NRW Holdings (ASX: NWH) has grown its dividend and earnings for five years, bringing it to #9 on our DGI ranking. The dividend yield sits at a healthy 5.26% fully franked or 7.51% gross. Earnings growth is expected to slow from 17.28% 5-year CAGR to a forecast of 7.02%. This gives NRW a stellar 12.28% Chowder Number.

NWH share price chart

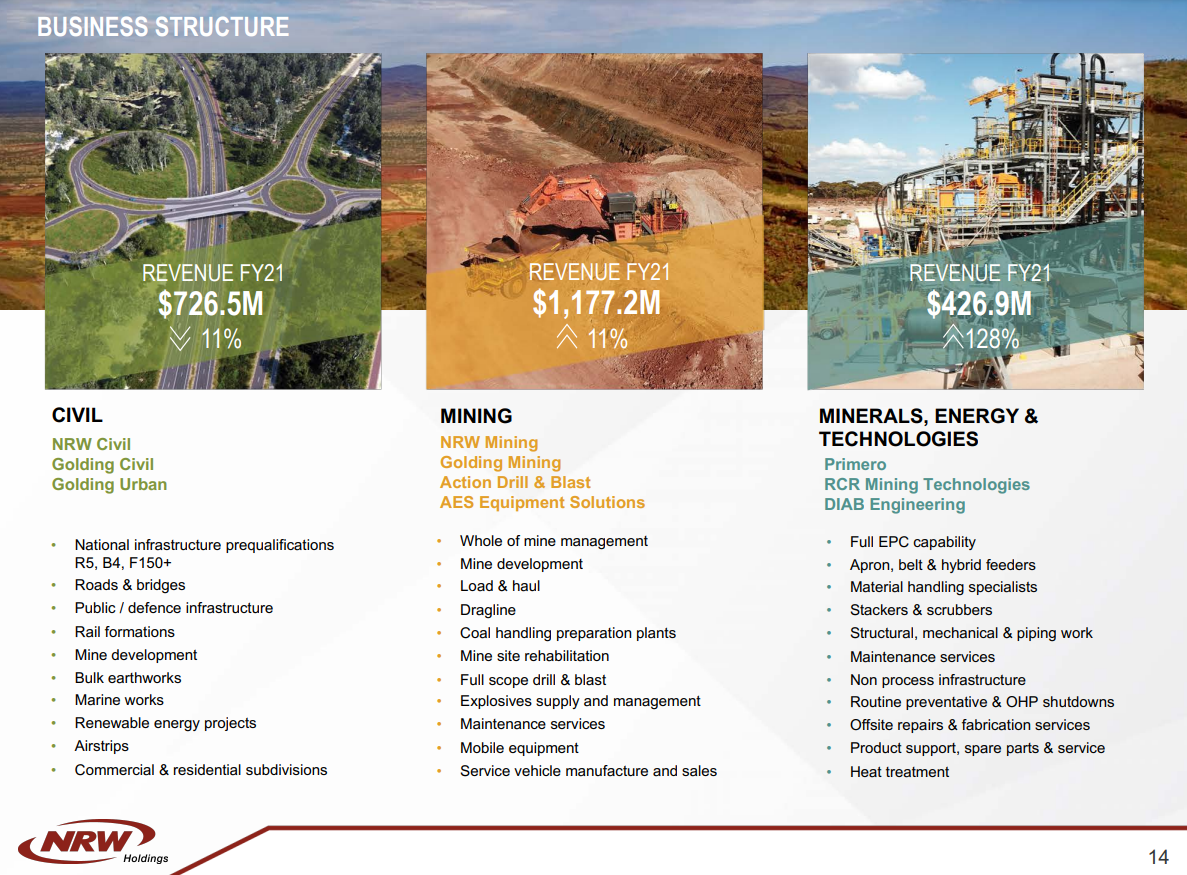

What does NRW Holdings do?

NRW Holdings provides diversified services to the mining, energy, civil infrastructure and urban development sectors. While they are often overlooked by investors, they are Australia’s second largest diversified contractor only to CIMIC (ASX: CIM). Their historical growth has been driven by sound capital allocation and a range of acquisitions, supporting both top-line and bottom-line improvements.

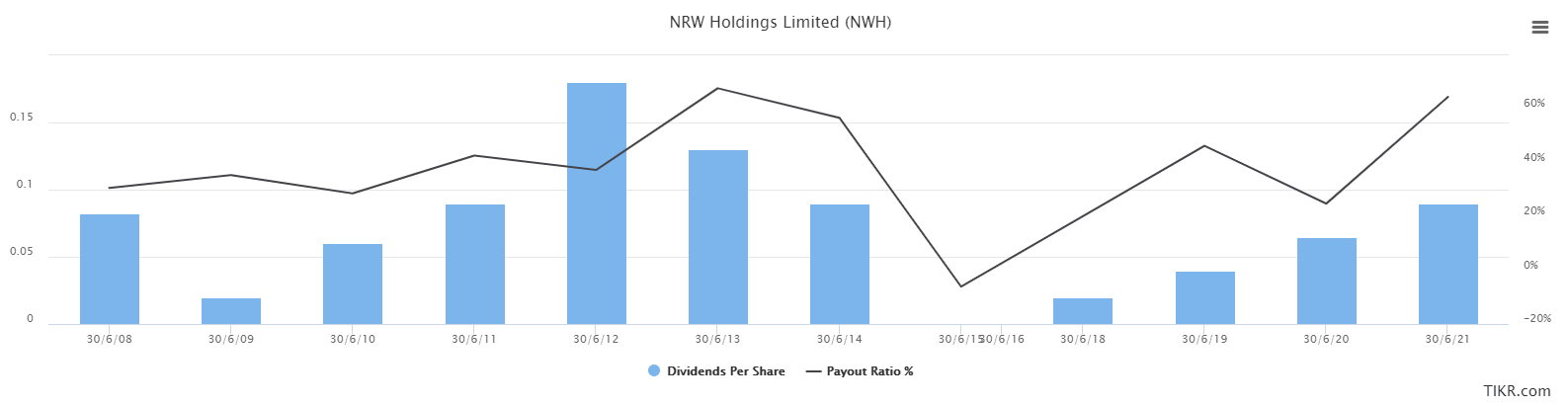

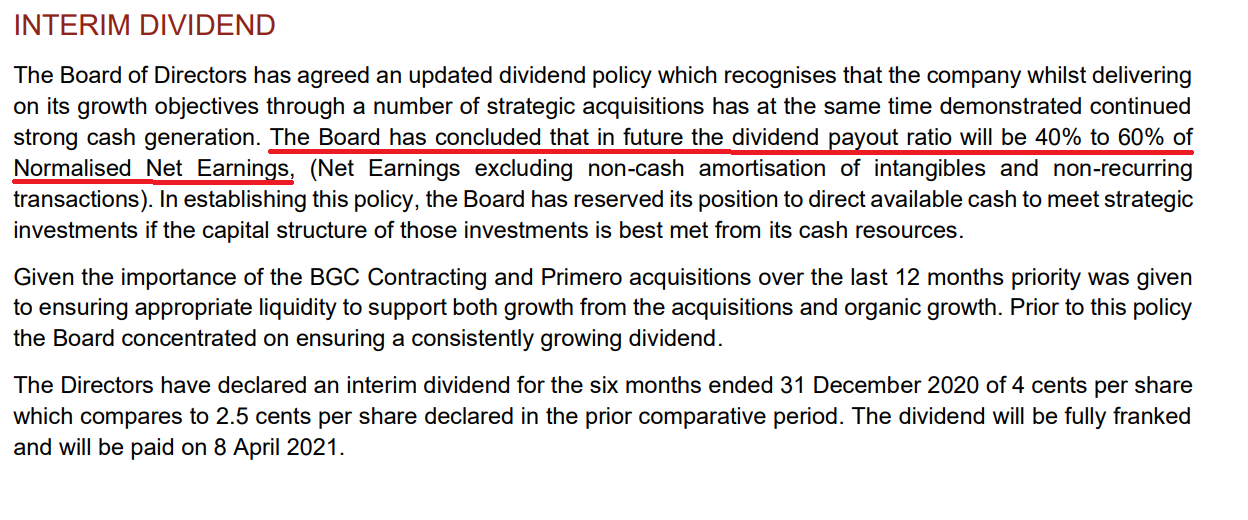

NRW’s Dividends

The dividend history for NRW has been mixed. Looking back at only five years, one can see that earnings have grown since 2016 and dividends since 2018. However, no dividends were paid in 2015-17, and prior to that, they were patchy.

The volatile troika of earnings, dividends and share price reflects the cyclical nature of NRW. When the mining construction and management have been booming, the company including their dividends have been booming too.

A new dividend policy announced in February 2020 confirmed the companies intention to maintain dividends at a 40-60% payout ratio. This enables continued investments and appears healthy if earnings growth and a dividend yield of +5% can be maintained. Historically, however, this has represented peak-cycle achievements.

Looking to forward returns

Continued growth in civil and mining infrastructure spending is expected to support near term earnings growth. The five analysts covering NRW are expecting growth to continue motoring in FY22 (consensus of almost 30%), though this declines rapidly to 7% thereafter. This remains healthy, though is based on optimistic forecasts of commodity prices and continued investments in mining infrastructure. Further projects in renewables and urban infrastructure may reward NRW shareholders with less cyclical dividends.

Valuation

Valuations are historically healthy for NRW, supported by a strong balance sheet with only 16% leverage. The price to earnings ratio is around 14, which is perhaps high. However, the price to free cash flow based on the trailing twelve months is merely three, and forecasts for around six on next year’s forecast.

Risks

The major risk for NRW is that earnings and dividends are highly cyclical. With a lot of projects in iron ore and coal, the spot price and investment decisions by the large mining companies will impact NRW substantially.

Furthermore, capital allocation decisions are very important for a company expecting to grow through acquisitions. This has contributed to shareholder dilution with the number of shares outstanding almost doubling (278m to 453m) from 2016 to 2021.

Final thoughts

Investing in cyclicals requires a different mindset from DGI. If one could have confidence in the consensus EPS growth for the next five years, for example, bolstered by civil works order book, then this may be a suitable investment.

However, future earnings for NRW are highly dependent upon the spot price of iron ore and coal. These prices are more volatile than dividend growth investors would typically seek in their own portfolios.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.