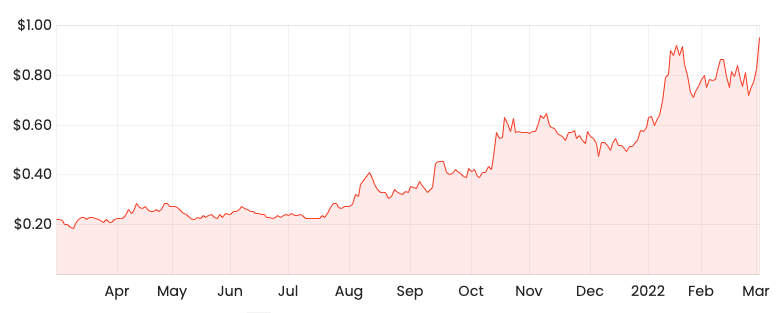

The Core Lithium Ltd

(ASX: CXO) share price has shot up 15.15% today to $0.95 after announcing an offtake agreement with Tesla Inc (NASDAQ: TSLA).

CXO share price

Core Lithium signs up Tesla

Core Lithium will supply Tesla with 110kt of spodumene concentrate – which lithium is derived from – over four years.

Supply will begin in the second half of 2023.

The deal also includes Tesla providing support for a potential Stage 3 expansion which would integrate into the electric vehicles maker’s supply chain.

The term sheet is subject to signing a definitive agreement by 27 August 2022.

Core Lithium already has 80% of its initial output sold under 4-year offtake agreements to Ganfeng and Yahua – both big players in the global lithium supply chain.

What is an offtake agreement?

An offtake agreement is where the middle or end-user signs an agreement with a miner to purchase materials from them.

For producers, it provides mitigates demand uncertainty on often accelerates project financing.

For the buyers, it guarantees future supply without needing to go out into the market and purchase at spot prices.

From explorer to producers

Producers differ greatly from explorers.

Explorers are still searching and determining the feasibility of a mining project. Hence explorers can be years away from actual revenue and profits.

Producers on the other hand are digging dirt up and selling to end-users such as Tesla.

Other notable lithium producers include Orocobre Limited (ASX: ORE), Pilbara Minerals Ltd (ASX: PLS) and Galaxy Resources Limited

(ASX: GXY).

What next for the Core Lithium share price?

Core Lithium’s Finniss project is located in the Northern Territory and is fully funded.

Work is currently underway on site construction and will create 250 new jobs in the region.

The project will begin production in the fourth quarter of 2022.

With most of its production locked away, there likely isn’t much more big news on the horizon for Core Lithium’s share price.

Although movements in the lithium price will directly impact the business.

The lithium price has increased 5-fold over the past year as demand soars from electric vehicles and battery makers.