The Dubber Corp Ltd (ASX: DUB) share price will emerge from the ASX suspension on Monday. I’m guessing the Dubber share price will be punished.

For context, I wrote last week why Dubber shares were suspended.

I have no dog in this fight — for or against the company. I issued a “sell” alert on Dubber in March 2022 to Rask members, after repeated attempts to get reasonable questions answered by management were, in my opinion, dodged by the company, its IR/PR team, or both. I remember they even joked after one call that the moderator of the investor call did a good job of avoiding the hard questions.

For what it’s worth, it pains me to write negative updates like this one on Dubber. Amongst a room of professional investors, I’m usually the optimistic one — I live by David Gardner’s portfolio construction strategy of ‘make your stock portfolio represent your best version of the future’. It might seem like fluffy words, but cautious optimism is what propels entrepreneurs and fuels capitalism — improving the world over time.

I also have friends who are analysts that have (like me) recommended Dubber, and I know plenty of shareholders who still own it. I know that some of my Rask Core 🌏 members, who have trusted me for years, will hold Dubber shares.

And so all of this makes me sad in writing another update.

As such, this will be the final time I cover Dubber’s results here on Rask Media. I’ll only comment on the company if I’m asked directly

via our Q&A form, on The Australian Investors Podcast.

With that said, let’s get into it…

Corrected results

Since last Monday, when Dubber shares were suspended, what we now know is probably much worse than I had expected.

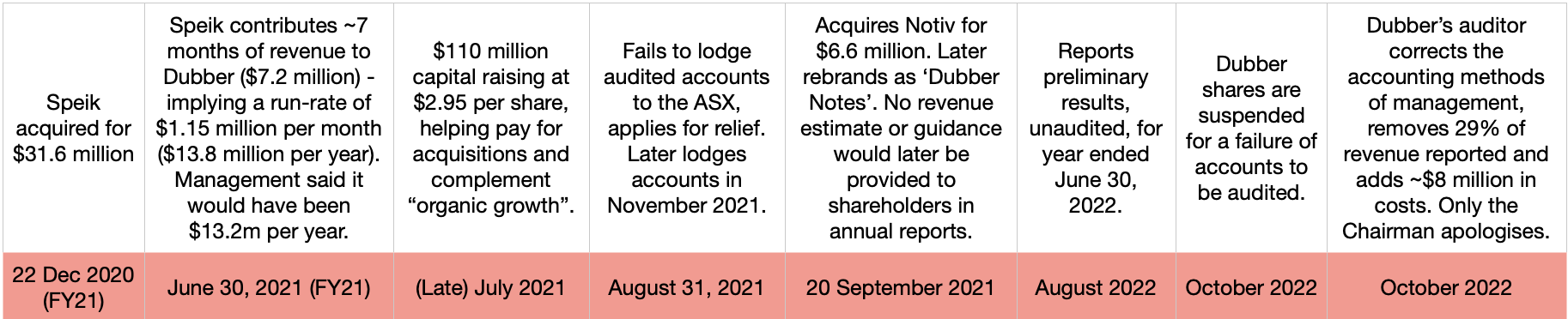

Last year (FY21), when management and the board of directors at Dubber failed to lodge their audited financial results on time, the company applied for relief under ASIC ruling. Not a great look, but ok.

They took a couple of months to get their accounts audited.

(Side note: a two-month extension is a lengthy amount of long time, especially given the company already had a couple of months to compile the results after June 30th.)

If you ask me, they reported a poor set of financial results in FY21 – a loss of $31.7 million. What made the result particularly bad is that while revenue/sales went up $10.7 million, expenses and costs went up a lot more. Hence, the loss widened from $18 million to nearly $32 million.

I can excuse a company for failing to get accountants to audit every line item of a multi-national company like Dubber. Especially coming out of Covid (travel restrictions) and when the company has made acquisitions (making the audit quite a bit tougher).

(Side note: it was between then and now that I told Rask members to sell because, in my opinion, the company repeatedly avoided my questions — and those of other investors and analysts. Amongst other things, of course.)

This year around (FY22), the company didn’t get relief from reporting laws. But I still suspected it might just be a timing or audit complexity issue.

Finally, after 5 days of suspension, we got the news. On Friday night just gone — after the market closed — the company released a few corrections and its annual report.

(A side note on Friday night results: while most sceptics will accuse a company of publishing results when no one can see them — a Friday night because even stock market analysts have a social life — it’s not always in the company’s control when announcements are made. Furthermore, sometimes allowing investors to have a weekend to digest good or bad results can be a wise move as it removes impulsive trading activity. But still, Friday night analysis is hard. I had to interrupt my Netflix binge and chat with another analyst because this one was too big to ignore).

So what was reported by Dubber on Friday night?

The key changes that were issued against its ‘preliminary results’ are as follows:

- Dubber’s revenue was overstated by $10.3 million. That’s means Dubber reported 29% more revenue than it should have. Put another way, the retracted revenue was equivalent to ~41% of what ended up being reported as correct.

- Dubber needed to incur an extra cost of $8.16 million because, in my interpretation, a company would not pay its bill to Dubber. Note: the reason I’m sure is this might be the bill of a customer of a customer (e.g. a telco partner’s corporate client who uses Dubber for note taking — but didn’t pay the telco. I couldn’t figure it out).

What was reported in the rest of the Dubber annual report?

Please note: Dubber’s first lodgement of unaudited results in August 2022 did not include any disclosures on management incentives, or some important accounting notes I like to read, so we had to wait until this week. Hence my embedded tweet, above, which suggested we need to wait for the annual report to get to the bottom of some things.

The key insights for me in the annual/audited report are as follows:

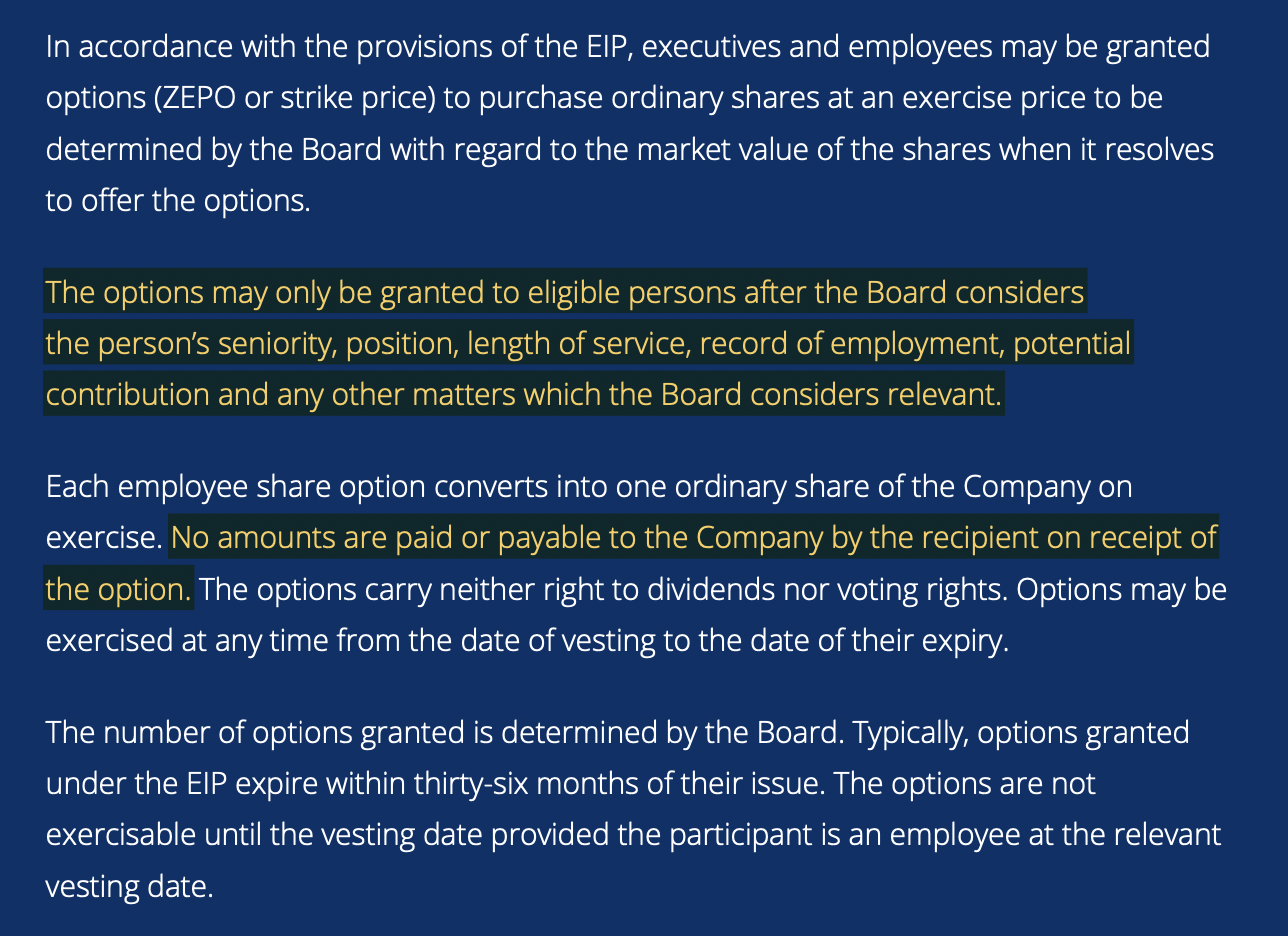

- The company continues to offer huge amounts of ‘Zero Exercise Price Options’ or ZEPOs, for short. This is an option that allows employees, directors and senior staff to get shares for zero cost to them. Incredible. Imagine just getting shares that you can instantly sell for a profit. In my opinion, these options are grossly unfair to long-term shareholders. More on this below.

- In total, 9 of the 240+ employees were paid $13.4 million, including $10.3 million of options. In other words, these options are equivalent to 41% of yearly revenue of the business. This would be like the baristas at a cafe taking 60 cents out of the cash register for every $5 coffee sold — plus a $2 coin in shares of the cafe.

- The company claimed it achieved organic growth. More on this below.

- Dubber’s loss widened from $31.6 million to $83 million.

- Despite its huge $110 million capital raising a little while back, the company blamed company valuations for being too high in the first half of the FY22 year, then blamed an uncertain environment in the second half of the year, as reasons why acquisitions were not made.

Organic growth? Nah, it’s acquisitions.

If we assume an additional ~6.67 months of revenue from Speik (and none from the Notiv acquisition, which I can’t figure out), at the run-rate management disclosed a year earlier ($13.2 million), Dubber should have added an extra $7.2 million of revenue.

But it only added ~$5 million of service revenue.

So if we assume Speik was consistent (which it might not have been, it could have gone backwards — but keep in mind I think the sellers of that business got paid out early for good performance ), the overall Dubber business went backward ~$2 million.

I could be wrong because I’m just trying to piece together numbers based on prior disclosures.

Chairman apologises

To his credit, Dubber Chairman Peter Clare said the following in the annual report:

“I would like to sincerely apologise to shareholders, on behalf of the Board and CEO, for the delayed lodgment. A full review is underway and any necessary changes or improvements to avoid such an event occurring again will be implemented with the Board’s full support.”

That was the only mention of the word “apologise” in the annual report. A delayed lodgement is the lesser issue in my opinion.

Rapid value destruction

I’ll now move from mostly factual reporting to conclude with some insights.

Because the board of directors at Dubber have repeatedly granted so many “ZEPOs” to select staff (which have hurdles like ARR or product releases), shareholders’ long-term wealth has been crushed.

And, sadly, I suspect any form of long-term recovery in Dubber’s share price is unlikely. There are still so many options outstanding.

This is not because the share price has fallen (that’s okay if you’re a long-term holder). It’s due to something else…

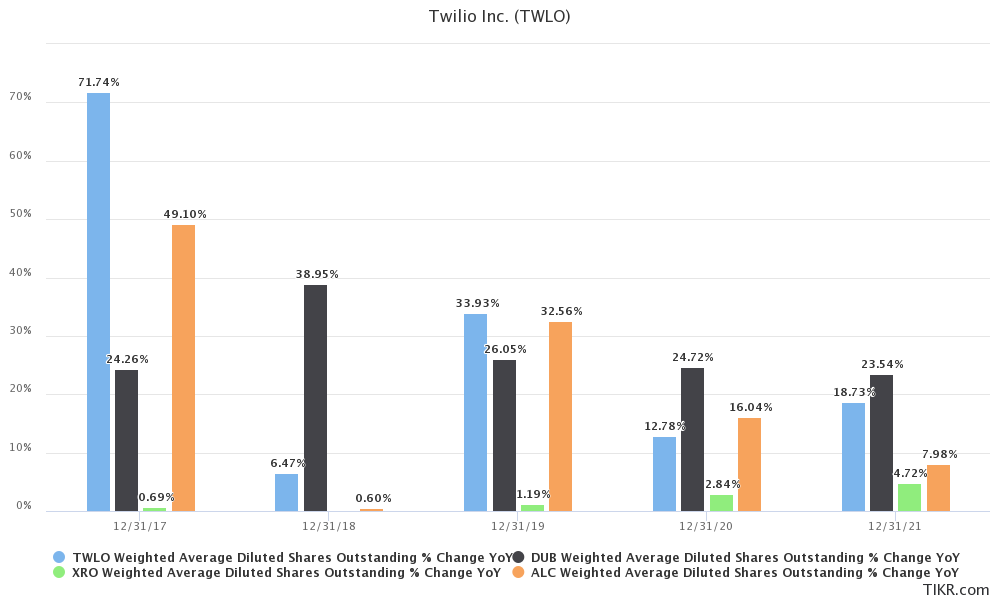

The following chart shows a side-by-side comparison of 4 technology companies that have been hit really hard over the past year.

Courtesy of the fantastic Tikr terminal, a freeium tool for great financial data on public companies, you can see the number of shares in each company (as a percentage of all shares) going up over time. For example, if a company with 10 shares this year issues another 1 share to you next year, its share count goes up 10%.

This is called “dilution” in the investments industry because unless you’re the one receiving the shares, your ownership is diluted again and again and again every time this happens. It’s like when your aunt Bertha used the same amount of Cottees raspberry cordial in more and more water. It dilutes the good stuff until the point the raspberry is tasteless.

By way of context:

- Twilio Inc (NYSE: TWLO) is a US-based technology company that does cloud-based communication. It’s not perfectly similar to Dubber but it’s technology is based in the cloud (like most new software is these days) and it specialises in helping large customers communicate with their customers (think Uber drivers sending you a text message). You can see Twilio has been aggressively issuing shares (blue columns) but it’s slowly coming down. Twilio shares are down 76% year over year.

- Xero Ltd (ASX: XRO) is a high-quality cloud-based accounting software provider. You can see Xero doesn’t issue a lot of shares (green columns). Xero shares are down 43% shares year over year. I own Xero shares.

- Alcidion Group Ltd (ASX: ALC) is a small-cap healthcare technology business that is scaling. You can see (in the orange columns) that it has tapered off issuing shares to investors, acquisition targets or staff. Like Dubber, Alcidion used new shares as a currency to afford the acquisition of other businesses. But now that Alcidion it is scaling it should probably no longer need to dilute shareholders. Alcidion shares are down 63% year over year.

- Dubber (black line) has issued lots of shares, with more than 20% more shares being added every year. Selling shares when they are high can be a good thing (it means fewer shares are issued) but now that shares have fallen, if it needs to raise capital it will be more dilutive (because it has to sell more shares to get the same amount of money).

So what’s the problem?

The difference between Dubber and these other businesses is that Dubber has been giving away and selling shares at a fast clip, while its financials haven’t been materially improving. It could change, in time. Especially if management can execute and grow the business without making acquisitions. I really hope they can. Because they have a lot of passionate employees and a product that should be getting more attention as compliance in banking and telecommunications becomes more important.

However, if management cannot quickly return the company to growth and stop issuing shares, I think there’s an increasing probability that the Dubber share price won’t recover. This is because unless the company grows rapidly in the call recording space (and collects the fees from customers) the revenue (and any future profit) will be shared amongst more shares.

Source: Rask Media. The chart shows the Dubber share price (red) versus the Vanguard ASX 300 ETF (VAS) over two years (black).

Summary

Credit has to go to Dubber’s auditor and the ASX for ensuring the market is informed of the company’s financials. It’s a pity the corrections to the financials were so sharp.

I’m in no way suggesting the company had knowingly made mistakes. But mistakes were definitely made in the preliminary results (hence why they’re called preliminary).

Unfortunately, in my opinion, Dubber has avoided too many important but sensible questions from shareholders (e.g. “what is your revenue per subscriber?”), tends to unnecessarily complicated language, pays its senior staff too much for the financial value being created, spends too much on things like office spaces (e.g. in Melbourne), and needs some independent directors at the helm.

The longer I’ve invested the more I’ve realised that cautious optimism is always warranted by investors and analysts. But also that no investor or company is perfect. We all make mistakes. But it’s best to informed.

I recommended Dubber shares at one point because I thought the technology was great. Now I’m not as sure.