It’s rare to see a high-quality, growing, blue-chip healthcare share fall 26%, but that’s just what happened to Resmed CDI (ASX: RMD) after its Q4 2023 financial results.

ResMed is a world leader in devices and technology for the treatment of sleep apnea. It sells products and software to customers all around the world. It has done for many years…

So is ResMed’s share price an allergic reaction to Ozempic, or something else?

Is ResMed fundamentally damaged?

Or does this present the best buying opportunity for ResMed shares since 2017?

Let’s dive in…

ResMed share price

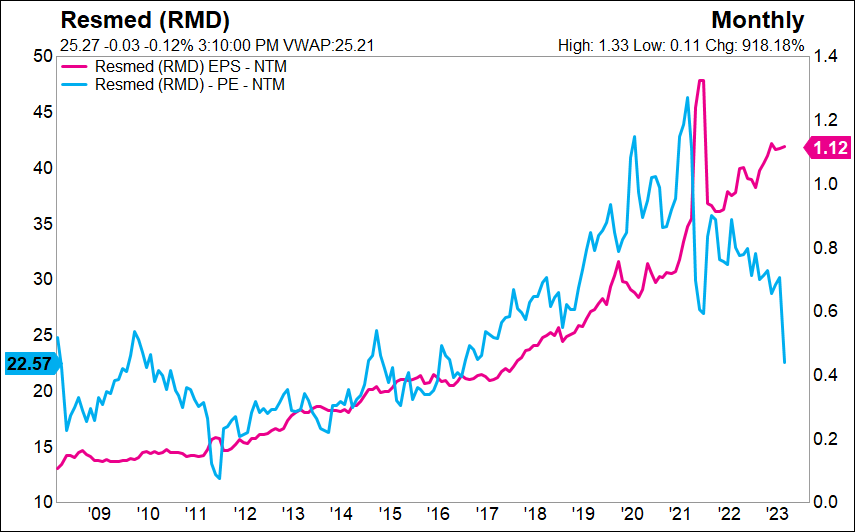

ResMed generated A$0.98 of earnings per share in FY23, up from $0.82 in FY22, and is forecast to grow further in FY24, to $1.09 per share, so what’s got the market spooked?

ResMed’s declining margins

In Q4’23, ResMed reported gross margins of 55.8% (down -2.05% year-on-year) which was 0.65% below analyst consensus estimates. Not usually a sign of a business with meaningful pricing power or a defendable moat.

However, digging in a little further we notice that Resmed’s Device sales grew +24% in constant currency terms, faster than Masks sales which grew +18%. As Devices are a significantly lower margin product than Masks, this sales growth mix negatively impacted gross margins.

Accelerating Device sales have been a predictor of future accelerating mask sales, so we think these margins normalise over time.

At an operating level, declining freight, labour and equipment costs should also help boost ResMed’s future profit margins. We think the company’s effort to simplify its product suite and optimise its production line should also not be underestimated in its ability to drive profitability higher.

Some argue that ResMed’s Mask business will be permanently impacted by increasing competition, notably from Phillips. We think this argument is flawed, particularly given the reputational damage suffered by Phillips after its product recall 2 years ago.

In 2020, prior to the recall, Phillips was targeting €700-800m in mask sales by CY25. That target has been reduced to only €400m in sales and in its most recent Q2 results, Phillips saw sales declining in its sleep and respiratory care division as it continues to lose market share to ResMed.

The market seems to think this reputational damage to Phillips will only benefit ResMed for a single year. However, it seems to be still winning market share two years on, and we think its instructive to study the impact of a product recall at ASX-listed healthcare peer Cochlear Limited (ASX: COH), which lost market share for eight years after its product recall.

It’s fair to say that people don’t like to take any potential risk when it comes to their health.

Ozempic

Novo Nordisk A/S’s (CPH: NOVO-B) pill is an oral version of semaglutide, the active ingredient in the company’s blockbuster weight loss injections Ozempic and Wegovy

(which the company has struggled to keep up production for, due to the exceptionally high demand).

Semaglutide mimics a hormone produced in the gut called GLP-1, which signals to the brain when a person is full. A late-stage trial in June 2023 found that a high dosage of the drug helped obese adults lose 15% of their body weight. The once-a-day pill does have some side effects, mostly mild-to-moderate nausea, constipation, diarrhea, and vomiting.

This is all relevant to ResMed as sleep apnea has until recently mainly been diagnosed in middle-aged obese men. However, management are quick to point out (in the recent annual report) that nearly 40% of new CPAP patients are female.

In any case, is this ‘wonder drug’ the cure for obesity and as a result, sleep apnea?

We think not.

While obese people often have sleep apnea, not all sleep apnea sufferers are obese. People with hypertension (83%), chronic heart failure (76%) and type-2 diabetes (72%) all suffer from high instance of sleep apnoea.

As a result, the sleep apnea addressable market is huge, estimated to be approximately 900 million people globally and with only 16 million people on CPAP devices, and with 80% of people undiagnosed, this exceptionally large market remains underpenetrated.

The upshot here is there is ample scope for both Ozempic and sleep apnea to co-exist and certainly for ResMed to continue its double-digit organic growth runway.

What is the upside for the RMD share price?

At $25.00 per share, we think the market is now underappreciating a business that can sustainably generate >15% top line growth, at 30% EBITDA margins and 20% return on invested capital (ROIC) from largely recurring revenues.

On that basis, in 3 years ResMed will be making $1.7bn in net income. Assuming it trades on the same 30x price-earnings ratio (P/E) it traded at pre-results, the stock is worth ~$35 per share before buybacks or other capital management.

In high quality, large cap companies, these sorts of opportunities only turn up once in a blue moon – usually when there’s a prevailing, exaggerated and feared shift in narrative.

In our view, narratives are best left for bedtime and investors should focus on the data.