The Woolworths Group Ltd (ASX: WOW) share price is rising today after recording an 8% jump in sales for the first half of FY22.

Keep up to date with the February 2022 reporting season calendar.

Woolworths share price buoyed by sales jump

Currently, the Woolworths share price is up 2.71% to $36.15.

Key financial results for the half ending 31 December include:

- Revenue of $31.89 billion, up 8.0% year-on-year (YoY)

- Earnings before interest and tax (EBIT explained) of $1.38 billion, down 11.0% YoY

- Earnings per share of $0.643, down 5.1%

- Interim dividend of $0.39 per share, down 26.4%

Woolworths benefitted from the recent acquisitions of PFD and Quantium boosting the top-line growth.

Core groceries sales increased 3.4% but moderated as lockdowns emerged in December.

Impressively, online sales increased 50.5% with both home delivery and stock pick up remaining resilient.

Woolworths also profited from a strong showing at its New Zealand stores, increasing sales by 8.3% and earnings by 3.3%.

Conversely, Big W sales fell 9% and profit plummeted 81.2% due to lower sales and COVID-19 restrictions.

Costs impact profits

Like Coles Group Ltd (ASX: COL) and Wesfarmers Ltd (ASX: WES), the business faced a myriad of pandemic induced headwinds.

High levels of staff absenteeism impacted distribution, trucking and in-store activity.

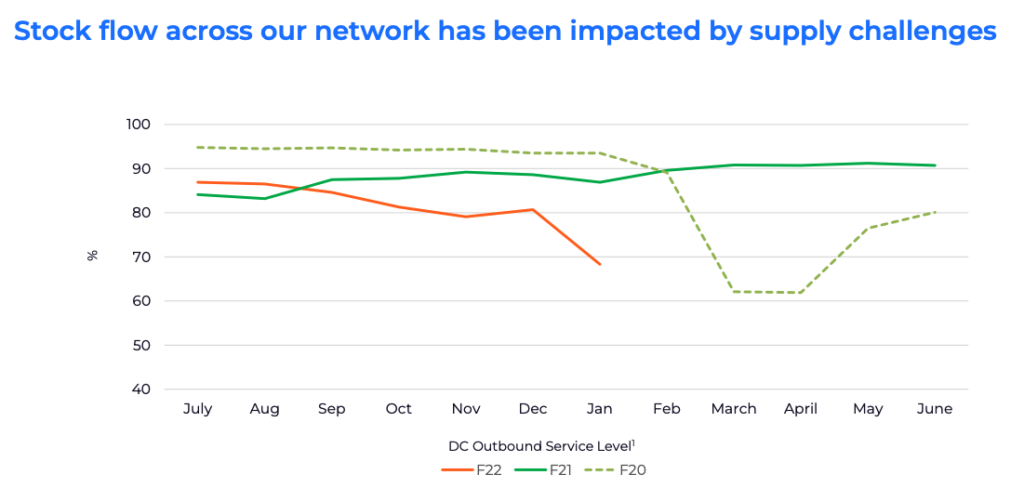

Moreover, Woolworths had difficulty sourcing ingredients, packaging and pallets impacting its supply chain.

Sea freight and shipping container shortages also weighed on margins.

Subsequently, Woolworths incurred $239 million in COVID costs, weighing on margins and contributing to the fall in EBIT and earnings per share.

“Customer scores were impacted by on-shelf availability as a result of supply chain disruption, but pleasingly, our market share and brand and reputation scores remained strong”

The other major pressure on profits was non-cash depreciation and amortisation charges.

The interim dividend decline was largely a result of demerging of Endeavour Group Ltd (ASX: EDV).

Excluding Endeavour, the dividend fell just 2.5%.

What next for the Woolworths share price?

Ongoing pandemic challenges continue to impact the Woolworths share price.

Australian Food sales are down 5% for the first seven weeks of 2022.

Big W sales have somewhat rebounded, down just 4% to start the year.

This has led to $34 million in one-off COVID costs, which should abate over the half.

Moreover, inflation is expected in the 2-3% range, leading to higher shelf prices.

“We expect inflationary pressures to continue to intensify due to industry-wide cost increases. It is inevitable that some prices will increase”