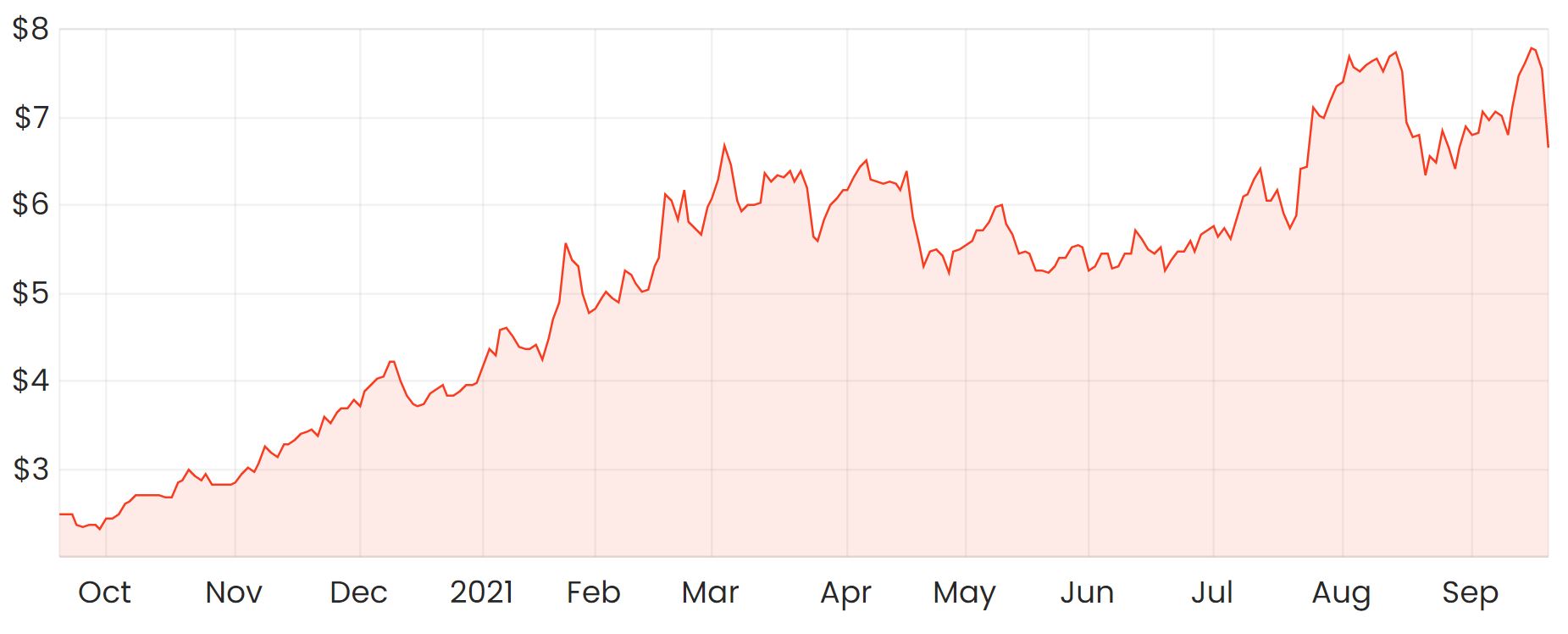

Shares in rare earths producer Lynas Rare Earths Limited (ASX: LYC) finished the day nearly 12% lower today amongst a sea of red on the ASX.

The materials sector was the hardest hit today with large declines from miners like Rio Tinto Limited (ASX: RIO), Fortescue Metals Group Ltd (ASX: FMG) and BHP Group Limited (ASX: BHP).

Lynas is one of only two companies in the world that’s involved in rare earth processing outside of China. Its deposit is located in Mt Weld, Western Australia, where its products are eventually used in things such as electronics, catalytic converters, and electric vehicles (EVs).

What’s causing the volatility?

The price of neodymium (one of Lynas’ main products) has remained steady recently, so it doesn’t seem like commodity prices have been behind the drop in Lynas’ shares.

It’s more likely that the situation between Australia and China has caused some uncertainty across the broader materials sector. The iron ore price has plummeted to around US$125 per tonne on the back of reduced steel output in China and Brazilian producer Vale ramping up its production.

Lynas’ exports to China made up 10% of total sales in FY20, a number which has been falling over the past several years.

But it’s not just demand-side factors that can cause volatility in the price of rare earths.

China remains the world’s largest producer of rare earths. If China’s government policies change which results in a potential oversupply, this can affect rare earth pricing on a global scale.

Given that China is planning to reduce its steel output, some might be speculating that it might do the same for products that require rare earths.

Summary

The longer-term thematic around rare earths still seems to be positive despite the recent volatility.

With so many moving parts that will affect Lynas’ profitability, I find it hard to get a read on the valuation.

If you want to learn how to do your own ASX company valuations, take our free share valuation course

, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.