The toll-road operator Transurban Group (ASX: TCL) share price will be on watch this morning after the business provided a Q1 trading update at its annual general meeting (AGM).

Currently, the Transurban share price is down 0.29% to $13.76.

Pandemic restrictions impact traffic

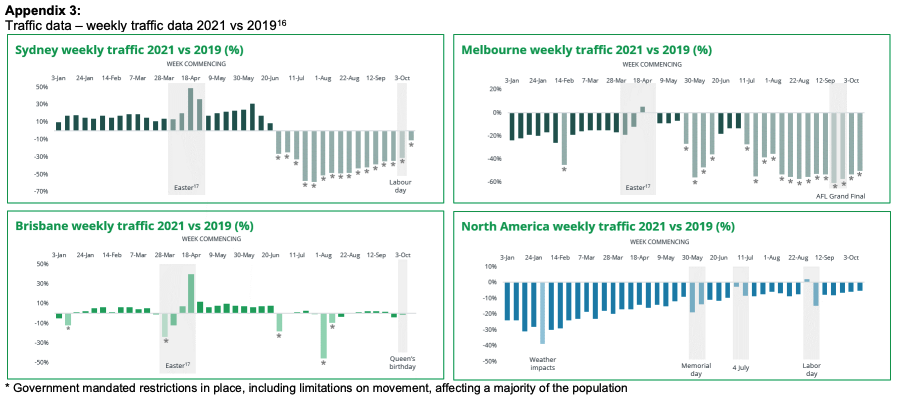

For the quarter ending 30 September, average daily traffic (ADT) decreased 12.4% across Transurban’s network over the same period in 2020.

Relative to pre-pandemic demand in 2019, ADT fell 34.5%.

Lockdown restrictions across New South Wales and Victoria, which accounts for about 75% of Transurban’s network, was the primary driver of reduced traffic.

Sydney traffic was down 43.7%. Meanwhile, Melbourne decreased 30.7%.

Positively for Transurban, Sydney has emerged from the worst of its lockdowns and Melbourne is expected to regain some freedoms tomorrow.

“Commercial traffic showed greater resilience across the Australian markets, with large vehicles closer to pre-COVID-19 levels than cars”.

Traffic in North America increased 29.0% for the quarter, as vaccine uptake improves and schools return. However, traffic still remains below pre-pandemic levels.

WestConnex raising complete

Transurban has successfully raised $4.22 billion to fund the purchase of the remaining 49% stake in WestConnex from the NSW Government.

The business, along with a consortium of infrastructure investors dubbed Sydney Transport Partners (STP), now owns 100% of the toll road.

A thorn among roses

The West Gate Tunnel Project in Melbourne continues to be a pain point for Transurban.

Builders, the Victorian Government and Transurban remain in a logjam over an expected $3.3 billion in additional costs relating to contaminated soil.

“Infrastructure projects not only take years of strategic planning but they can also be very challenging to deliver”.

Typically, tolls roads are great assets to own despite the big upfront capital requirement. It provides steady cash flows over decades and prices usually rise with inflation.

However, the development stage can be fraught with extra costs and subsequently stakeholders unwilling to chip in.

Transurban’s preference is to resolve the dispute internally but admits it may need to rely on the legal system.

My take

The Transurban AGM and quarterly update didn’t provide any surprises.

Traffic numbers were always going to be down, but upside exists once lockdown restrictions ease over the coming months.

The longer the soil dispute drags out, the more likely it heads to the courts.

It makes sense for Transurban to want to come to a mutual agreement, as it eliminates the uncertainty of a court verdict and means construction can restart.

If you’re looking for ASX dividend shares, check out 2 my colleague Jaz Harrison would buy.