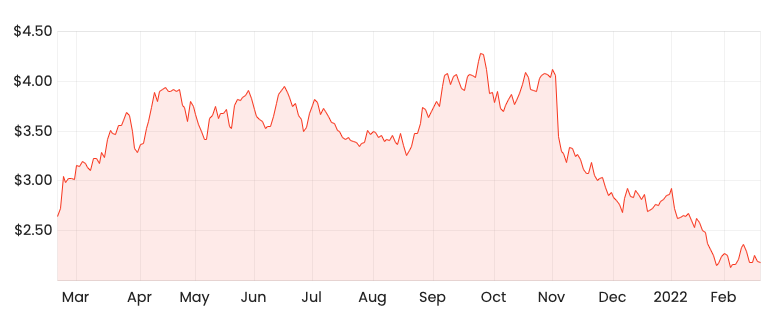

The Tyro Payments Ltd (ASX: TYR) share price has been hammered today after releasing its first-half report for FY22.

TYR share price

Tyro share price and profit reverses

Currently, the Tyro share price is down 21% to $1.72.

Key financial results for the half ending 31 December include:

- Revenue of $149.2 million, up 29.9% year-on-year (YoY)

- EBITDA of $2.7 million, down 67% YoY

- Loss before tax of $11.2 million, down from $2.8 million in the corresponding half

Tyro achieved growth across several of its key metrics. Merchants increased by 68%, Total transaction value (TTV) by 31% and merchant churn fell to 10.1%.

Its banking business also made a return providing $2.4 million in gross profit after temporarily being paused due to the pandemic.

Despite the aforementioned growth, Tyro also faced several headwinds including deferred pricing adjustments, losses from recent acquisitions and pandemic restrictions.

“…[we provided assistance including] terminal rental relief, loan repayment relief and we did not pass on scheme and interchange fee increases we incurred in the half”

Subsequently, expenses grew at a relatively faster pace than gross profit, leading to EBITDA and profit loss ballooning out.

This is a concern for Tyro. Payments companies typically see earnings increase as metrics such as merchants and TTV rise.

The fact Tyro earnings are going backwards indicates the company remains subscale despite its market share of 4.4%.

Tyro needs to continue to acquire new merchants to its platform to build the operating leverage required to churn out profits and lift its share price.

TTV no longer equals gross profit

Historically, Tyro has been an easy business to follow.

It processes payments for customers (TTV) and then takes a clip of each transaction (gross profit).

But post the acquisition of Bendigo and Adelaide Bank Ltd (ASX: BEN) merchant services division, transaction value no longer translates directly into gross profit.

Tyro and Bendigo Bank have a profit-sharing agreement, which means Tyro only receives a slice of the total pie.

Now getting a read on Tyro’s operating results is much more complicated.

What’s next for the Tyro share price?

The Tyro share price will be supported by TTV growth in the first seven weeks of the second half.

TTV is up 35%, leading to a gross profit uplift of 24%.

The Tyro share price will also benefit from the easing of restrictions, opening of international borders and return of workers to physical locations.

No concrete guidance was provided for FY22.