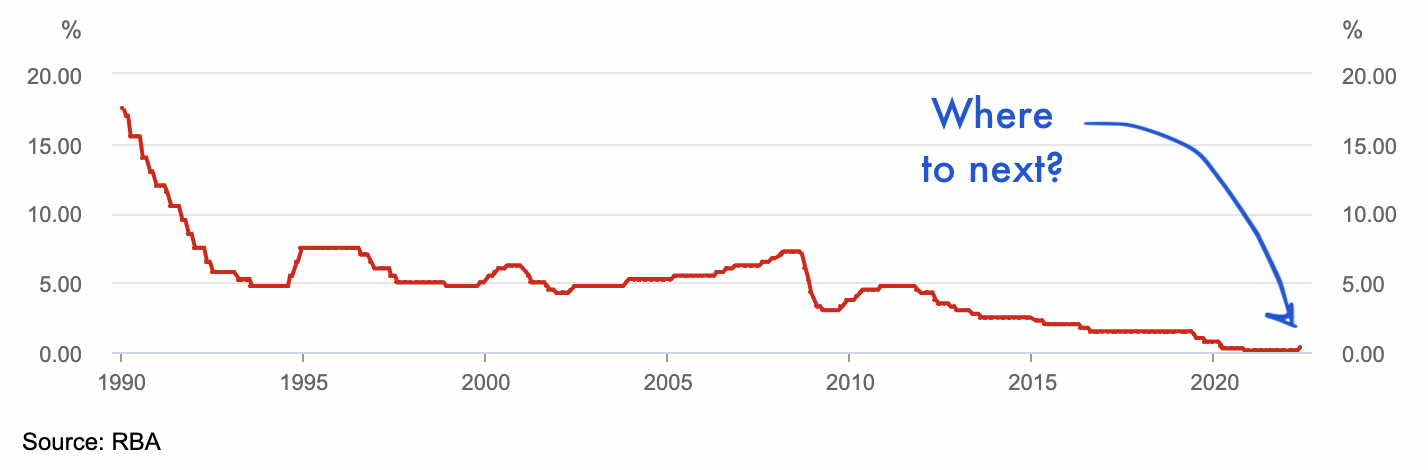

This week, the Reserve Bank raised interest rates, from 0.1% to 0.35%.

Some economic “experts” are now forecasting official interest rates to rise to 2-3% over the next few years.

Interest rates are like gravity. The higher they go, the quicker things fall.

The reality is that the higher interest rates go, the faster some stocks, bonds and properties will fall.

However, it’s not all bad news for investors. There are ways to avoid or beat rising interest rates.

Below, I offer 5 steps for share investors…

Here is a 5-step checklist to avoid letting your portfolio get walloped by interest rates.

1. Avoid highly indebted companies.

Companies with lots of debt will face higher interest rates and funding costs on their loans, so they will be hurt. Try to avoid companies that will be reliant on bankers in the next few years just to stay in business.

2. Avoid unprofitable companies.

Holding onto some unprofitable companies might be ok, provided they are resilient but don’t hold too many. I recently told Rask Invest members to sell terminals business Tyro Payments (ASX: TYR), and we put a sell rating on workforce management company RightCrowd Ltd (ASX: RCW). Unprofitable companies are hit harder than profitable businesses because, like indebted companies, they’re not self-sufficient and will eventually come knocking for extra money to fund their operations. Higher rates make that more expensive.

3. Avoid companies with no pricing power.

If a company is facing higher costs for its products (e.g. manufacturing costs or wage inflation) and it cannot pass those extra costs along to customers, its profit margins with be squeezed. Companies like Microsoft (NASDAQ: MSFT) have pricing power because they know your employer will never give up Microsoft Excel.

4. Avoid companies with poor growth.

I recently slapped a BIG fat SELL rating on Dubber Corp (ASX: DUB) shares for Rask Invest because I have strong doubts about the company’s true growth potential. Excluding acquisitions, Dubber is growing a lot slower than investors expect. The reason you want growth in your portfolio is that companies can often out-grow short-term issues — and flip a downturn in the economy into an opportunity. Amazon (NASDAQ: AMZN) did this during Covid.

5. Buy companies that are trading at really good valuations.

In the past 10 years, it’s been so hard to find high-quality companies trading at good valuations. But thanks to falling prices, now could be our opportunity to find and own these rare beasts — either through an ETF or directly. For example, ARB Corporation (ASX: ARB) might still be too overvalued for my liking, but thanks to a 10% fall yesterday, ARB shares are now heading in the right direction for value investors.

It seems like a pretty easy 5-point plan, right? You should be able to identify each of these 5 factors using data that is publicly available.

And what’s the worst that can happen if you follow the steps? Even if interest rates don’t rise as fast or hard as the “experts” are forecasting, at least you’ll have a pretty impressive portfolio of companies.

Want to learn more about valuation?

After 12 months in the planning, we’ve finally released our super popular, totally online, value investor program. Open now to early adopters, the Value Investor Program, in collaboration with Equity Mates Bryce & Ren, is the biggest, boldest and (I’d say) best online investment course in Australia for learning about investing in shares.

The new Value Investor Program is $300 cheaper than the first program yet it’s 4x more comprehensive than the first program. Plus, we’re doing 3 LIVE investor training sessions. Join me inside the program and you’ll get my full HD video tutorials, spreadsheets, Notion templates, PDFs and so much more. Click here to learn more.