The S&P/ASX 200 (ASX: XJO) finished the week on a negative note, falling 0.4% dragged lower by the real estate sector, which fell 2.1%.

The materials sector continued its recent weakness, down 1.3% behind another 1.7% fall in BHP Group Ltd (ASX: BHP) despite the iron ore price finally settling.

The real estate sector sold off heavily seemingly on the threat of central bank intervention into the property market.

ASX gold miners were also hit, with Silver Lake Resources Limited (ASX: SLR) down 5.1% as the gold price dropped on news of a rate hike in the US, which suggests an increasing opportunity cost of holding non-yielding assets; yet only time will tell.

Domain’s record, oil hits multi-year high

Domain Holdings Australia Ltd (ASX: DHG) hit a record high as predictions that property prices would increase 20% in the next 12 months grew.

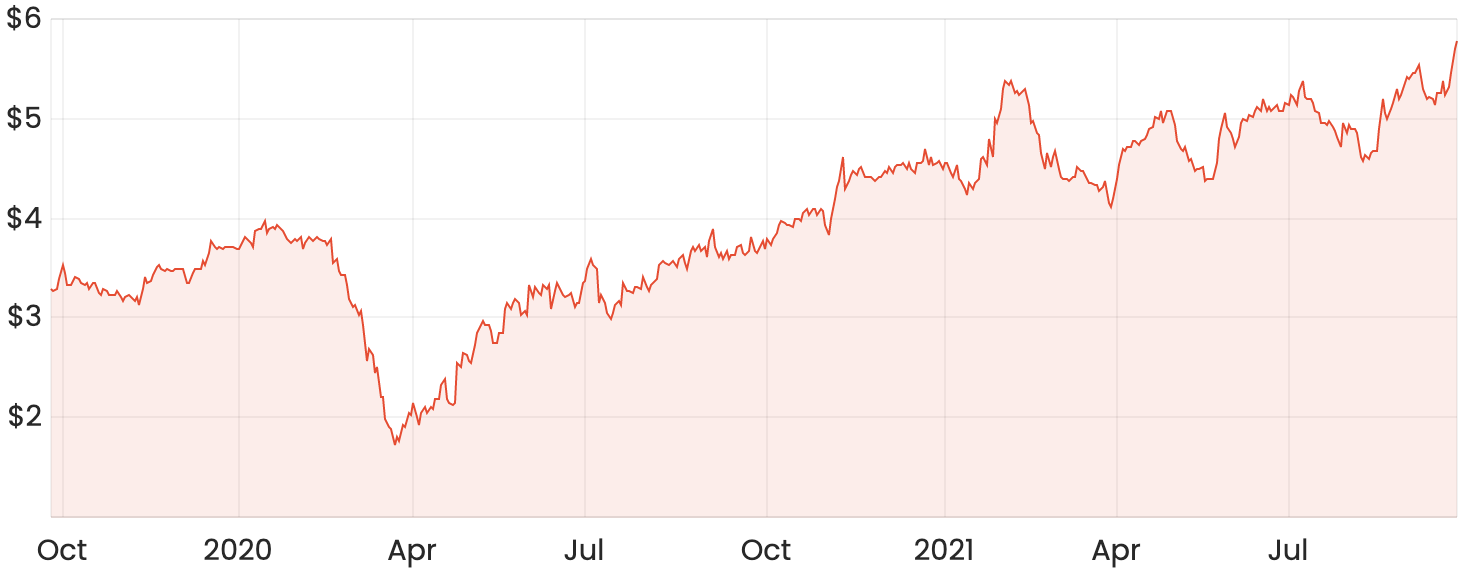

Similarly, the oil price hit the highest level since 2019, sending Santos Ltd (ASX: STO) 1.9% higher.

ASX 200 weekly movers

The ASX 200 finished the week down 0.8% despite the rough start on Monday, with the biggest highlight being AusNet Services Ltd (ASX: AST) jumping 28.8% as a bidding war appears to be on the cards.

Markets tended to look beyond the Chinese property market issues, backing in traditional energy companies, including Beach Energy Ltd (ASX: BPT) and Whitehaven Coal Ltd (ASX: WHC) on signs of a strong global recovery.

The lesser known, lower quality miners bore the brunt of the sell-off, with Lynas Rare Earths Ltd (ASX: LYC) falling 8% and Nickel Mines Ltd (ASX: NIC) down 12.8% over the five days.

ASX 200 today

Looking ahead, the ASX 200 is heading towards a flat open on Monday despite a mostly positive lead from US markets on Friday. To find out more, check out my US stock market report.