The Sigma Healthcare Ltd (ASX: SIG) share price has sunk into the red today after the business downgraded profit expectations.

Subsequently, the Sigma share price is down 6.67% to $0.49.

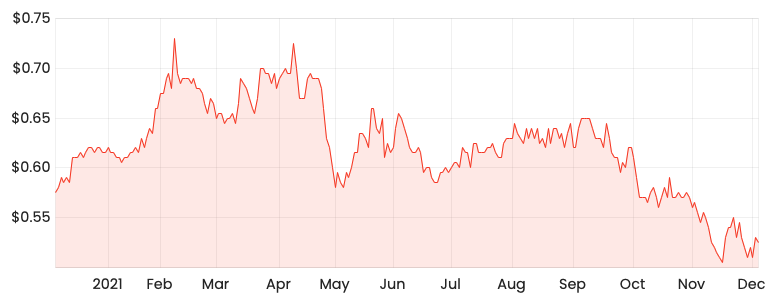

SIG share price

Forget about growth

With ten months of FY22 complete, Sigma anticipates its underlying EBITDA result will be down 10% compared to FY21.

In FY21, Sigma achieved an underlying EBITDA of $81.1 million. Therefore today’s guidance implies an earnings result of around $72 million.

The updated profit guidance is a reversal from the 5% underlying EBITDA growth provided in September.

New software is no good

The business noted operational issues relating to a new Enterprise Resource Planning (ERP) system.

ERP’s assist businesses like Sigma manage operations including finance, human resources, supply chain and procurement across one system.

In theory, ERP’s should reduce administration and simplify business activities – not add to them.

However, the new system has only complicated operations.

“Unfortunately, this has had some significant impacts on our customers, and we are rectifying these issues as quickly as possible” – Interim CFO Jeff Sells

Sigma’s primary job is distributing prescription, over-the-counter and generic medications to hospitals, pharmacies and healthcare providers.

With the ERP not running properly, this has led to delays and subsequent one-off operating costs of $25-$30 million.

As a result of the cost increases, net debt for the year will be also be impacted.

Management noted that ERP issues have only been exacerbated by the impacts of the pandemic.

Potential sales boost in FY23

Sigma noted that the impacts will be largely confined to FY22, which ends on January 31.

However, delayed sales from FY22 will flow into FY23, which should abate as the year progresses.

“Notwithstanding this set-back, we remain confident in the future growth profile for Sigma” – Chairman Ray Gunston

My take

Two issues arise when implementing new software.

The first is transitioning existing records and data across. The second is training all of your employees on how to use a new system.

Imagine using Windows for 10 years. And then overnight your work changes its systems to Apple.

Sigma has obviously had some teething issues, and $25 million in extra costs is nothing to be sneezed at.

With the uncertainty of the ERP roll-out still over the business, I’ll be watching Sigma from the sidelines for now.

If you enjoyed this update, consider signing up for a free Rask account and accessing our full stock reports.