Business is all about people. I believe these 2 ASX growth shares possess great cultures run by quality management teams.

Plenti Group Ltd (ASX: PLT)

The Plenti share price has been quite volatile but it’s building a strong working culture.

PLT share price

Plenti listed on the ASX in late September 2020 and provides efficient, simple and competitive loans through simple digital experiences.

Remember the days of completing piles of forms just to get a loan? Plenti is all about making it easier and more efficient for customers.

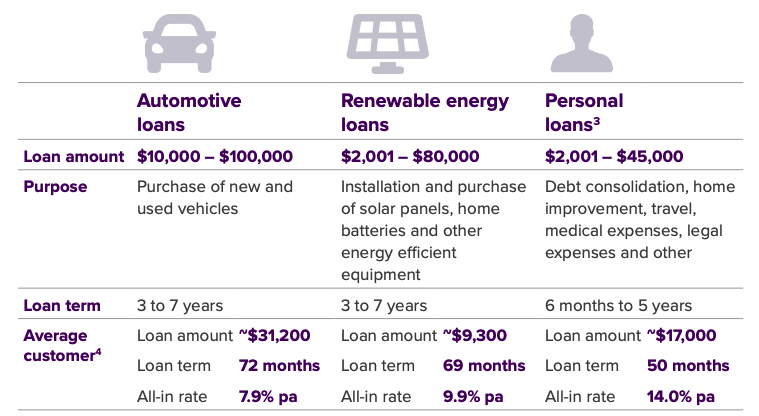

It primarily provides loans for the purchase of automotive vehicles, purchase and installation of renewable energy products like solar panels and batteries and other personal expenses like home improvement, travel and medical needs.

Its point of differentiation is that these loans are funded from a range of funding platforms. So retail, institutional and government investors can make a return from backing such loans.

That’s the business, how about the people who drive performance?

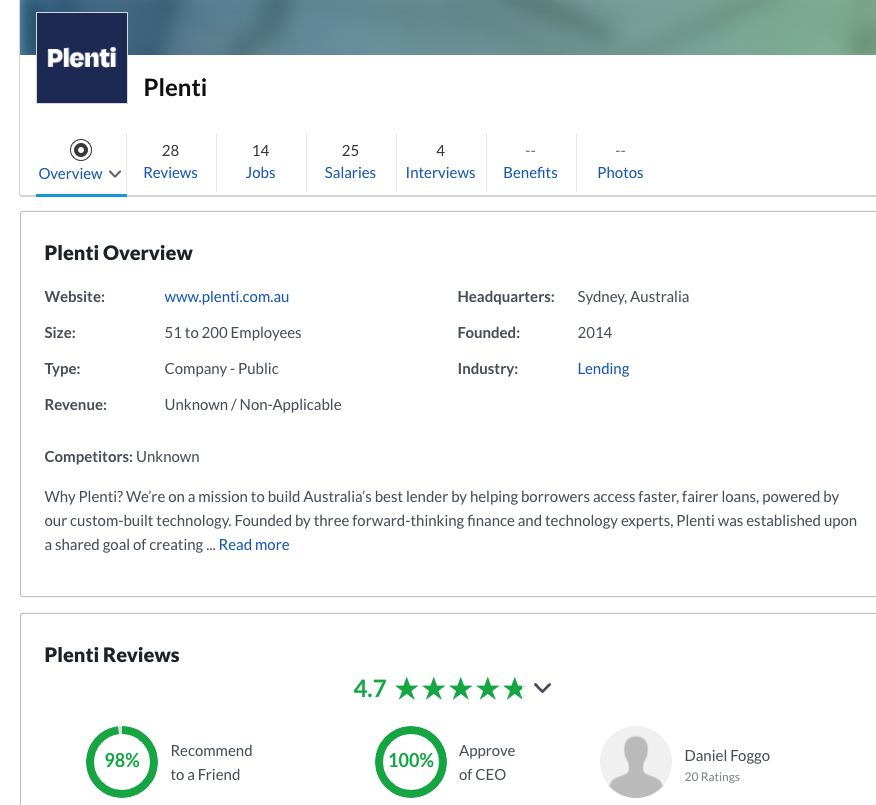

Plenti has a pretty high rating on Glassdoor as seen below although there are only 28 reviews to date.

Management’s openness and transparency is a common theme amongst the reviews. A few current and former employees found management’s willingness to be open to feedback to improve the service they provide to customers as a significant positive.

And I think the Company’s constant commitment to improving the customer relationship is the key driving force behind its strong growth in revenue.

It’s striving to take market share from major banks like Commonwealth Bank of Australia (ASX: CBA) and National Australia Bank (ASX: NAB). These banks have solid employee reviews on Glassdoor but Plenti has a much more nimble workforce, who seems to be much more driven. I think Plenti’s superior culture is something to keep an eye on down the track.

Audinate Group Ltd (ASX: AD8)

The Audinate share price has maintained some sort of consistency over the last two years but is currently suffering a downward trend due to the global chip shortage.

AD8 share price

Audinate manufactures and develops networking technologies that provide high quality and efficient transmission of audio. It’s also developing technology in the video space after acquiring Silex Insight.

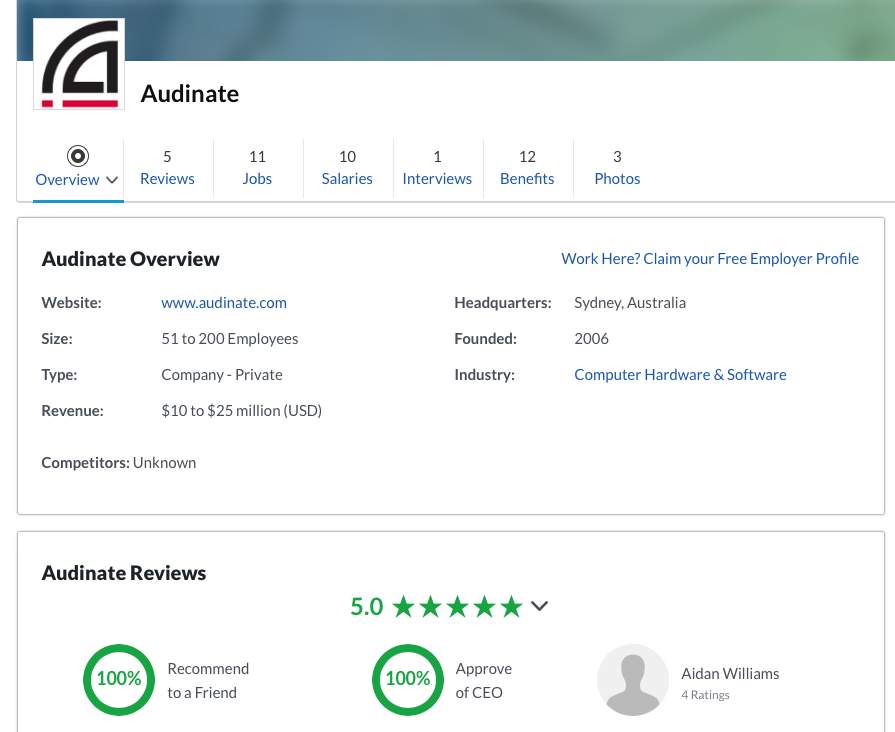

As you can see, Audinate gets full marks but there are only five employee reviews.

According to LinkedIn, Plenti has 163 employees and Audinate with 155 staff, so the reviews are only a small sample size, which may not broadly reflect the culture.

Similar to Plenti, employees at Audinate are enamoured with management because they’re great leaders. It seems like management at Audinate provide the support needed for employees to flourish and are receptive to feedback.

I think being open to feedback is integral for not only growth in a company but personal development.

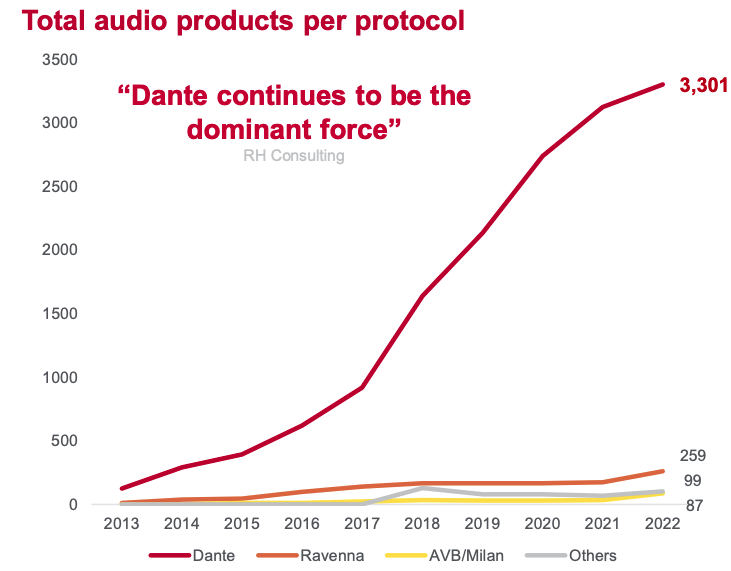

It reminds me of the late Steve Jobs‘ famous quote, ‘Stay hungry. Stay foolish‘. Such an attitude is particularly important in companies that are attempting to take market share through innovation. So, it’s no surprise to see Audinate continue to crush its competitors in the audio space.

Both companies continue to take market share in their respective pockets, and I think their great cultures will play a pivotal role in continuing this trend.