Shares in bookmaker Pointsbet Holdings Limited (ASX: PBH) finished the day 4.3% lower today despite announcing a new partnership in the US.

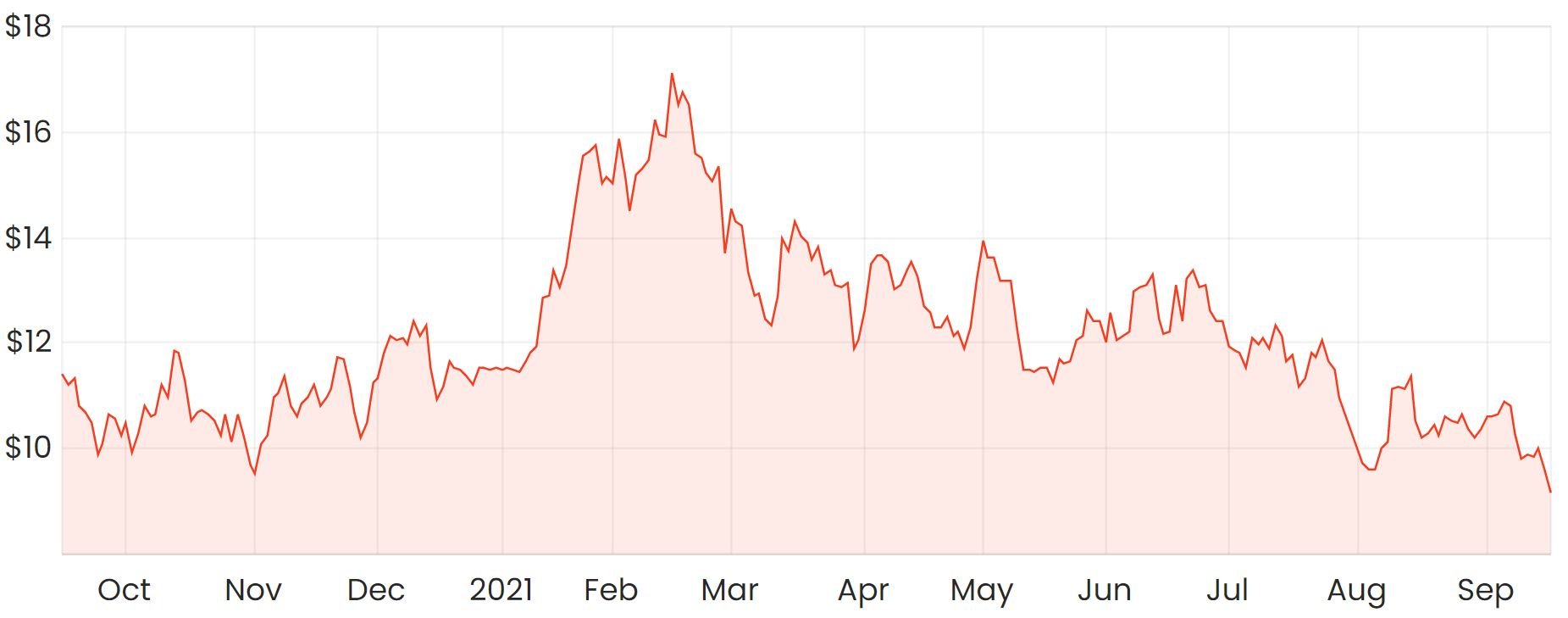

Pointsbet shares have struggled since the start of the year, down by around 50% after reaching highs of $18.25 in February.

However, since listing on the ASX at just $2 per share, long-term holders have still made impressive returns despite the recent share price weakness.

Agreement details

Today’s announcement revealed that Pointsbet’s subsidiary in Texas entered into an agreement with Austin FC (AFC) of Major League Soccer (MLS) to appoint Pointsbet as AFC’s exclusive sportsbook partner.

It also made a deal with AFC’s home stadium where Pointsbet will be the venue’s exclusive partner for sports betting throughout Texas.

Under Texas law, all forms of sports betting are currently illegal. However, management noted it’s expecting legislation will be changed to allow sports betting to be offered by professional sporting teams.

The deal is conditional on enabling legislation. However, if successful, Pointsbet will partner with Q2 Stadium to operate online and retail sports betting through the Pointsbet app and website with an agreement lasting 10 years.

Recent financial results

When Pointsbet reported its FY21 results, it revealed revenue had jumped 159% from FY20 to $194.7 million.

Sales and marketing expenses ballooned to $170.7 million, largely due to the US expansion. It is worth noting that Pointsbet has made upfront investments in order to enter new US jurisdictions, so they might not be ongoing.

The increased investment into the business saw Pointsbet’s net loss widen to $164.3 million. Cash outflow from operations came in at $119.1 million, down from an outflow of $30.3 million in FY20.

My take

A widening net loss from increased investment isn’t necessarily a bad thing. If it can successfully enter and establish itself in new US states, I’d imagine that the business could one day become much larger than it currently is.

Given the recent selldown of Pointsbet’s shares, it might be worth taking a look at its valuation.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.