The Crown Resorts Ltd (ASX: CWN) share price has won the lottery this morning after the embattled casino operator received a third takeover bid by private equity outfit Blackstone Inc.

Subsequently, the Crown share price is up more than 15% at the time of writing to $11.42.

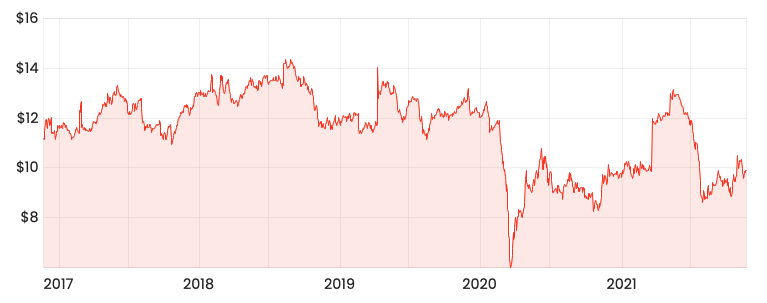

CWN share price (end of day)

Third time lucky?

The non-binding and unsolicited bid of $12.50 per share is Blackstone’s third attempt at securing Crown after previous offers of $11.85 and $12.35 per share.

Blackstone already owns a 9.99% shareholding in Crown and therefore holds significant voting power.

The offer is still subject to a number of conditions including:

- Exclusive due diligence on Crown by Blackstone

- Approval by the respective state casino regulators

- Final approval by the Blackstone investing committees

- A binding agreement

- Unanimous recommendation by the Crown board

- An independent expert concluding the $12.50 per share offer is in the best interests of shareholders

- Regulatory approvals and conditions relating to Crown’s licenses

Despite the uncertainty relating to ongoing investigations by the West Australian, New South Wales and Victorian regulators, Blackstone is still willing to purchase Crown:

Blackstone has stated that it is prepared to proceed with the proposed transaction upon Blackstone receiving final confirmation of suitability from the Regulators, even if the Perth Royal Commission remains ongoing, Crown’s consultation process with the NSW Independent Liquor & Gaming Authority remains ongoing, the legislation to implement the recommendations of the Victorian Royal Commission is yet to be finalised or passed, or the current AUSTRAC investigations are not completed.

Blackstone noted that the consequences of the aforementioned investigations may impact the takeover offer.

Enough fluffing about

Blackstone has issued an ultimatum to the Crown board and to a lesser extent, shareholders.

Accept our $12.50 per share offer and remove the uncertainty of outcomes relating to state regulatory investigations and management execution.

Alternatively, take on those risks yourself but don’t expect us to keep our offer on the table if the cards don’t fall your way.

The private equity bidder hasn’t even had a chance to look at the Crown books yet despite two previous attempts.

Crown has said it has not formed a view on the proposal and no shareholder action is required at this stage.

But from Blackstone’s viewpoint, it’s about time Crown got off the fence and stopped fluffing about.

If you enjoyed this update, consider signing up for a free Rask account and accessing our full stock reports.