Little known mobile app Life360 Inc (ASX: 360) share price has increased 150% in 2021 as the company continues to release impressive results.

Let’s take a closer look at the $1.5 billion company and three reasons why I think it could be a great buy today.

An introduction to Life360

Essentially Life360 is a location tracking app that helps a family ensure safety. Users download it onto their mobile devices and then create private groups called circles with family and friends.

The app provides place alerts, SOS notifications, driving reports and location sharing for members within a circle. It’s helped dispatch 7,610 ambulances, over 7 billion safe arrival notifications and 1.4 million help alerts.

1. Accelerating adoption and growth

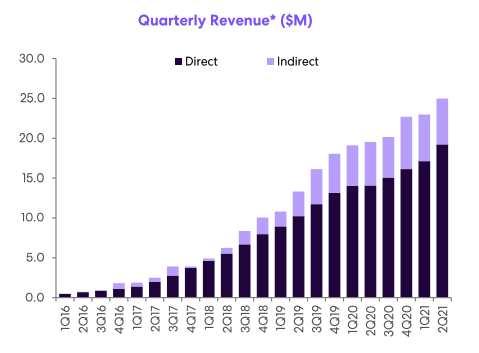

Over the past five years, Life360 has grown rapidly. Monthly active users (MAU) have increased 51% per annum now sitting at 32.4 million. Moreover, quarterly revenue has continued to grow despite pandemic related headwinds in the past 18 months.

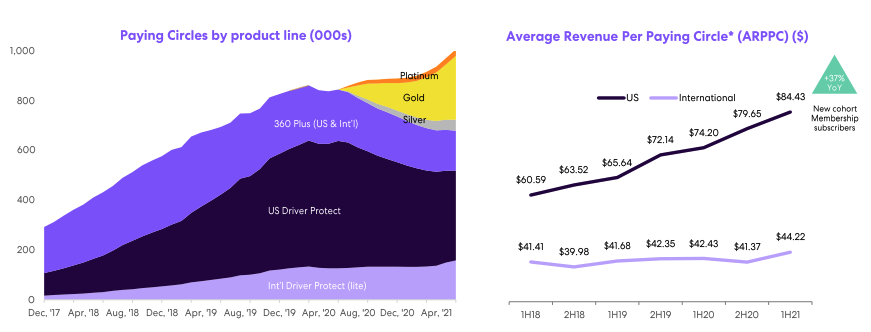

It now has 1 million paying members, with average revenue per user (ARPU) increasing over time.

In its most recent report, the business reached $105.9 million in annualised monthly revenue (AMR). Over $100 million in AMR is a significant achievement for any company and validates that it’s not just a temporary fad.

Management noted on the most recent call it expects growth to accelerate in the coming months as pandemic related restrictions on schools, leisure and travel ease. This means more kids are out and about resulting in higher demand for Life360 products.

As a result, AMR guidance was upgraded to $120-$125 million by December 2021.

Moreover, the app is ranked #7 on the App Store with a 4.6-star rating, behind the likes of Facebook and Whatsapp.

2. Multiple ways to win

Optionality is something that is difficult to quantify in a business. However, Life360 has a number of ways it can win.

Notwithstanding strong adoption in the United States (where it derives a majority of revenue), it can continue to expand its offering abroad. Life360 currently has operations in 12 other countries however these geographies are largely underpenetrated.

Moreover, it can focus on growing MAU or upselling existing paid subscribers into higher-tier plans.

Additionally, management has noted it is actively evaluating acquisition opportunities to enhance its product suite.

3. Tapping in the right hemisphere

The right side of the brain is considered to be the more emotional side.

Anecdotally, Life360 seems to be quite a divisive product.

Parents love it because they can check on their kids. Kids hate it because parents can check on them.

In a world becoming more and more digitally connected – parents are scrambling for ways to leverage technology to look after children.

Life360 taps into this emotion and is a way of alleviating concerns. Like optionality, it’s difficult to quantify this advantage.

It won’t appear in the financials or numbers, but I believe location tracking is a trend that will become increasingly prevalent when it comes to parenting.

Final thoughts

The overall thesis for buying Life360 shares today is that the business continues to grow at 20%+ while maintaining sound churn levels.

Key drivers going forward is MAU, ARPU and customer churn. The business needs to keep converting customers into paying subscribers to validate the current valuation.

In a world (and parents) increasingly reliant on technology, Life360 is positioned well to benefit.