, Australia’s largest bank, when interest rates go up, their customers (households) tend to struggle to meet their mortgage repayments. Therefore, CBA might even struggle more than some companies.

This is called company-specific risk. This can be diversified.

For example, while a company like BHP, the world’s largest mining business, might be affected if iron ore prices fall – as they did in 2015, and BHP was forced to cut its dividend payment – it won’t be affected in the same way as CBA when interest rates go up.

Nor will iron ore prices impact CBA. Or its mortgage holders.

Through this simple example you can see three things:

1. All companies are affected by market factors (e.g. interest rates, wars, recession, etc.)

2. But some companies are affected more by certain factors (e.g. iron ore, mortgages going up, etc.)

3. Even Australia’s biggest company (BHP) has cut its dividend in the past 10 years.

This is why diversification is essential for income investors

The easiest way to diversify a passive income portfolio, in my opinion, is through the use of ETFs in the core of your portfolio.

Why use ETFs?

In the past, stock brokers and “wealth advisers” would tell their clients to hold 30 stocks. “It’s a race to 30,” the broker would say.

They did this because if one stock went bad – or failed to pay a big dividend, like BHP – the other 29 could ‘balance it out’.

(The brokers would also love this idea because they could charge commissions on 30 stocks… but that’s a horror story for another day.)

But here’s where this gets interesting…

Right now, you can purchase a single ETF, like the Vanguard Australian Shares Index ETF (ASX: VAS) or Betashares Australia 200 ETF (ASX: A200) or VanEck Australian Shares Equal Weight ETF (ASX: MVW) and get dozens of dividend-paying stocks, with one purchase.

For example, inside the VAS ETF, an ETF which holds around 300 Australian shares, you will get some BHP, some CBA and some ARB, as well as CSL, Westpac, Coles, Woolies, Telstra and many more.

In other words, you can make one trade and get exposure to 300 different shares. By my count, that’s 10x more stocks than the broker strategy, at 1/30th of the trading fee.

(And zero in commissions!)

Above-average performance

Because the ETFs I’m talking about are low-cost index-tracking ETFs, and very well diversified, as we know; you get a return that’s nearly identical to the stock market overall. Like the ASX 300 for VAS, top 200 for A200, and so on…

Some so-called ‘advisers’ call index funds an “average return”, as if it’s a slur on people who invest this way.

However, thanks to 20+ years of SPIVA research, we know that about 85% of professional fund managers do worse than the index.

So, according to my grade 6 math, an index fund ETF investor would be getting “above average returns”…

With far less effort than stock picking.

With drastically lower fees than managed funds.

With way more transparency than LICs.

And, of course, you still get all of the lovely tax-effective franking credits.

And at tax time, the ETF provider will even send you a tax report to hand to our accountant.

Pretty good, right?

See which ETFs I recommend (free)

At Rask, any time I hear an investor talk about a ‘big dividend stock’ I can’t help but think to myself:

It sounds great, mate, but have you considered what would happen to your income if that stock cut its dividend? Or have you considered why you need to put your passive income at great risk when you could just buy a highly regulated, proven, low-cost, diversified, easy-to-use, ETF paying 4-6% in income, often including franking credits?

At Rask, when our team constructs portfolios for Rask Invest, we have something called the ‘best expression principle‘. Basically, it’s a rule that demands us to stop and ask ourselves, ‘is there a better way to achieve our goal?’

When it comes to passive income, ETFs are an absolute no-brainer. But they still require careful thought and care, especially because a good passive income portfolio needs more than just shares to be fully resilient against market forces.

But even if it’s not for your entire portfolio, at least part of everyone’s portfolio should include ETFs.

You can view the ETFs we are currently invested in by going to the Rask Invest website >> clicking “investment portfolios” >> selecting the portfolio (e.g. Terra). Then scroll down and click ‘asset allocation’.

Like everything we invest in, we like to keep things fully transparent at Rask. And low cost. And easy. And automated. And, of course, 100% long term.

If you like passive income, click here to learn more about how we invest.

Stay tuned for my next email on passive income.

Thanks again for joining us.

Onward & upward!