Global markets – week in review

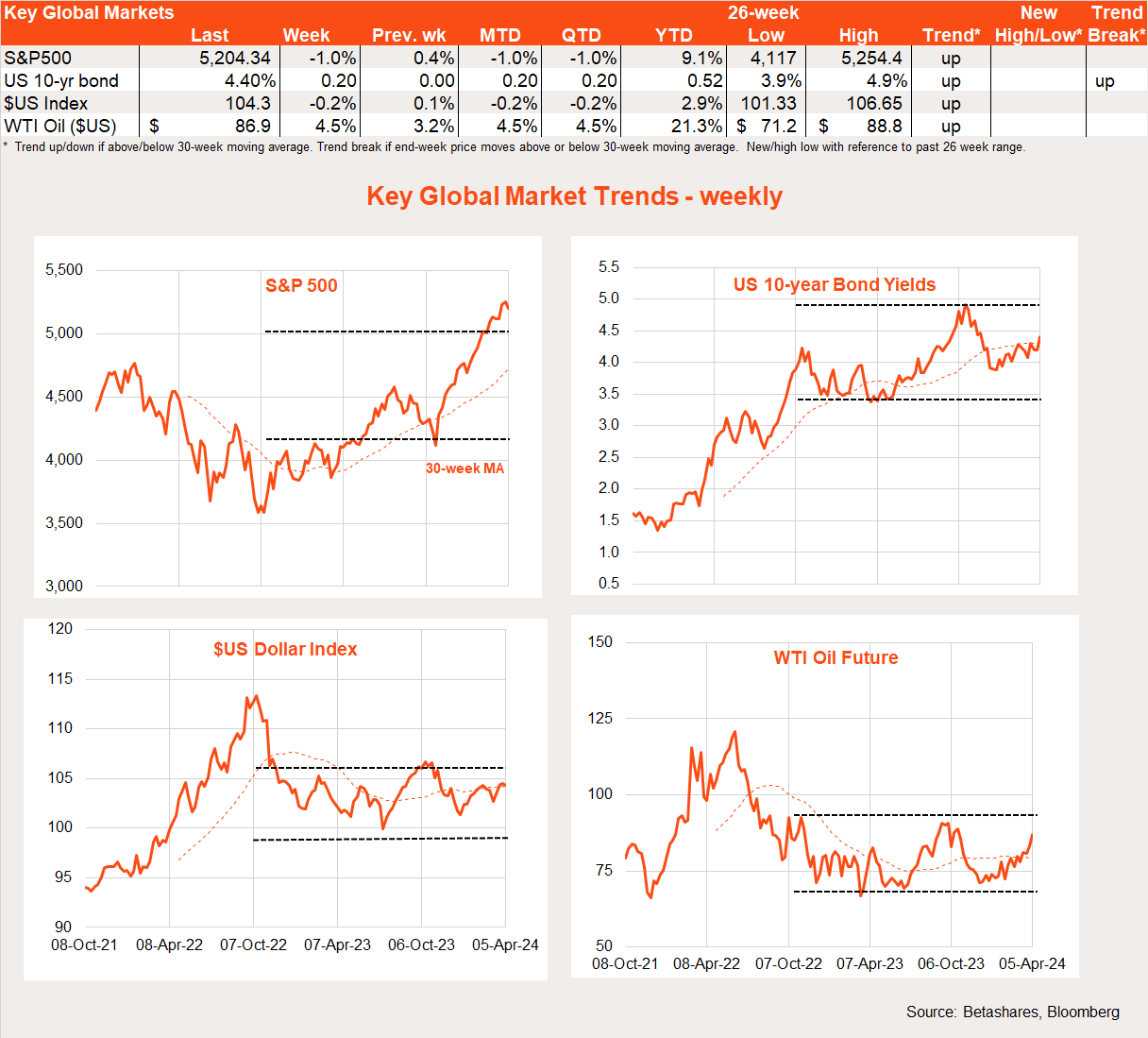

It was largely a case of good news is bad news again on Wall Street last week, with a series of stronger-than-expected activity reports pushing back rate cut expectations further – pushing up bond yields and pushing down equity prices in the process.

Equity prices have withstood the moderate rebound in bond yields so far this year, but with valuations stretched – both in outright PE and relative equity-risk price premium terms – they could be nearing a breaking point where a deeper correction develops.

Also not helping is the rebound in oil prices on simmering Middle East tensions, with new risks that Iran could be dragged into a conflict with Israel.

The highlights last week were stronger-than-expected reports on US manufacturing, job openings and the March payrolls report. The US ISM manufacturing report pushed above 50, suggesting the sector is finally recovering from its post-COVID slump.

Job openings failed to decline as expected and remain at a relatively high 8.8m. And there was a much stronger-than-expected 303k gain in employment during March (market 200k), allowing the unemployment rate to drop back to 3.8% from 3.9%. The saving grace in Friday’s payrolls report – and which likely stemmed a potential further equity decline – was the 0.3% gain in average hourly earnings (in line with market expectations), which saw annual wage growth ease further to 4.1% from 4.3%.

Israel’s strike in Syria, which killed a top Iranian military commander, has created new tensions, with oil prices lifting 4.5% last week, to be up 21% year to date.

The upshot of all this is that the US market now anticipates only two Fed rate cuts later this year – compared to the six expected at the start of the year. US 10-year bond yields lifted 0.2% to 4.4% last week, compared to a low of 3.88% around Christmas.

Also steadying markets to a degree, however, is ongoing commentary from the Federal Reserve (including from Powell himself) that rate cuts are still, at this stage, likely this year – although there is no hurry.

The week ahead

Against this backdrop, this week’s March reading on consumer (CPI) and producer (PPI) prices will no doubt be key – any major upward surprise could finally be the straw that breaks the back of the unrelenting equity market rally, at least for a time.

For what it’s worth, the market expects the monthly gain in the core CPI to ease back to 0.3% from 0.4% in February, allowing annual core inflation to ease to 3.7% from 3.8%. Monthly growth in the PPI is also expected to ease back to 0.2% from 0.3%.

The other highlight this week will be the start of the Q1 earnings reporting season, with a few major financials [JPMorgan Chase & Co (NYSE: JPM), BlackRock Inc (NYSE: BLK) and Citigroup Inc (NYSE: C)] kicking off the beauty parade on Friday.

As reflective of a strong economy, the earnings season is likely to be upbeat – but whether that’s enough to offset pressure from delayed Fed rate cut hopes remains to be seen.

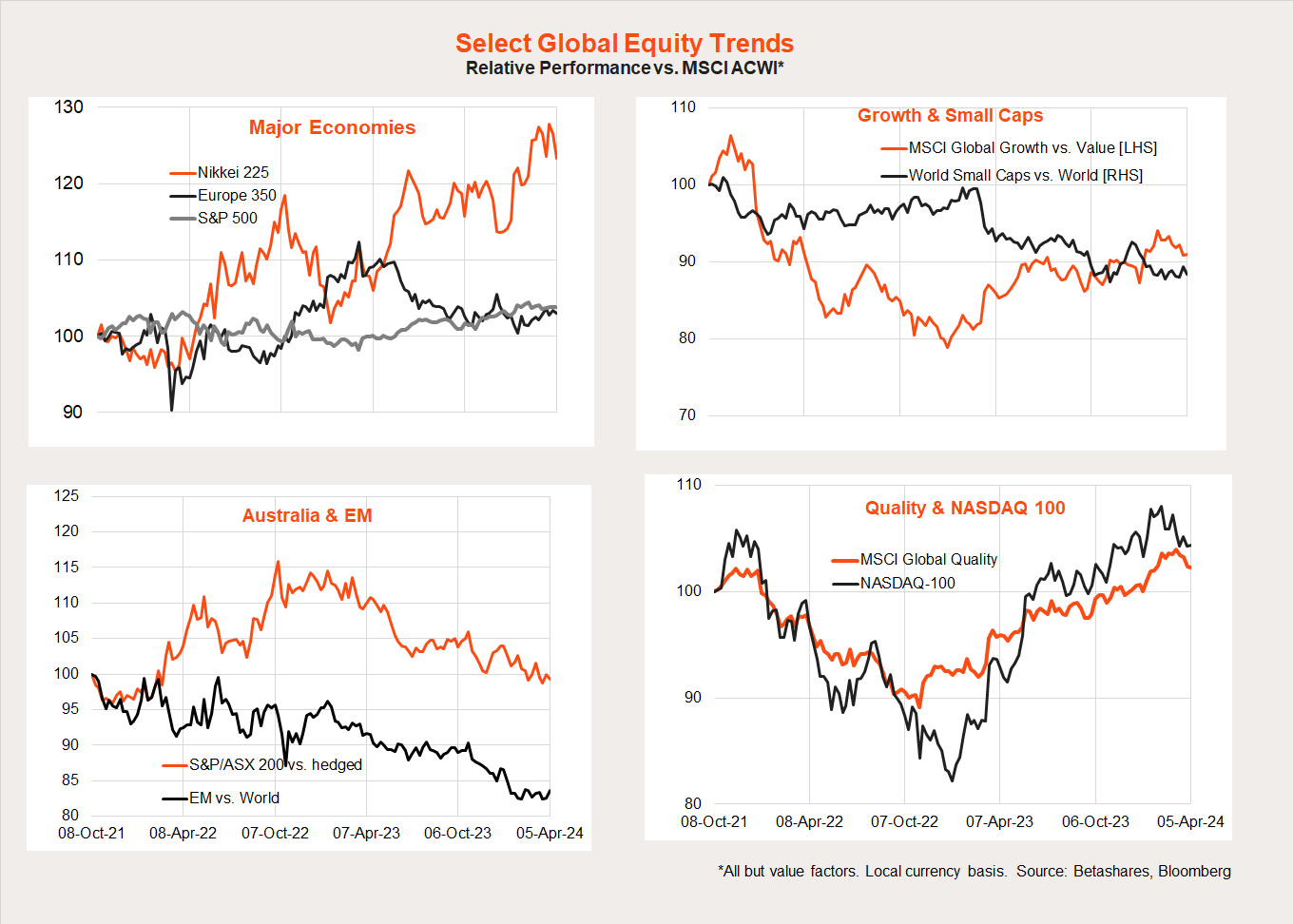

Global equity trends

Looking at global equity trends, the rebound in bond yields is helping drag back the relative performance of growth over value, as evident in the pullback in Nasdaq-100 (INDEXNASDAQ: NDX) relative performance.

Japan and Europe are also faring better, while Australia and emerging markets less so.

Australian markets

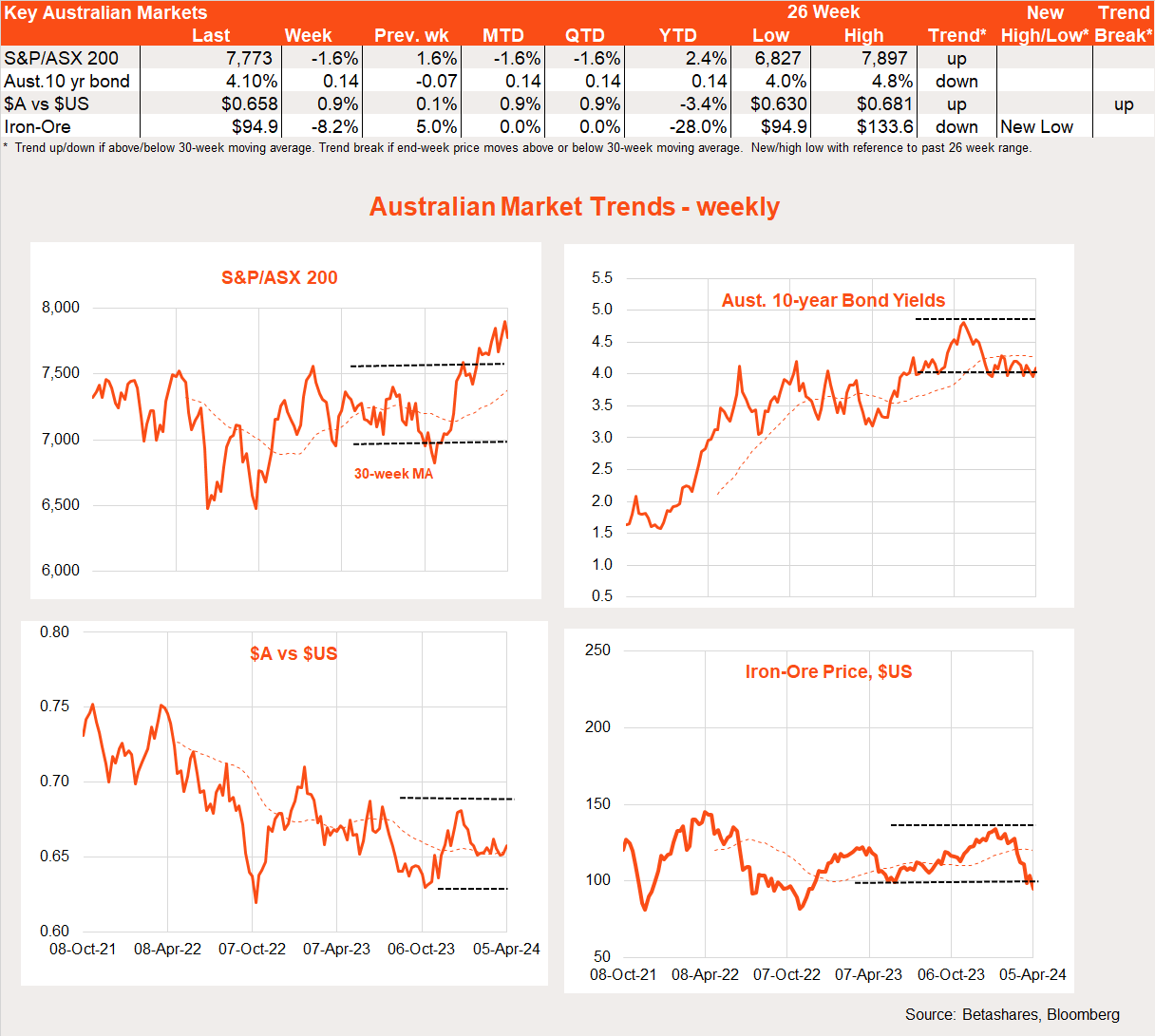

With little local news to digest, the S&P/ASX 200 (INDEXASX: XJO) pulled back 1.6% last week in line with global trends -while bond yields edged higher.

The $A held firm despite a further 8% slump in iron-ore prices to below $US 100/tonne.

The only point of interest in the minutes from the latest RBA policy meeting was the decision not to formally contemplate a rate hike among policy options – further confirming the Bank’s gradual shift to a more neutral policy bias.

In other data, national house prices kept rising (is that news?), while ANZ Group Holdings Ltd (ASX: ANZ) job ads pulled back a little further – the latter consistent with a glacial slowing in labour market strength.

Local highlights this week will be an update on the state of consumer and business confidence with the Westpac Banking Corp (ASX: WBC)/Melbourne Institute and National Australia Bank Ltd (ASX: NAB) surveys, respectively.

Although there have been tentative signs of recovery of late, household confidence remains in a slump.

Business confidence has been more upbeat due to strength in most other areas of the economy away from consumer spending.

Have a great week!