Wealth platform Netwealth Group Ltd’s

(ASX: NWL) share price has rocketed over 170% in the past five years.

Founded by the Heine family (who own 53% of the business) back in 1999, the business is now the industry leader in net inflows and satisfaction.

Let’s dive in and see what makes it such a quality company.

Bring advice into the 21st century

Netwealth operates in the Australian wealth platform market, estimated to be worth around $915 billion each year. Previously, the market has grown about 7% per annum.

Historically, the industry has been occupied by legacy advisory firms like AMP Ltd (ASX: AMP), IOOF Holdings Limited (ASX: IFL) and the big four banks.

Advisors would house clients funds on platforms and recommend products from their respective advisory firms.

However, the Future of Financial Advice reforms in 2012 and the Royal Commission in 2017 resulted in many advisors either going independent or leaving the industry altogether.

Subsequently, this opened the door for independent platforms such as Netwealth and Hub24 Ltd (ASX: HUB) to grab market share.

Netwealth offers a user-friendly interface, a range of investment options and better functionality illustrated by its number one rating for overall satisfaction by Investment Trends.

The hunter becomes the hunted

Netwealth has wasted no time capitalising on the evolving financial advice market.

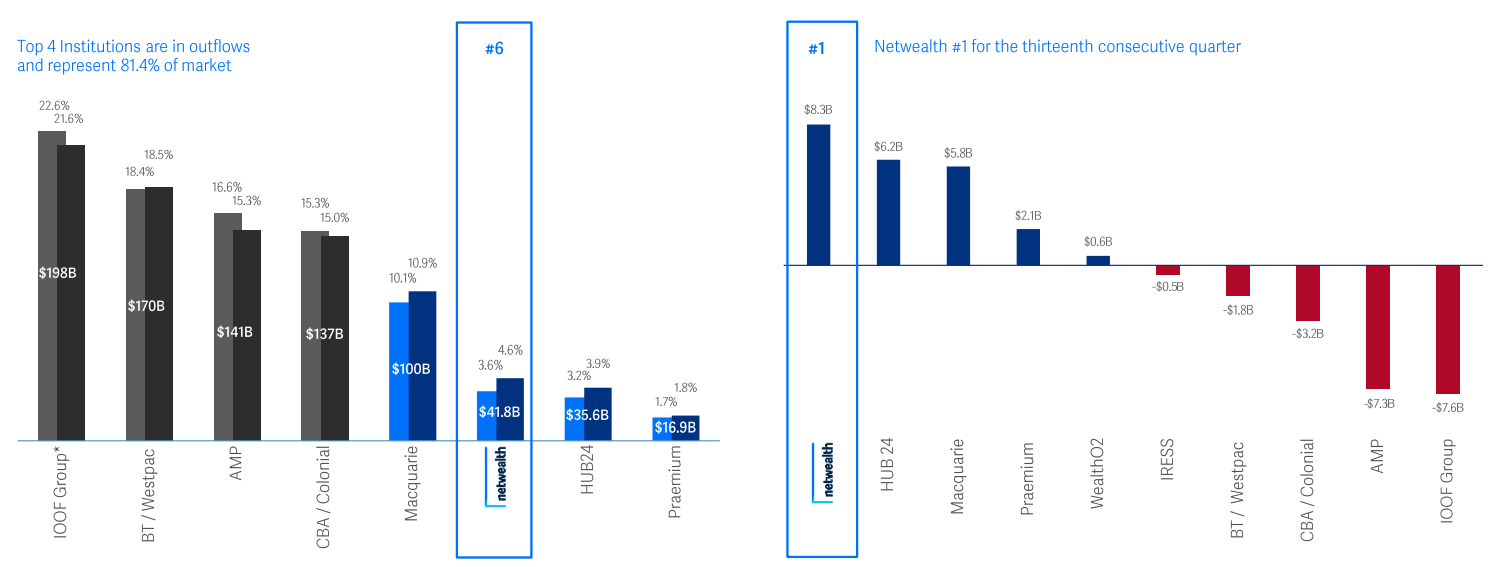

It leads the market in net inflows at the expense of incumbents, AMP and IOOF.

The business now has $49.7 billion in funds under administration (FUA), $10.5 billion in managed accounts and $12.4 billion in funds under management (FUM).

Incumbents are racing to update their platforms to keep up. But it doesn’t look like growth will slow down with Netwealth expected to achieve another $10 billion of FUA net inflows in FY22.

Growth? Tick. Profit? Tick.

Often businesses that are scaling rapidly bleed cash. Not Netwealth.

The business achieved revenue of $142 million in FY21 with profits of $54.1 million. It even paid an 18.56 cents per share dividend.

Netwealth makes money in several ways including:

- Administration fees for holding funds on behalf of clients

- Transaction fees when a client buys or sells

- Management fees on its in-house funds

- Ancillary fees from earning interest on clients cash held on the platform

Adding the four revenue streams together, Netwealth earns about 0.36% on its FUA.

Currently, the business has a net margin of 37.3%. In other words, for every $100 Netwealth makes in revenue, $37.30 is profit.

Thesis killers

The biggest threat to Netwealth is competitors cutting prices and starting a bidding war.

Given incumbents still hold the lions share of FUA, their scale may allow them to squeeze Netwealth’s revenue margin.

Further, if the Heine family were to leave this would be a big red flag.

Also, a slip in industry awards for satisfaction would be an amber light that the business is losing its technology advantage.

Final thoughts

With only $49 billion of a $915 billion market (about 5% market share), I believe Netwealth has a long runway for growth.

The company remains on my watchlist and I’ll be looking to buy shares in the near term.