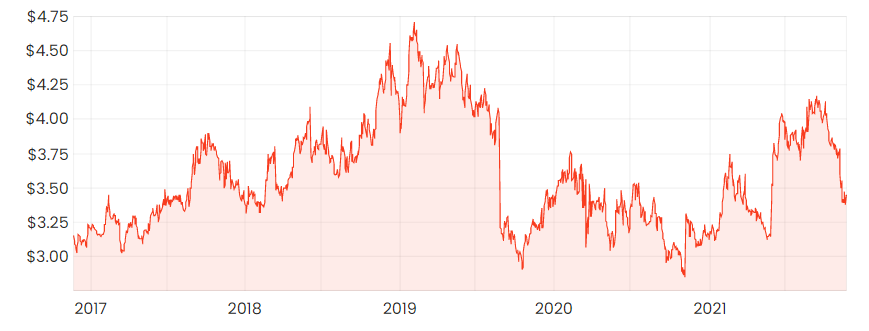

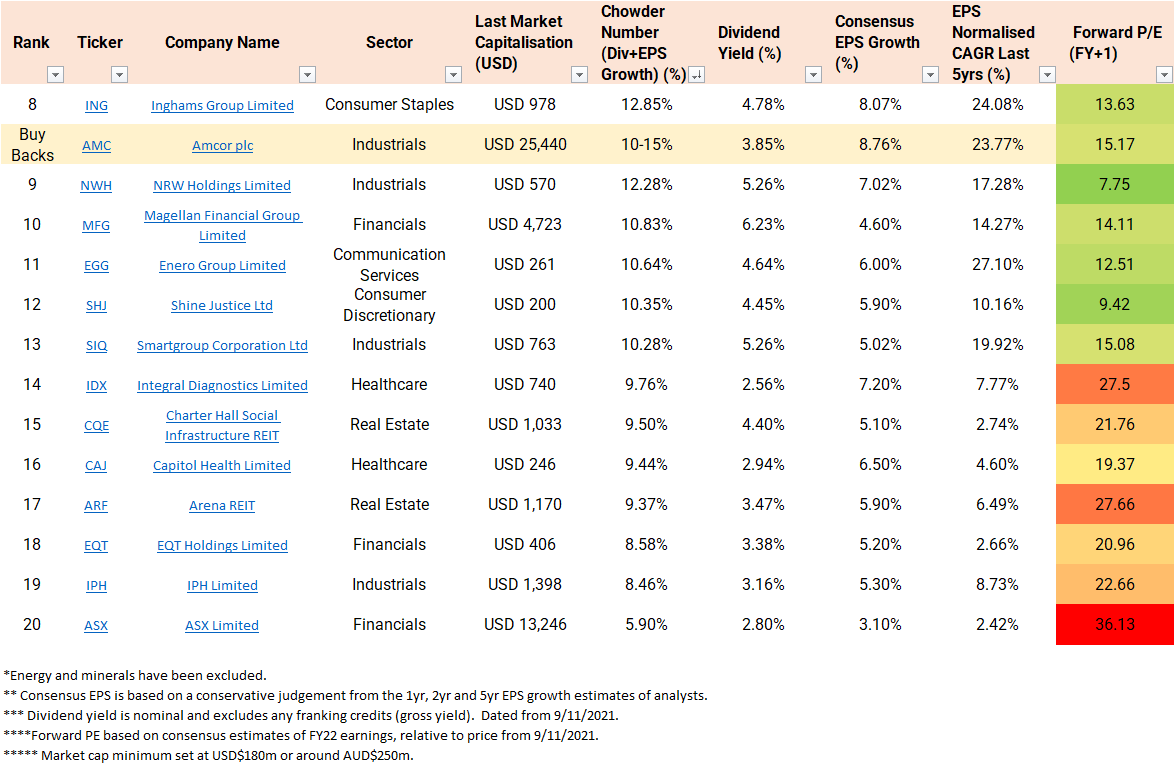

Inghams Group (ASX: ING) has had a volatile dividend history and is currently paying 4.78% fully franked or 6.82% gross. Analysts are predicting an FY23 forward dividend yield of 5.8%, and earnings per share (EPS) growth of 8.07%. This gives ING an impressive 12.85% Chowder Number, at arguably a reasonable valuation.

ING share price chart

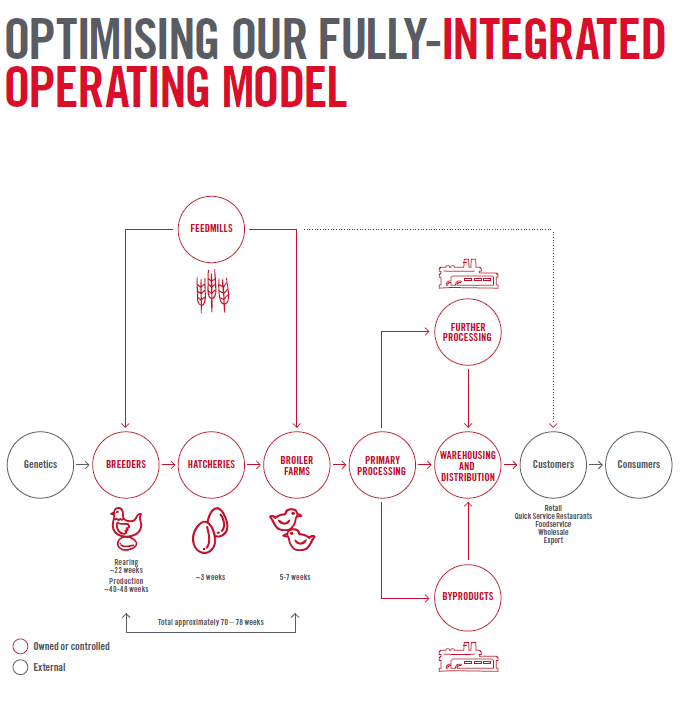

What does Inghams Group do?

Inghams was founded in 1918 and has gone on to become Australia and New Zealand’s largest integrated poultry (chicken and turkey) company producer. As an integrated business, Inagham’s employs more than 8,000 staff across their feed mills, farms, hatcheries, processing plants and distribution centres.

Each week Inghams supply over four million birds to supermarkets like Woolworths Group Ltd (ASX: WOW) and Coles Group Ltd (ASX: COL), restaurants and foodservice customers like Collins Foods Ltd (ASX: CKF). That puts into perspective my three chickens that were eaten by a fox last night. RIP Nugget, Ginger and Chippy.

Turbulent history with private equity

Inghams was taken over by TPG (private equity) in 2013, and then re-listed in 2017. During this period the chickens were taken to feedlots to fatten them, up-sold $540 million of property and then leased back; under-invested in capital expenditure (CAPEX); put in long term contracts just prior to the IPO, and input contracts came to an end shortly after IPO with increasing costs; etc.

Shortly after IPO, the chickens came home to roost, and the financials looked a lot shakier. Debt weighed on the company, while the company also had to invest in maintenance and growth CAPEX. Despite moderate revenue growth, earnings ultimately collapsed aided by Covid headwinds.

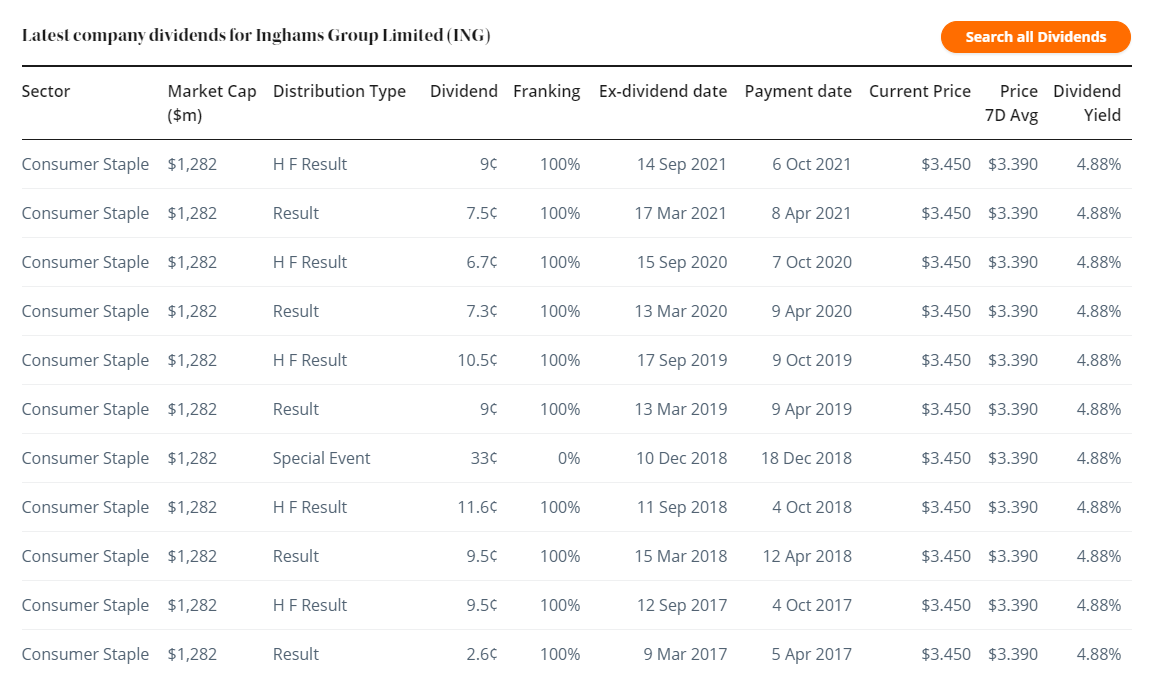

Inghams’ Dividends

A special dividend of 33 cents or $150 million of capital was returned to shareholders in FY18 after the IPO. Excluding that, dividends collapsed from 21.1 cents in FY18 to 14 cents in FY20. With the recent history behind it, Inghams increased its dividend in FY21 to 16.5 cents (71% payout). Dividends are expected to be 18 cents in FY22, maintaining the payout policy of 60-80% of net profit (NPAT).

Forward returns

Analysts are forecasting EPS growth of over 8%. To break that down, in a mature poultry business we can expect population growth of ~1% and increased per capita poultry consumption of 1-2%.

Exporting is not really an opportunity due to prohibitive transport costs – that’s why poultry farms are near urban centres. Operating efficiencies seems an unlikely source of growth, due to historically high feed costs and wage inflation. And as Inghams have five customers representing 60% of sales, buyers wield significant power over pricing and therefore margins are unlikely to increase.

That means the remaining growth would need to come from increasing market share. As it stands Inghams are already defending against new entrants. There may be some potential gains with new products, but it’s hard to underwrite 5% EPS compound annual growth (CAGR) on that basis alone.

Source: Inghams Group Annual Report 2021.

Valuation

Inghams is trading on a forward price-earnings ratio (PE) of 13.4x, which is in the middle of its historical range (~11-15x). However, the free cash flow yield has dropped below 5% due to lease payments, CAPEX requirements, etc. For Inghams to be considered “cheap”, those investors who are bullish on earnings growth estimates would need to eventuate.

Risks

The major risk for Inghams is that it maintains its market share, but faces increasing margin pressure from suppliers (feed costs, wages), buyers (highly concentrated) and maintenance CAPEX. Biosecurity is also a risk with intensive agriculture.

Final thoughts

Inghams is a mature business paying a decent fully franked dividend. However, combining the turbulent history and Covid headwinds, it can be difficult for investors to have confidence in the high growth rates forecast by analysts.

For more on dividend growth Investing, see my recent article which outlines the screener approach being used above.