The News Corporation Class B Voting CDI (ASX: NWS) share price is flying today after the business provided a bumper first-quarter update.

Currently, the News Corp share price is up 10.25% to $34.93.

Divisional growth spurs profit jump

Key highlights from the first quarter of FY22 include

- Revenue of $2.50 billion, an 18% increase year-on-year (YoY)

- Segment EBITDA of $410 million up 53% YoY

- Net income of $267 million, compared to $47 million in FY21

- Free cash outflow of $25 million

- $1 billion stock repurchase program

Building on its strong FY21, the company achieved growth across all of its divisions in Q1.

Digital Real Estate recorded a 47% jump due to strong performances across REA Group Limited (ASX: REA), Realtor.Com and the acquisition of Mortgage Choice.

Like equity markets, real estate values have boomed across Australia and California leading to heightened activity of News Corp’s websites.

Subscription Video services, including Kayo, Binge and Foxtel increased revenue by 3% YoY. The 17% increase in paying subscribers was offset by lower commercial revenues and fewer residential broadcast subscribers.

Dow Jones revenue, which publishes The Wall Street Journal and Barron’s among other titles, increased revenue by 15% as a result of digital subscriptions growth and higher advertising revenue.

Similarly, Book Publishing increased 19% from higher sales of popular titles including Bridgerton, Vanderbilt: The Rise and Fall of an American Dynasty and The Cellist.

News Media recorded growth an 18% jump in revenue, again driven by subscription revenues and advertising.

Commenting on the result, Chief Executive Robert Thomson said:

“I am pleased to report that the first quarter of Fiscal 2022 was the most profitable of its kind since the re-launch of News Corp in 2013, building on the trends evident in the last financial year”.

Out with the old, in with the…old?

The invention of Netflix and the decline in newspaper delivery should have resulted in News Corp’s business model collapsing.

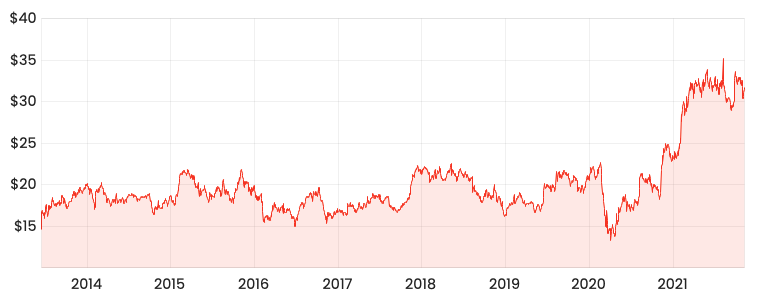

Instead, after years of the share price effectively trading in the same range, the News Corp share price has shot up in value in the past 18 months.

Traditional publications have been digitised. Meanwhile, the company has capitalised on the shift to online classifieds for real estate.

Even Foxtel is recording growth, after years of decline.

Credit where credit is due. Despite facing significant industry headwinds, News Corp looks to have weathered the storm.

Overall, the Q1 update was a great result and should provide the foundation for another year of growth in FY22.