The Australian Ethical Investment Limited (ASX: AEF) share price has risen 5% to $9.60 after management flagged accelerated growth in its FY21 update.

FUM jumps 50% on strong net inflows

Key highlights for the financial year ending 30 June 2021 include:

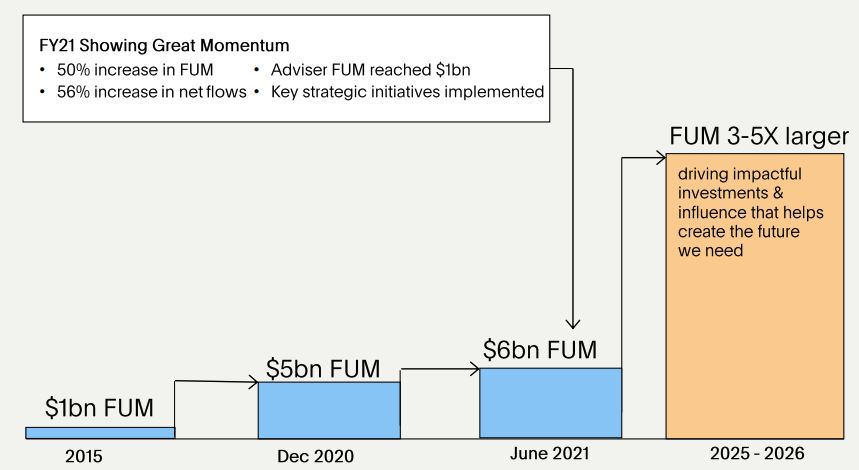

- Funds under management (FUM) jumping 50% to $6.07 billion

- Operating revenue up 18% to $58.7 million

- Underlying profit after tax up 19% to $11.1 million

- Final dividend of 5 cents per share, fully franked

It was a bumper year for Australian Ethical, with $1.03 billion in net flows into its funds in addition to the market movement of $0.99 billion.

Both operating divisions, superannuation and managed funds experienced inflows. Super jumped 31% while managed funds more than doubled FUM over the period.

Similar to revenue, operating expenses increased 18% over the year. However, $4.6 million was dedicated to investing in its brand, new hires, distribution and customer experience. Removing the effect of investments, expenses only grew 5%.

Subsequently, earnings for the year moved in line with revenue and growth, however operating leverage is expected to expand in future periods.

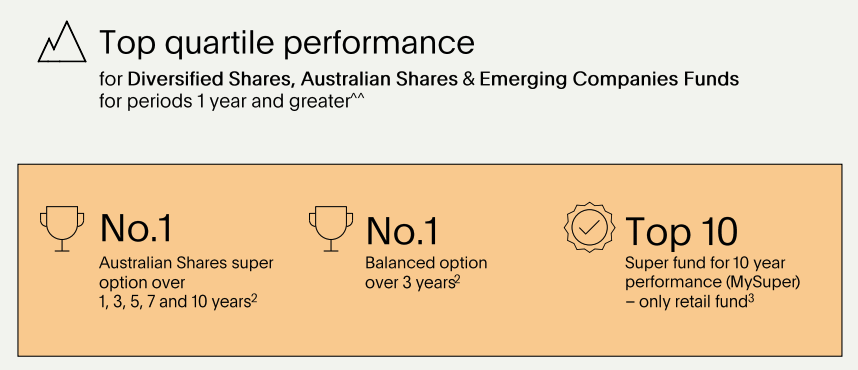

Underlying fund performance remains strong

The company retained its impressive investment performance record.

Notably, it is the number one performing Australia shares super option over 1, 3, 5, 7 and 10 year periods.

Additionally, the emerging companies fund was a standout performer, leading to a $2.9 million performance fee.

Outlook for FY22 and beyond

Australian Ethical is aiming to drive FUM over the medium term to between $18 billion to $30 billion.

This will be achieved through continued strategic investments in brand, digitising operations and customer experience.

Additionally, the business will expand its distribution team to capture advisor and institutional opportunities.

“Looking out to the medium and long-term, we expect to see higher levels of profitability and operating leverage from achieving greater scale as we realise the anticipated benefits of investing in our business”.

My take

It’s been a mixed bag of results for fund managers this reporting season.

Magellan Financial Group Ltd (ASX: MFG) underwhelmed with its update

whereas Pinnacle Investment (ASX: PNI) far exceeded expectations.

For Australian Ethical, the result itself had been largely flagged prior to today’s announcement.

However, the commentary about growing FUM and accelerating investment is what has captured the market’s attention.

It’s currently trading on an eye-watering 100x earnings, therefore a lot is baked into the current price.

I’ll be updating my valuation post the result to see if shares offer value today.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.