Merchant bank Tyro Payments Ltd

(ASX: TYR) share price has risen 1.68% to $3.64 after the company recorded double-digit growth in its FY21 result.

Organic growth accelerates

Key financial highlights from FY21 include:

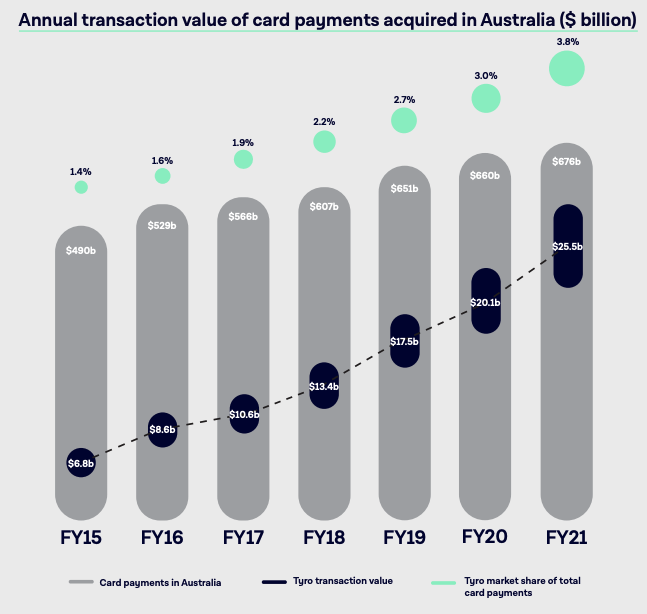

- Transaction value increasing 26% to $25.5 billion (FY20: $20.1 billion)

- Merchants choosing Tyro reaching soared 81% to 58,186 (FY20: 32,176)

- Gross profit increasing 28% $119.4 million (FY20: $93.5 million)

- Earnings before interest, tax, depreciation and amortisation (EBITDA explained) of $14.2 million (FY20: Loss of $4.4 million)

- Statutory loss of $29.8 million (FY20: Loss of $38.1 million)

Given the difficult operating conditions for Tyro’s primary core verticals of retail, hospitality and health, the business has done an admirable job achieving meaningful double-digit growth.

The partnership with Bendigo and Adelaide Bank Ltd

(ASX: BEN) will only accelerate this growth, adding $5 billion in annual transaction value.

The big jump in merchants was largely a result of onboarding 18,490 Bendigo merchants in the final month of FY21.

The business is showing signs of operating leverage as volumes increase. Operating costs for the year increased 7.9% compared to gross profit growth of 28%.

Despite this, the business still reported a statutory loss due to non-cash expenses including depreciation and share-based payments.

Customer experience falls after connectivity issue

Due to the terminal connectivity issue in January

, Tyro’s net promoter school dropped 22 points to +22 from +43 in FY20.

Transaction churn ticked upwards to 8.7% compared to 8.0% in FY20. Conversely, merchant churn fell to 11.3% compared to 11.7%.

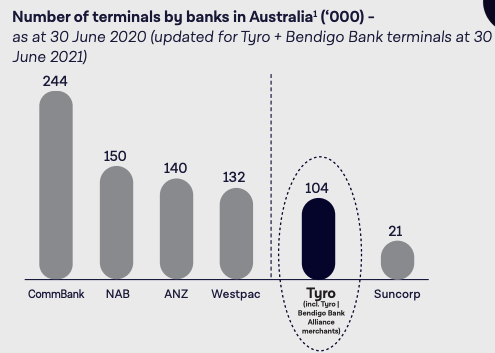

Positively, Tyro’s market share now stands at 3.8% and is the 5th largest acquiring bank in Australia.

Update on FY22

Transaction value for the first 7 weeks of FY22 is up 24% on FY21. All states are recording positive growth except for New South Wales (due to pandemic restrictions).

Additionally, loans and deposits for Tyro Bank are meaningfully up to start the year.

No further guidance was provided.

My take

A great result for Tyro all things considered.

The company is taking market share from the incumbent big four banks despite the connectivity issue. Additionally, operating leverage in FY21 will only increase as volumes scale.

The positive EBITDA number should flow through to the profit line in future periods. Consequently, Tyro looks to be approaching an inflection point in terms of profitability.

However, it should be noted similarly tech-focused competitors like Smartpay Holdings Ltd (ASX: SMP) and Afterpay Ltd (ASX: APT) acquirer Square are nipping at Tyro’s heels.

I’ll be revisiting my valuation of Tyro to update it for the latest results before making an investment decision.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.