Credit Corp Group Limited (ASX: CCP) has kicked off the February earnings season with a record first-half result increasing profit by 8%.

Subsequently, the Credit Corp share price is up 4.96% to $35.57.

Credit Corp purchases outstanding debt balances from institutions such as banks. It then aims to collect that money over time to earn a return on its investment.

Record half despite difficult market conditions

Highlights from the first half of FY22 include:

- Revenue of $203.9 million, a 9% increase year-on-year (YoY)

- Net profit after tax (NPAT) of $45.7 million, an 8% increase YoY

- Dividend of 38 cents per share, up from 36 cents

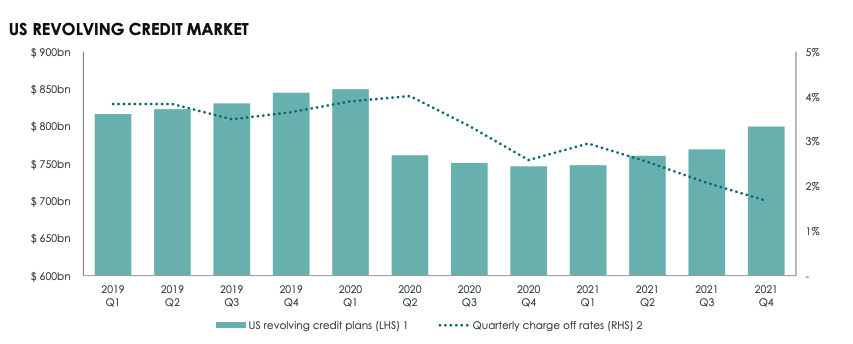

Unsecured credit, such as credit cards or personal loans, have been impacted by record government stimulus and higher household savings as border restrictions limited movement.

As a result, the supply of purchase debt ledgers (PDLs) has fallen over the past two years placing pressure on Credit Corp’s revenue and earnings.

Despite market volumes for unsecured debt remaining low, Credit Corp was able to offset the downturn by taking market share in its emerging US business.

Its US collections increased 15% over the half, while productivity increased 28% to $335 collected per hour.

The company also benefited from the purchases of the Radio Rentals and Collection House

acquisitions, which increased Australia collections by 6% and NPAT by 5%.

With stimulus unwinding, restrictions easing and interest rates on the up, the company expects PDL volumes to return to historical levels.

“Aus/NZ consumer lending demand accelerated over the December quarter as key markets emerged from COVID lockdown”

“Record monthly originations were recorded in December”

“Credit Corp enjoys strong purchasing relationships and is well-positioned as unsecured credit balances recover and charge-offs normalise”

Outlook for FY22

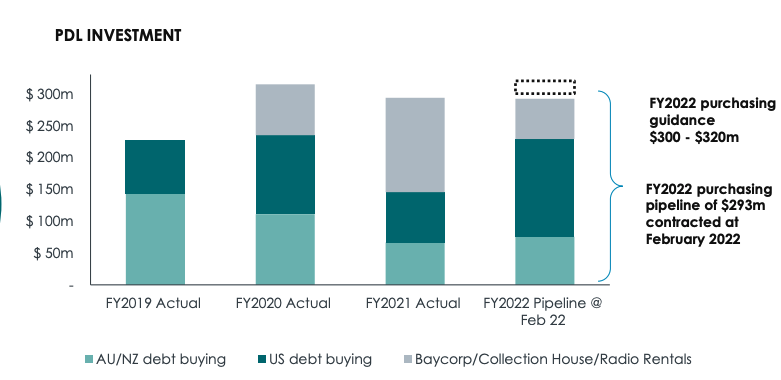

After a record half, Credit Corp will accelerate its PDL acquisitions to position itself for future growth.

Subsequently, the company provided the following guidance:

- PDL acquisitions of $300 million to $320 million, up from $280 million to $300 million

- Net lending volumes of $45 to $55 million, unchanged from prior guidance

- NPAT of $92 million to $97 million, unchanged from prior guidance

- Earnings per share of $1.37 to $1.44, unchanged from prior guidance

Credit Corp will continue to pilot new programs including Wizpay, a Buy Now, Pay Later product, the auto loan re-launch and the US instalment loan.

To keep up to date with our coverage on Credit Corp and the ASX, be sure to bookmark the Rask Media home page.