The Mineral Resources Limited (ASX: MIN) share price has dug itself a hole this morning down 7% after announcing the first-half earnings for FY22 had collapsed 80%.

Mineral Resources operates three key divisions: Mining Services, Iron Ore and Lithium.

Anchor your portfolio with these top 20 dividend growth ASX shares

Iron ore price collapse annihilates earnings

Key highlights for the first half ending 31 December 2021 include:

- Revenue of $1.4 billion, down 12% year-on-year (YoY)

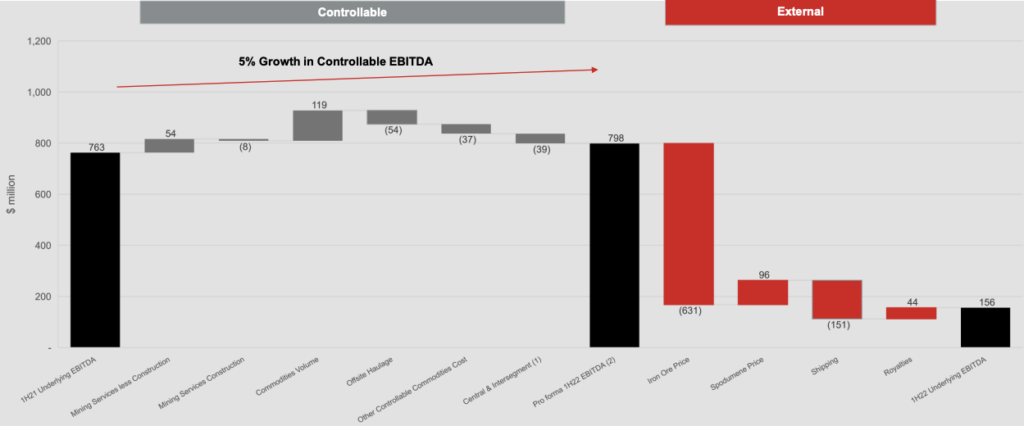

- Underlying EBITDA of $156 million, down 80% YoY

- No interim dividend

- Cash on hand of $751 million, down 51% YoY

Despite a 25% increase in production, Mineral Resources earnings collapsed due to a 41% decrease in the average iron price the miner received.

Mineral Resources iron ore mines are relatively higher cost than peers such as Fortescue Metals Group Limited

(ASX: FMG) and BHP Group Ltd (ASX: BHP).

Therefore when the price falls, profits are more severely impacted.

Increased costs also weighed on earnings, with a $54 million increase in haulage and a $151 million rise in shipping being the main culprits.

Positively, the Mining Services division increased its revenue and EBITDA by 28% and 20% respectively.

Four new contracts were signed, in addition to three renewals resulting in a 100% contract retention.

Lithium production was on par with the corresponding half, with a 204% increase in the achieved lithium price producing a $67 million EBITDA gain.

With the lithium remaining elevated, Mineral Resources will restart operations at its Wodgina lithium project.

Dividend cut to focus on growth

To continue investment in its operations and in light of the fall in profit, Mineral Resources has cancelled its interim dividend.

Commenting on the result, Managing Director and founder Chris Ellison said:

“It hasn’t been easy and the challenges during 1H22 were amplified by the collapse in iron ore prices. This has delivered our worst first half financial result in three years”

“These results do not reflect the substantial progress in our iron ore, lithium and gas businesses during the last six months which will create significant value for decades to come and which underpins our long-term growth for our Mining Services division”

What’s next for the Mineral Resources share price?

The company reconfirmed its full-year production targets including:

- Mining services volume growth of 15-20%

- Spodumene export volume of 450-475 ktpa

- Iron export volume of 18.5-19.5 mtpa

However, it has done little to calm the market, with the Mineral Resources share price continuing to fall.

As demonstrated in today’s result, Mineral Resources is at the mercy of commodity prices.

If lithium and iron ore prices increase, the Mineral Resources share price should follow. The opposite is also true.