The PEXA Group Ltd (ASX: PXA) share price is moving higher today after the business upgraded its prospectus guidance for FY22.

The biggest IPO of 2021: PEXA Group (ASX: PXA)

PEXA share price supported by housing activity

Currently, the PEXA share price is up 14.05% to $19.40.

Key financial results for the half ending 31 December include:

- Revenue of $145.4 million, up 46% year-on-year (YoY)

- Pro forma EBITDA of $75.5 million, up 71% YoY

- Net profit after of $9.7 million, up from a loss of $1.6 million

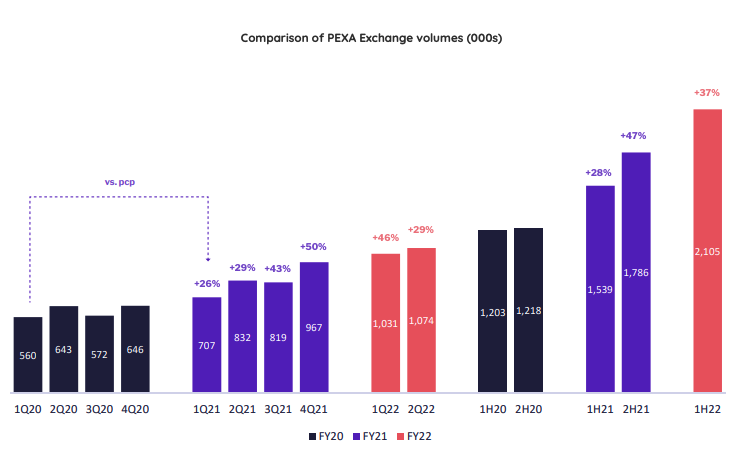

It was a record first-half result for PEXA, which processed 2.1 million property transactions, a 37% jump on the prior year.

The Australian property market remained buoyant while increased penetration in states such as Queensland supported growth.

Subsequently, PEXA reached 60% of its forecasted prospectus volumes.

“Our strategy to build on PEXA’s position as the operator of Australia’s leading digital property settlements platform is delivering attractive results”

Revenue was also supported by average price increases across all three transaction types: transfer, refinance and other.

As for costs, expenses increased 15% year-on-year but remain largely in line with pre-pandemic levels.

UK expansion accelerating

The PEXA share price could be heading even higher as the business capitalises on several growth opportunities.

PEXA has had seven UK-based banks complete testing via the PEXA settlement payment solution in conjunction with the Bank of England.

Moreover, an agreement has been signed with Her Majesty’s Land Registry.

It has locked in another four testing slots for October 2022, with ‘significant interest’ from the conveyancing industry.

PEXA also noted it had launched two new products under its Insights division.

Furthermore, it made its first purchase under the Ventures segment, Landchecker.

Landchecker provides a one time platform for property information including planning permits and restrictions, past house prices and land attributes.

What’s next for the PEXA share price?

The PEXA share price is likely racing higher today as a result of the business upgrading its prospectus guidance.

PEXA now expects the following financial result for FY22:

- Revenue of $265-$275 million, up from $246.9 million

- Pro forma EBITDA of $120-$130 million, up from $107.6 million

- Net profit minus amortisation of $55-$65 million, up from $37 million

It’s the second time PEXA has beaten its own forecasts in just six months of life as a public company.

Overall, it’s a terrific result by PEXA and little surprise the share price is rising.