The Fortescue Metals Group Limited (ASX: FMG) share price jumped more than 8% today to $15.45.

However, there were no company announcements. The USD/AUD exchange rate didn’t materially move. Nor did the Iron Ore price.

So what’s causing the Fortescue share price to jump? And is now the time to buy Fortescue shares?

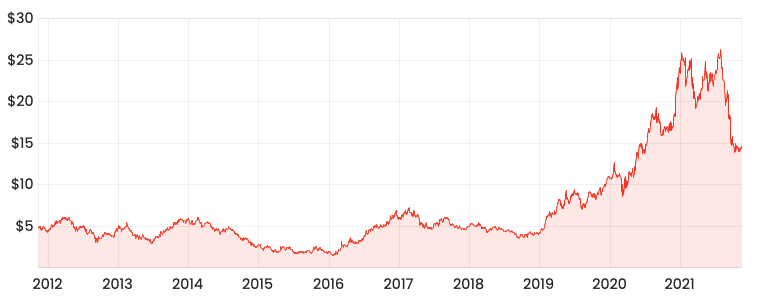

Fortescue share price chart

FFI making moves

The only notable news overnight related to Fortescue’s renewable subsidiary Fortescue Future Industries (FFI).

FFI is tasked with producing zero-emission green hydrogen from 100% renewable sources.

“FFI is a developer, financier and operator investing in zero-emission resources to produce renewable energy at a scale equal to the oil and gas super majors”.

The subsidiary signed a Memorandum of Understanding (MOU) with Los Angeles-based Universal Hydrogen Co. to provide green hydrogen for the aviation sector.

Green hydrogen is an ideal aviation fuel given that it is found to be four times more efficient than traditional jet fuel.

It also refuels in minutes compared to 30-45 minutes for electric vehicles and is a better store of energy.

Finally, it produces zero emissions, making it a potential solution for decarbonising the earth.

Green hydrogen 101

The benefits of hydrogen have been known for some time.

But historically, it hasn’t been feasible. Hydrogen is abundant but rarely found on its own.

Therefore, it needs to split from other compounds such as water (H2O). The usual process, called electrolysis, consumes a lot of energy.

Hydrogen is the most common element in existence. In fact, the universe is 75 per cent hydrogen by mass – so we’ll never run out of it. It’s also the simplest. To make it, you just run electricity through water.

– Chairman Andrew “Twiggy” Forrest

While hydrogen on its own may be good, if you burn a tonne of coal and gas to get it, the cost outweighs the benefits.

However, using renewable energy – such as that from solar and wind – to split the hydrogen atoms ensures the benefits of hydrogen largely remain intact.

Saving Fortescue and the world

It might sound somewhat contradictory for a company that literally digs stuff out of the ground to be jumping on the climate change choo-choo train.

The iron ore company I founded 18 years ago, Fortescue, generates just over two million tonnes of greenhouse gas – every year. Two million tonnes. That’s more than the entire emissions of Bhutan.

But Twiggy and the band at Fortescue aren’t doing this simply for philanthropic purposes.

Diesel, which is used to power Fortescue’s vast vehicle fleet, is one of the group’s biggest costs.

In fact, a shareholder at its AGM estimated the cost of diesel to Fortescue at $3.80 or 28% of direct iron ore costs. Then it was asked how would green hydrogen reduce this expense?

Chief Executive Elizabeth Gaines commented that she expects the cost of diesel and energy volatility to keep rising.

Therefore, replacing its mobile fleet with green hydrogen vehicles by 2030 (Fortescue’s target) would “significantly contribute to lowering of [Fortescue’s] costs”.

My take

Hydrogen is by no means a silver bullet for climate change.

Problems still exist such as cost, transport difficulties and lack of existing infrastructure.

But to bet against Fortescue, which has become the world’s 4th largest iron ore producer, would be a mistake.

Subsequently, I’d consider adding a position in Fortescue today despite the price jump.

Fortescue has defied the odds before. Don’t be surprised if does it again.