For investors and customers lucky enough to get a slice of the IPO, the Aussie Broadband Ltd (ASX: ABB) share price has doubled, tripled, quadrupled, quintupled one year since its initial public offering (IPO).

The business raised $40 million at $1.00 per share back in October 2020. After rocketing 90% on its first day of trading, the Aussie Broadband share price has continued to trend higher to now sit at $5.14.

Why is the Aussie Broadband share price up 500%?

The Aussie Broadband share price has risen as investors grasp the quality and growth profile of the company.

In its latest financial result, Aussie Broadband recorded an 84% jump in revenue to $350 million. Additionally, earnings before interest, tax, depreciation and amortisation (EBITDA explained) was up 433% on FY20 and 55% ahead of the prospectus forecast.

The strong financial performance is primarily a result of Aussie Broadband’s growth in NBN subscription plans. Residential connections increased 50% while business connections improved 90%.

More recently, the business took 25% of all new connections in the June quarter.

Aussie Broadband has disrupted traditional telcos such as Telstra Corporation Ltd (ASX: TLS) and TPG Telecom Ltd

(ASX: TPG) by lasering in on the customer experience and support.

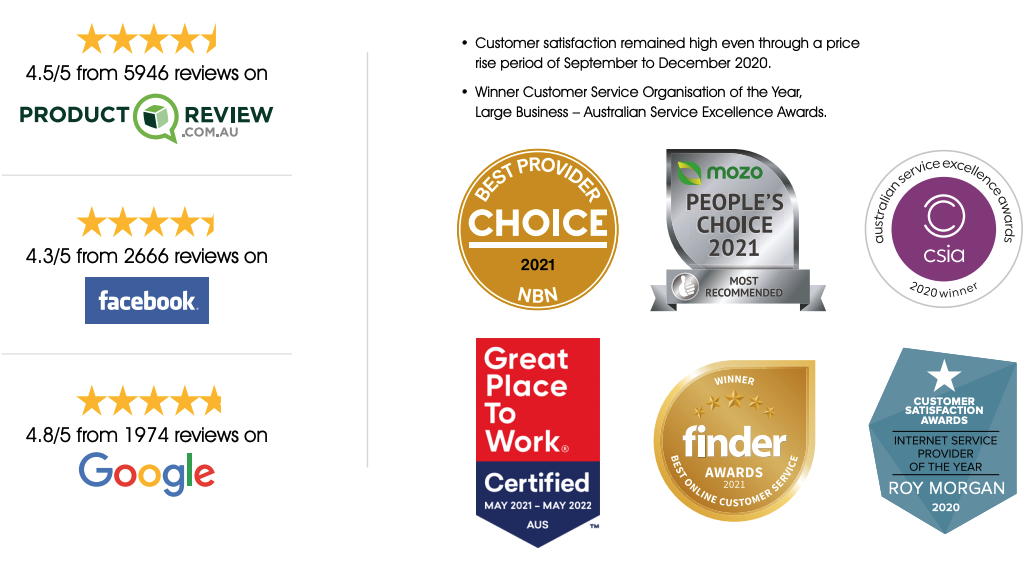

Demonstrating its customer-centric approach, the company recorded only 5.76 complaints per 10,000 services and an average wait call time of just 138 seconds.

Same, same but different

The jump in Aussie Broadband’s share price is somewhat in part due to a change in investor sentiment.

Telecommunications is a notoriously difficult industry to make money in. Plenty of competitors, terribly low margins and low barriers to entry.

Despite all of this, the business has focused on the most profitable NBN customers.

Aussie Broadband has a 15% market share of high-speed internet plans, compared to just a 5% total market share.

This means it’s typically able to charge a premium price in what is a commoditised industry. As investors have realised it’s not just another telco

, the Aussie Broadband share price has taken off.

What’s next for the Aussie Broadband share price?

The business recently raised $124 million for potential acquisitions at $4.00 per share.

With the Aussie Broadband share price current at $5.14, some investors may choose to pocket a quick 23% gain by selling shares on market.

As a result, the share price may move lower in the near term. But I suspect over the longer term, Aussie Broadband will continue its vision to disrupt the Aussie telco sector.