Shares in Insurance Australia Group Limited (ASX: IAG) finished 7% lower today after providing a trading update and downgrading FY22 guidance.

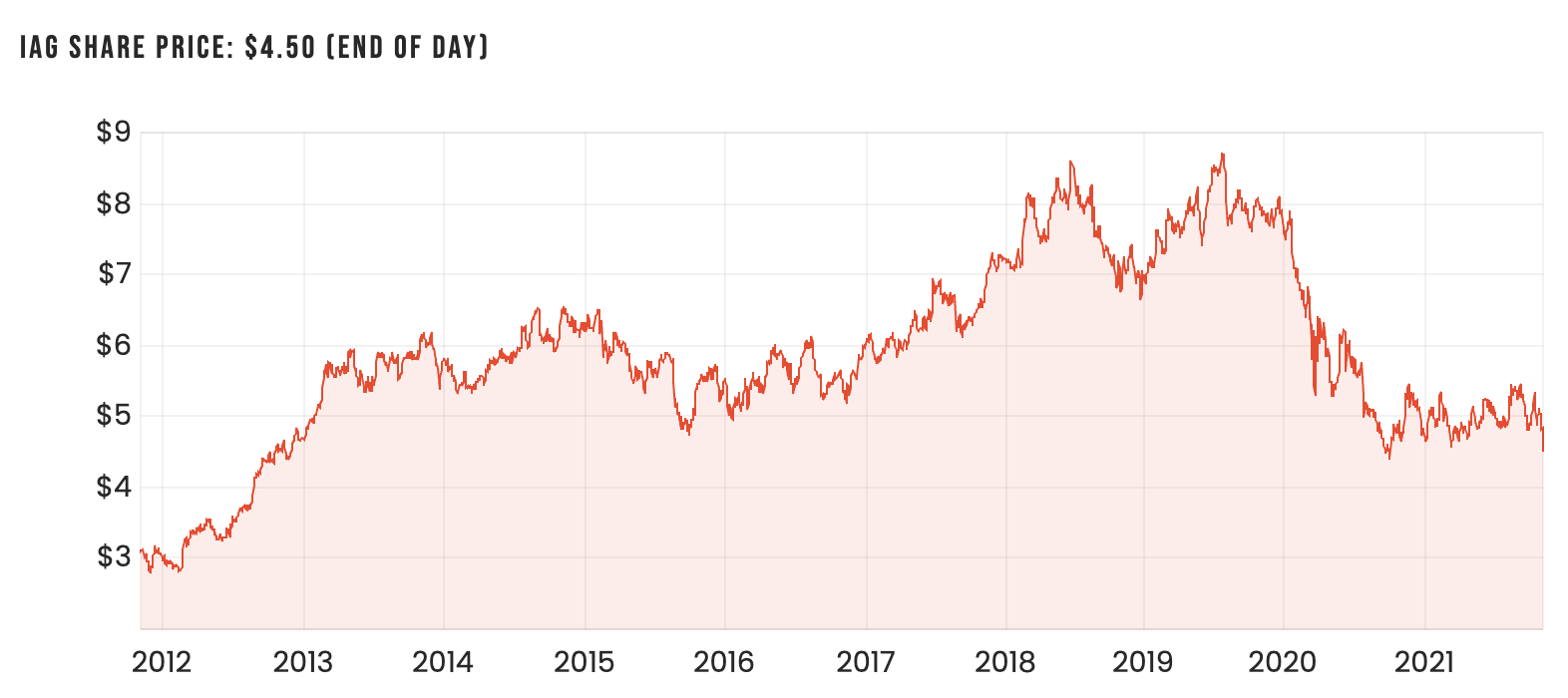

It’s been a tough ride for long-term shareholders of IAG as you can see from the chart below. Shares are still trading around where they were at the time of the GFC.

Perils update and guidance revision

Today’s update was in relation to various severe weather events in South Australia, Victoria and Queensland over the course of October.

As a result, IAG received around 14,000 claims and this number is expected to increase. It’s expected that the net cost for this event will be $169 million.

IAG had previously anticipated these sorts of events as part of its natural perils allowance, but the magnitude was clearly underestimated. Following these recent events, IAG has increased its expectation for FY22 net natural perils claim costs to $1,045 million, up from $765 million.

As a result, IAG lowered its FY22 margin guidance range from 13.5-15.5% to 10-12%.

IAG Managing Director and CEO Nick Hawkins said: “We remain confident in IAG’s operational momentum in FY22, after the strong start in the first quarter that we reported at the recent AGM,”

My take on IAG shares

This update highlights one of many challenges faced in the insurance industry. With wild weather events expected to happen more frequently, this is likely headwind on profitability and earnings predictability.

The RBA’s recent decision to keep the cash rate target at a record low level of 0.1% will also likely act as headwind for now.

With limited short-term catalysts, the proposition of owning IAG’s shares is likely based around a value play, with shares at a fairly undemanding trailing earnings multiple of 15.

I’d prefer to invest in growing companies with structural tailwinds, so IAG is going to be a no from me.

If you’re looking for some more share ideas, click here to read: 2 fast-growing ASX software companies for your watchlist.