In the final edition of Watchlist Wednesday for 2021, we’ll be taking a look at under-the-radar Macquarie Telecom Group Ltd (ASX: MAQ).

It’s a business you may not have heard of.

But this is a quality owner-operator company showing the incumbents how telecommunications can and should be done.

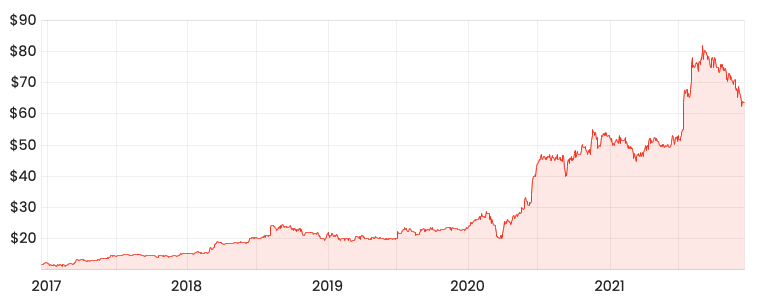

Macquarie Telecom share price

Changing the game

Founded by two brothers, David and Aidan Tudehope in 1992, Macquarie Telecom had a simple goal of capitalising on the “underserved and overcharged” corporate customer.

Both remain involved with David as CEO and Aidan as Managing Director of Hosting. Between them, they own 54% of the company.

Rewind to the 1990s and the market was dominated by the government-owned Telstra Corporation Ltd (ASX: TLS), which classified customers as “subscribers”.

A subtle but meaningful way that the industry saw businesses as little more than a number.

“Our customers have always had significant successful businesses, but will always be lost as a rounding number for the Australian telcos and public clouds”.

Smaller but better

To create a niche for itself, Macquarie Telecom did two things differently. Customer service and innovation.

It opened Australia’s first tier 3 data centre in 2003.

In 2005, it was the first company to bring competition to government security.

In 2015, it launched the first wide-access network (WAN) to enable cloud offerings.

And today it’s Australia’s only true sovereign private cloud provider.

As a result of its innovative mindset, the business has the highest customer satisfaction in the market, with a net promoter score (NPS) of +86.

“We are the most recommended cloud service provider in Australia”

In fact, in 2020 it was crowned the World’s Best Customer Experience at the World Communication Awards in London. It’s the only Australian company to win the award in 22 years.

In many ways, it’s similar to Aussie Broadband Ltd (ASX: ABB). Except instead of households it’s going after the corporate segment.

Wind in its sails

Macquarie Telecom’s industry is experiencing enormous structural growth as more businesses and governments move data into the cloud.

In the next two years, 47% of workloads will be in the public cloud, up from 30% in FY21.

Furthermore, cyber security is becoming an increasingly bigger threat to nations.

Macquarie Telecom offers a 24/7 support line with over 200 staff cleared by the Australian government.

It boasts 43% of government agencies as customers, which should only grow over time as governments become more conscious of where and who hosts their data.

Investing for the future

The business is expecting EBITDA of $39-40 million in the first half, with continued investment into its data centre assets and cloud services.

It’s using its telecom division as a cash cow to fund new investments and therefore look less profitable on a short-term horizon.

However, taking a long-term outlook, the business should see its profits rise as more projects conclude.

Final thoughts

Macquarie Telecom isn’t the most exciting business at face value.

But I believe it deserves a spot on any investor’s watchlist who is looking for a steady compounder in an attractive industry.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.