Qantas Airways Limited (ASX: QAN) has reported a loss of $2.3 billion as domestic lockdowns and closed international borders significantly impacted operations.

Pandemic restrictions lead to FY21 loss

Key financial results for the year ending 30 June 2021 include:

- Revenue of $5.934 billion

- Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of $410 million

- Underlying earnings before interest and tax (EBIT) loss of $1.525 billion

- Statutory loss before tax of $2.351 billion

Total sales loss from COVID reached $16 billion resulting in revenue 67% below FY19 levels.

Positively when domestic borders were open, Qantas saw significant cash generation in addition to higher yields on Qantas freight.

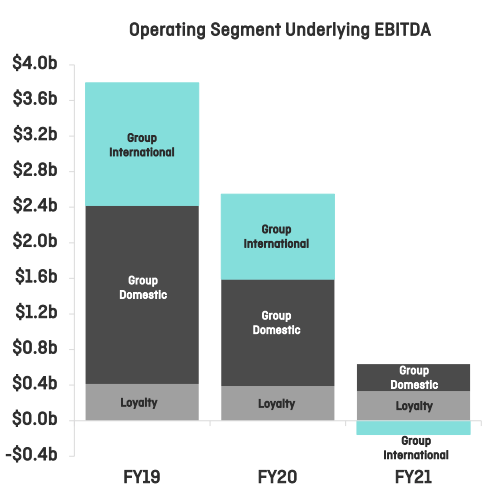

To put in perspective how pandemic restrictions affected Qantas and other travel dependant companies such as Webjet Limited

(ASX: WEB) and Flight Centre Travel Group (ASX: FLT), EBITDA fell significantly compared to FY19 and FY20.

Management has stripped $650 million of costs out largely resulting from 9,400 staff exiting the business and streamlining operations through digitisation.

Despite standing down staff, the large amounts of fixed costs running an airline meant Qantas recorded underlying and statutory losses.

CEO Alan Joyce said:

“This loss shows the impact that a full year of closed international borders and more than 330 days of domestic travel restrictions had on the national carrier. The trading conditions have frankly been diabolical”.

Travel expected to rebound in FY22

Qantas expects international border closures and quarantine restrictions to ease once 80% of the population is vaccinated. This is expected to be completed by December.

As a result, domestic volumes in the second half of FY22 is expected to be 110% of FY19 levels.

Additionally, international flying capacity is expected to ramp up to 30% at the start of the second half to up to 70% in a years time.

My take

Qantas is at the mercy of politicians currently as Australian borders remain closed to the rest of the world.

This would be frustrating for Joyce given his European and American counterparts are ramping up activity.

For example, America’s biggest airline United Airlines Holdings Inc (NASDAQ: UAL) is projecting its third-quarter flights will only be 26% below FY19 levels.

The positive for Qantas is that it’s a better airline today than what it was pre-pandemic.

Management has stripped out $650 million in costs this year. Meanwhile, its main competitor Virgin is a shell of its former self.

With major markets Melbourne and Sydney in lockdowns, sentiment is at an all-time low. If you’re even going to own an airline, now’s the time.

To keep up to date on all the latest news regarding Qantas and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.