The Bega Cheese Ltd (ASX: BGA) share price is sinking today despite the business forecasting a 44% jump in EBITDA for FY22.

Currently, the Bega Cheese share price is down 10.85% to $5.01.

Bega owns a variety of consumer staples brands including Bega Cheese, Farmer’s Table, Vegemite and ZoOSh.

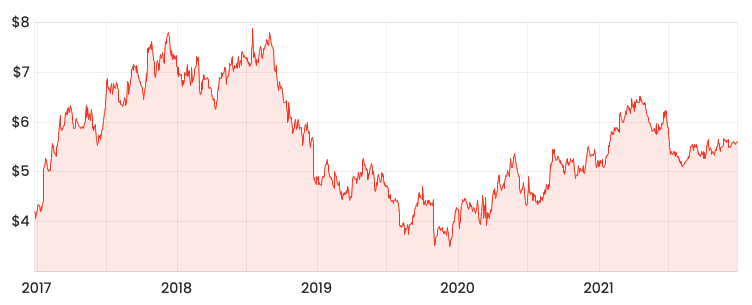

BGA share price

Pandemic weighs on first half

Bega cheese has been plagued by the pandemic and rising input costs over the first half of FY22.

Additionally, the business has incurred significant costs relating to COVID-19, particularly in regards to its supply chain.

Lockdowns across Australian states have disrupted logistics, led to factory shutdowns and increased health and safety costs.

Furthermore, despite positive seasonal conditions, farm milk supply across Australia remains flat if not declining.

As a result, competition for supply has increased leading to upward pressure on farmgate milk prices, a key input for the business.

Bega expects the pricing pressures to remain for the remainder of the year.

“The strength and diversity of the Bega Cheese business has positioned the company well to deal with the many changes and challenges associated with the impact of COVID-19”

The aforementioned pandemic costs will be somewhat mitigated by improved market returns and one-off costs from FY21 not occurring.

“The timing of both price increases and the removal of COVID-19 related costs will affect business performance in FY22”

Notably, Bega also pointed out structural changes in the Chinese infant and toddler nutrition market, which plagued former market darling A2 Milk Company Ltd (ASX: A2M).

On a positive note, the business expects normalised EBITDA for FY22 of $195 million to $215 million. At the midpoint of guidance, this is a 44% improvement on the $142 million Bega achieved in FY21.

Additionally, Nega noted the acquisition of Lion Dairy and Drinks is progressing well and synergies are on track.

Is the Bega (ASX:BGA) share price a buy after its Lion Dairy acquisition?

My take

It’s difficult to get a read on Bega given it’s still integrating Lion into its business.

The half-year result in February should shed more light. However, on face value, a 44% jump on operating earnings is a decent result.

Clearly, the market has reacted negatively to the news, sending the Bega share price markedly lower.

If you’re looking for share ideas, don’t miss Owen and Anirban chat about 4 rapidly growing ASX and global stocks for 2022.