Frontier Digital Ventures Ltd (ASX: FDV) is set to restructure the company after achieving a record EBITDA result in the third quarter of FY21.

FDV owns a portfolio of online classifieds and marketplaces in emerging and frontier markets.

It’s aspiring to emulate the success of Australian-based platforms such as REA Group Limited (ASX: REA) and Carsales.Com Ltd (ASX: CAR) overseas.

FDV share price

Restructure along geographic lines

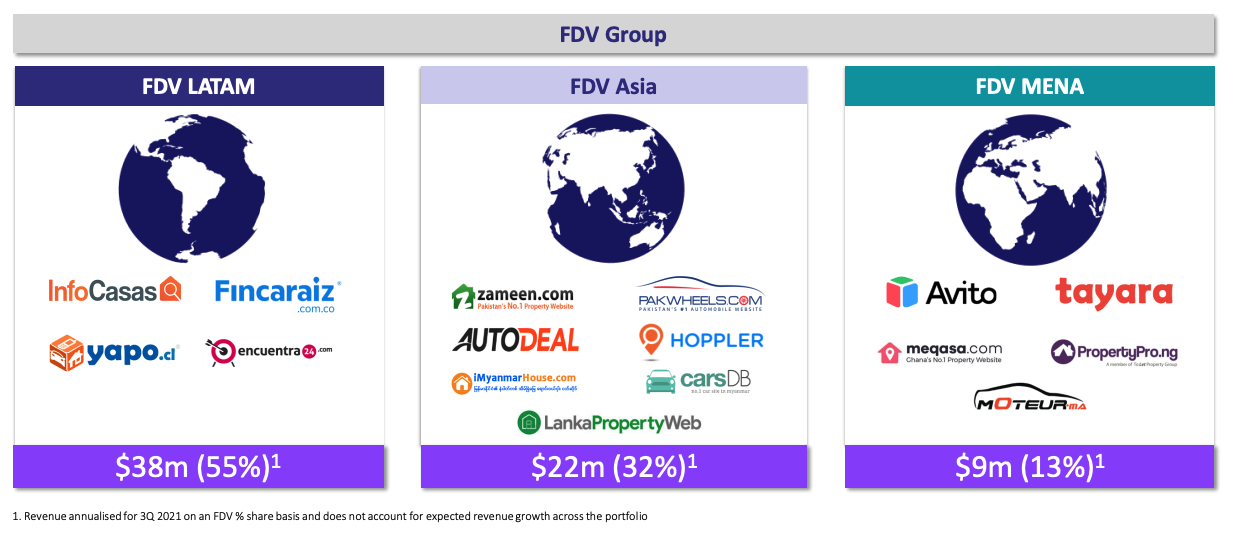

The company will restructure itself across three geographical regions:

- Latin America (LATAM)

- Asia

- Middle East and North Africa (MENA)

Management was light on details regarding the change, however noted operational efficiencies, increased regional presence and greater alignment as benefits.

Record Q3 sparks investor interest

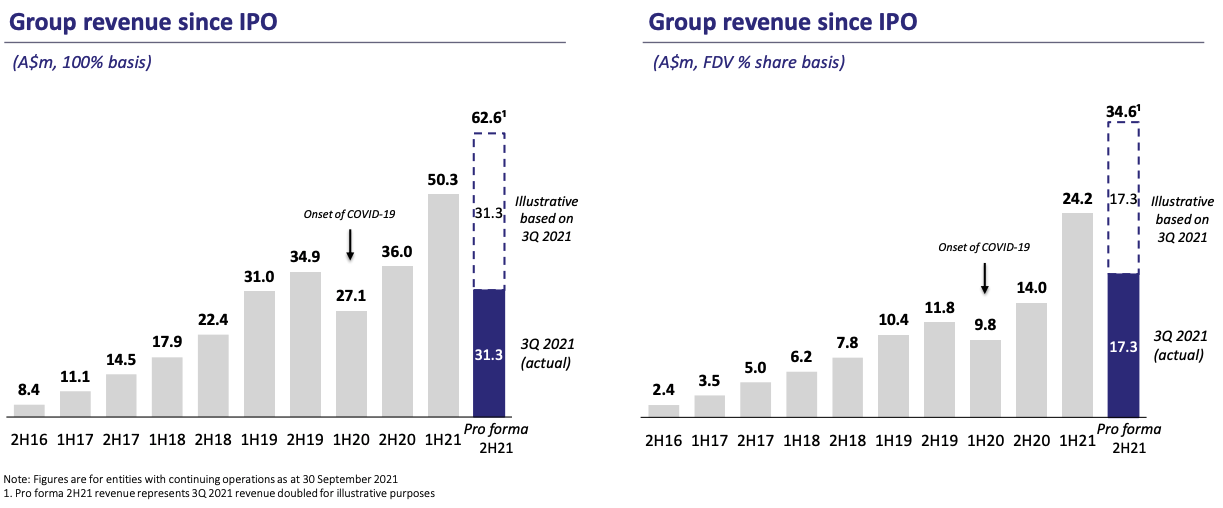

FDV also released an updated investor presentation to market its latest set of results.

For the third quarter of FY21, the company achieved:

- Revenue of $17.3 million, up 248% year-on-year (YoY)

- Record portfolio EBITDA of $1.2 million

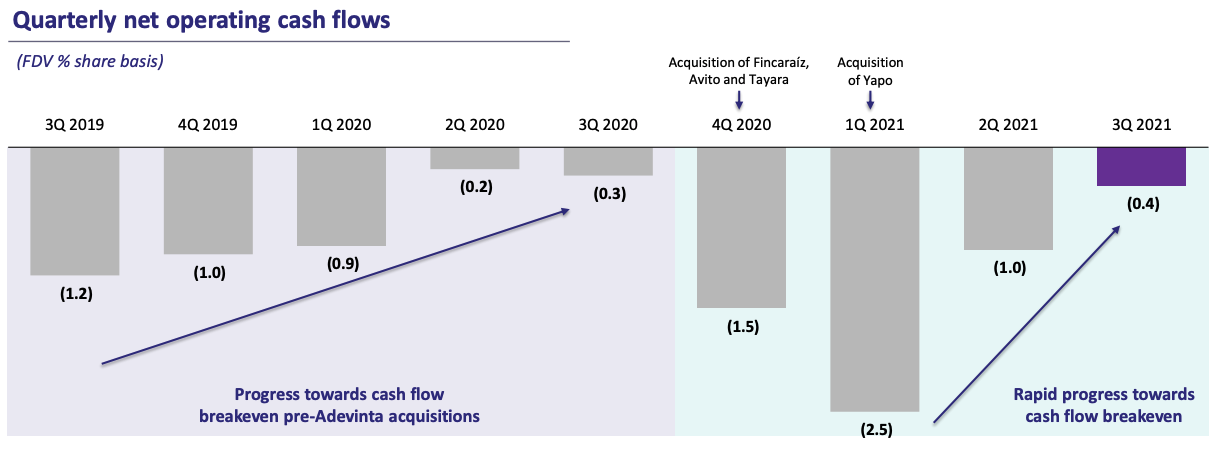

- Operating cash outflow of just $0.4 million

Pakistan’s number one property site Zameen and South American property portal InfoCasas provided the lions share of revenue for the quarter.

“The performance of Zameen and InfoCasas highlights the significant revenue growth and equity value that can be created as our operating companies facilitate an increasing number of property and auto transactions in their respective markets”.

Activity has considerably accelerated over the past 12 months after an initial fall as the pandemic struck.

Subsequently, FDV losses continue to fall with the company recording close to breakeven on an operating cash flow basis.

However, the losses can begin to mount after new acquisitions, as seen at the start of 2021.

My take

FDV is a fascinating company. It provides Australian investors with exposure to emerging markets without the need to buy an index or invest abroad.

But it also takes a private equity-type approach to investing – small bets across several platforms – with the hope that one or more become monsters.

Given the lack of visibility and local knowledge, you have to trust management to make smart capital decisions.

But I think it ticks a lot of boxes. Founder led (10.6% shareholding), a solid track record of smart investments and long growth runways.

For these reasons, I think FDV is worthy of a place in a portfolio. Albeit a small one, given the inherent risk and opacity.