The S&P/ASX 200 (INDEXASX: XJO) has shown lots of share price ups and down this year. Luke Laretive of Seneca Financial Solutions tells us 3 reasons why we are underweight ASX retail shares. Are these share prices undervalued?

1. Higher interest rates, tighter wallets

Rising interest rates and significantly increased mortgage rates, has slowed down consumer retail spending.

Exacerbated by many Australians rolling off fixed rate mortgages and rental rate increases (in line with or above inflation), consumers now have less spare cash to spend on discretionary goods relative to essential purchases.

Retail turnover has held up remarkably well year to date according to ABS data, but growth is trending down, per the chart below.

The next 12-18 months represent a key risk for demand, as effects of monetary policy tightening flows through the economy.

Retailers are sensitive to demand given inventory levels can overstock, forcing write-offs or discounting.

Combine that with higher wages, store rents, and power prices, and retailer profitability could get squeezed.

In November’s AGM reporting season for ASX-listed companies, we’ve started to see some cracks in retail activity forming, with sales falling upon prior comparable periods.

2. Results from ASX retail shares have started to show falling sales

In November, AGM season has seen several retailers confess that conditions are less rosy than they were in the pandemic stimulus fuelled boom of 2020-21…

- Lovisa Holdings Ltd (ASX: LOV) reported like for like sales declining -6.2% for the first 20 weeks of FY24 relative to last year, about one percent worse than consensus analyst expectations.

- Shaver Shop Group Ltd (ASX: SSG) reported like for like sales to the end of October down -5.4% vs FY23.

- City Chic Collective Ltd (ASX: CCX) reported Q1 revenue down a whopping -32% from last year, with both Australia -36% and USA -26.8% struggling. Q2 to date hasn’t fared much better with revenue down -22% from last year.

- Adairs Ltd (ASX: ADH) reported group sales down -9% FY24 to date (21 weeks).

- Baby Bunting Group Ltd (ASX: BBN) reported comparable store sales down -8.5% at its October AGM.

- JB Hi-Fi Limited (ASX: JBH) like for like sales down -1.4% in September quarter.

- Nick Scali Limited (ASX: NCK) founder Anthony Scali selldown $50m worth of shares, representing 5.7% of issued capital, which may indicate weakness in furniture retail following a record year in FY23 with after-tax profits up 34.9% to $101.1 million.

This is a diverse set of retailers all reporting sales going backwards, across furniture, jewellery, clothing, personal care and electronic appliances.

Super Retail Group Ltd (ASX: SUL) reported +2% like for like sales growth, surprising the market and supporting the narrative that car repairs are a necessity.

However, Bapcor Ltd (ASX: BAP) shares plummeted -18% in October after admitting profit was tracking below expectations thanks to “low single digit” revenue growth year to date.

3. Valuations not yet attractive for ASX retail shares

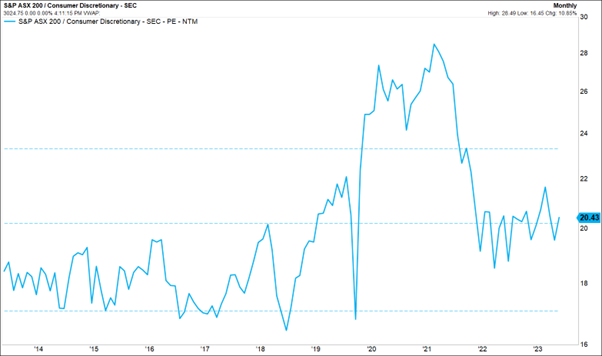

The S&P/ASX 200 Consumer Discretionary sub-index still trades on a forward P/E of 20x.

This partially reflects the large weighting to the largest ASX-listed retailer, Wesfarmers Ltd (ASX: WES) which trades on an elevated valuation thanks to the quality of its brands (Bunnings, Kmart, Officeworks etc).

However, it still broadly reflects the fact that valuations have not caught up to the reality of falling sales – both prices and earnings estimates look vulnerable to declining from here.

Hence, we think valuations are not yet attractive enough to purchase shares, but we are keeping on some of the higher quality retail shares that have a demonstrated history of growing shareholder wealth.

Lower quality retail shares can screen as cheap but turn out to be value traps.

What ASX shares to buy?

There will come a time (maybe soon) that the retail sector will represent good value buying, but we want a more favourable risk/reward outlook.

In our large cap Australian shares fund, we are overweight businesses with strong market positions and earnings growth potential that are mispriced by the market, such as this overlooked property technology business, and this healthcare business.