The Computershare Ltd (ASX: CPU) share price will be on watch today after releasing its first-half results overnight.

Keep up to date with the February 2022 reporting season calendar.

Computershare provides a range of services for public companies.

These include managing share registries, employee share plans, governance and corporate actions (mergers, bankruptcies).

Mixed-bag delivers modest growth

Key highlights from the first half ending 31 December 2021 include:

- Revenue of $1.2 billion, up 4.6% year-on-year (YoY)

- Earnings before interest and tax (EBIT explained) of $157.8 million, increasing 16.7% YoY

- Earnings per share (EPS explained) of 22.76 cents, up 4.5% YoY

- Interim dividend of 24 cents per share franked at 40%, up 4.3% YoY

From a divisional perspective, Register Maintenance, Governance services and Employee Share Plans performed strongly.

Management cited its technology platform and improved customer experience as key drivers of growth.

The above gains were offset by lower volumes for event-based divisions, such as Bankruptcy and Class Actions.

Corporate Action revenue was also down, with lower participation in Hong Kong IPO’s. which were a large contributor in the corresponding period.

The new acquired Corporate Trust division is performing above expectations.

Fee revenue is growing. Meanwhile, the division serves to be a direct beneficiary of rising interest rates.

Finally, the US Mortgage Services business remains subdued but activity is expected to pick up in the second half of 2022.

“Our global operating businesses continues to perform well, CCT’s earnings contribution is running ahead of plan and we expect to benefit from a 25 basis points interest rate rise in the United States in Q4”

Hidden gem

While the divisional results were a mixed-bag, Computershare guided towards a potential hidden gem going forward.

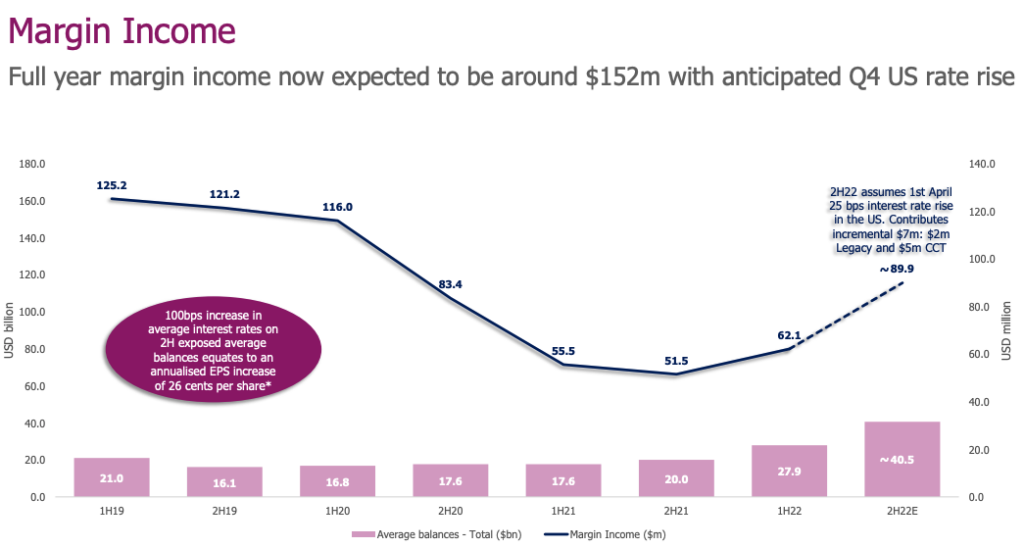

The Computershare share price benefits from rising interest rates as the margin income it earns on client cash increases.

For example, if Company A is paying a dividend, Computershare will hold that distribution in a cash account.

That account will earn interest at the cash rate, which Computershare accounts as margin income.

Falling interest rates have historically been a headwind to margin income.

But with major US banks expecting between four to seven rate rises over 2022, Computershare earnings could pop up quickly.

“A 100bps increase in interest rates on the exposed average balances we currently manage would generate an annualised EPS increase of 26 cents per share”

What’s next for the Computershare share price?

As a result of the strong first-half performance, management is upgrading FY22 guidance to:

- Earnings per share growth both 9%, up from 2%

- EBIT ex-margin income up 13% compared to 4%

- Margin Income upgraded to $152 million, a 5% increase on prior guidance

Given interest rates will likely increase over the following months, there could be further positive guidance revisions on the horizon.

“We are deploying capital in businesses with high levels of recurring revenues, strong competitive advantages, positive industry growth trends and above average returns on capital”