The Tyro Payments Ltd (ASX: TYR) share price will likely come under pressure this afternoon after the company announced details of a class action.

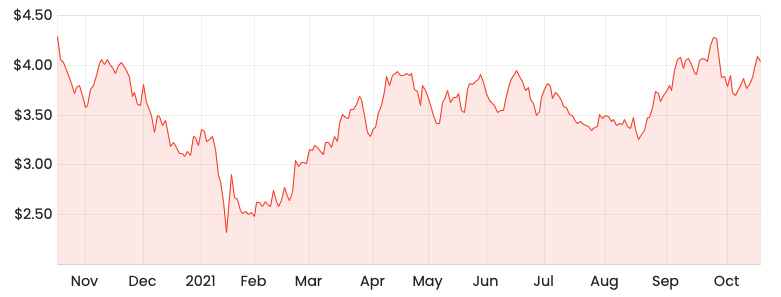

Currently, the Tyro share price is down 4.21% to $3.87.

TYR share price

January outage leads to class action

Tyro has become aware of proceedings against the business alleging amongst other things like misleading and deceptive conduct.

The company understands the proceedings relate to the January terminal connectivity incident.

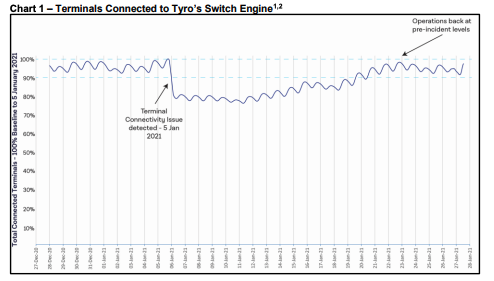

For approximately three weeks, terminals across the Tyro network were affected by a software update that disconnected the terminals.

It left merchants unable to process payments, significantly impacting trading.

At one point, 30% of Tyro’s terminal fleet was offline.

The business has since rectified the issue and provided a failsafe solution to merchants in the event of future loss of connectivity.

In 18 years of operations, it’s Tyro’s first major outage.

Internal resolution process settles 92% of cases

Tyro had already established a remediation program, providing two options for affected merchants:

- Accelerated Path Assessment – if loss is assessed, merchants would be offered a fee rebate to offset any financial loss

- Case Managed Path Assessment – tailored remediation for specific claims suffered by a merchant

As of today, 92% of merchants who have selected one of the two options have had their claims settled.

Notably, Tyro did not say how many affected merchants chose this option.

However, in May the business said 3,656 merchants had registered claims through the process.

“Notwithstanding the filing of the Federal Court proceedings, Tyro continues to encourage merchants claiming any impact to register their claims to participate in its direct remediation process by contacting Tyro at [email protected] or on 1300 966 639”

My take

Tyro was smart getting on the front foot and trying to remediate merchants individually rather than opt for a class action.

It’s less costly for both sides, merchants can receive remuneration more quickly and uncertainty is reduced.

In class actions, the only real winners are the lawyers.

Despite Tyro’s efforts, it looks like enough disgruntled merchants have banded together to take the company to the Federal Court.

As an investor, it’s difficult to quantify the potential impact of the class action without knowing more details.

The Tyro share price slid over 25% in January on news of the connectivity issues. I don’t expect a repeat of that, but I expect the case to weigh on the share price over the near term.