Transurban Group (ASX: TCL) will acquire the remaining 49% equity stake in Sydney toll-road network WestConnex from the NSW government for $11.1 billion.

The Transurban share price has subsequently been placed in a trading halt, while the business raises $4.2 billion in fresh equity.

Transurban set to take full control

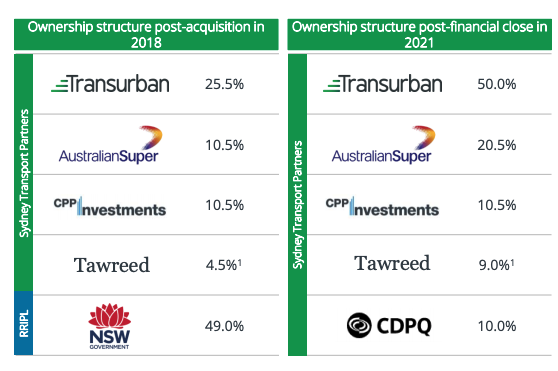

Transurban, as the largest investor is Sydney Transport Partners (STP) has won the bidding process to acquire 49% of WestConnex.

STP is a consortium of infrastructure investors led by Transurban. STP originally purchased a 51% stake in Westconnex back in 2018.

Transurban will contribute $5.56 billion towards the transaction as a mix of equity and cash.

The business will raise $3.97 billion through a 1 for 9 pro-rata renounceable entitlement offer. Essentially, existing shareholders will be entitled to purchase 1 new share for every 9 they currently own.

The new capital will be raised at $13.00 per share, which is an 8.3% discount to Transurban’s last trading price.

It will also raise $250 million from Australian Super in a separate placement at $13.07 per security. The remaining $1.41 billion will be sourced from available cash reserves.

The transaction values WestConnex on an enterprise value of $33 billion.

Back in 2018, the implied enterprise value of the transaction was $25 billion. The increase in valuation is attributed to the opening of toll roads contributing positive cash flows and a reduction in capex.

What is WestConnex?

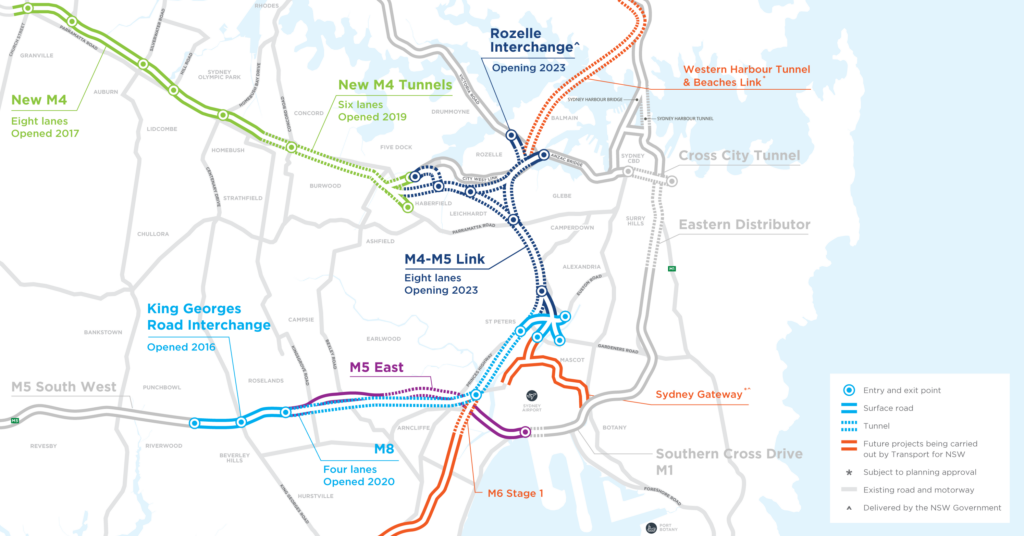

WestConnex is a toll-road network with six assets located in Sydney. Four of the six assets are currently operational with two under construction.

It is estimated by 2031, 40% of the Sydney population will live within 5 kilometres of a WestConnex toll road.

By purchasing the remaining 49% stake, STP now owns 100% of WestConnex and will be able to collect toll revenue until the concession expires in 2060.

Infrastructure assets such as toll roads are in high demand as they provide reliable and steady cash flows with embedded price increases.

STP is able to increase prices at the greater of 4% or CPI through to 2040. Thereafter, the greater of 0% or CPI until 2060. Not great for drivers, but great for investors.

What does this mean for the Transurban share price?

It makes sense for Transurban and STP to acquire the remaining 49% stake in Westconnex given its existing 51% holding.

It will add to its toll road stable and solidify its position in NSW.

I expect the Transurban share price to trend towards the $13 equity raising price in the near term.

Any other updates?

The business provided an update on the West Gate Tunnel Project. All parties have entered remediation, however, no deal has been reached.

Transurban also provided distribution guidance for the half ending 31 December 2021 of 15.0 cents per security. However, it may vary depending on ongoing disruptions due to the pandemic.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.