I love the expression, “When the going gets tough, the tough get going” and I think this applies to Lovisa Holdings Ltd (ASX: LOV) and PWR Holdings Ltd (ASX: PWR).

LOV share price

Lovisa targets young females, who want a wide range of cheap jewellery and accessories for going out, work events and occasions.

What’s so special about a fast-fashion retailer? There are plenty of those around – right?

Upon reflection over the past decade or so, I have seen so many independent fashion accessory stores shut up shop. However, Lovisa still remains and is even bigger and stronger today. It has dominated this niche segment for some time.

Retailers would normally not fall into the category of a ‘resilient’ business but Lovisa showed otherwise since the onset of the pandemic in 2020. Revenue only dropped 3% in FY20 and bounced back strongly, increasing by 18% in FY21.

I think one crucial reason why Lovisa is so resilient is that buying cheap fashion accessories is almost a rite of passage. Guys and girls tend to go through a phase of focusing on self-appearance. Also, teenagers and adolescents generally don’t have high levels of discretionary income, so they tend to want cheap but good quality fashion accessories.

Another factor is Lovisa’s large footprint of physical stores, which I find are always packed every time I walk past one.

I also think Lovisa’s aggressive rollout strategy in a weak economic environment could prove to be a big catalyst driver for future growth.

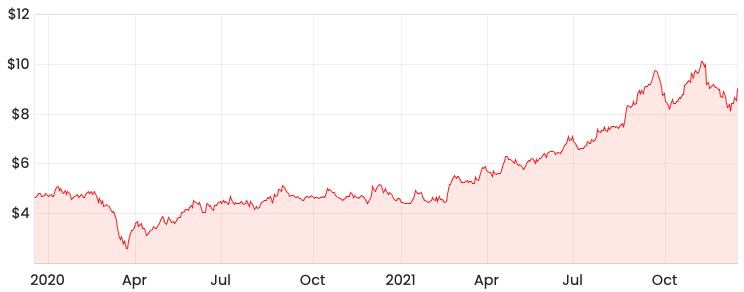

PWR share price

My colleague, Lachlan Buur-Jensen provides a great overview of the business of PWR Holdings.

PWR continues to be the dominant cooling systems provider for Formula 1 and despite the Grand Prix coming to a standstill during 2020, revenue only dropped 0.5% in FY20.

Not only that but gross margins continue to hit above 77%, which has been the case for the last six years.

The actual solutions PWR provide are niche and customised, creating high barriers to entry for new competitors. Over time, it’s built strong relationships with teams on the F1 grid and dominates this niche. As a result, it’s been able to extract higher margins, remain resilient in turbulent times and grow revenue when things are going well.

Another key reason behind PWR’s resilience is it develops solutions and products that are mission-critical. A racing car is unable to finish the race without a cooling system

Given there is so much on the line in Formula 1, teams are willing to pay a premium to ensure they have the best equipment.

As a result, price becomes a distant factor behind reputation.

If you are on the hunt for more ASX growth share ideas, consider signing up for a free Rask account.