Rumoured takeover target Iress Ltd (ASX: IRE) recorded a 9% rise in profits for the first-half of FY21.

The market has reacted indifferently to the news, with the share price up 0.4% to $15.14.

Profits rise on organic and acquisition growth

Key operating metrics for the six months to 30 June 2021 include:

- Pro forma revenue growth of 1% to $298.7 million

- Pro forma profit after-tax increase of 9% to $27.1 million

- Return on invested capital stable at 9%

- 90% total recurring revenues

- Interim dividend of 16 cents per share, 80% franked

- Free cash flow of $34.4 million for the half

Iress has used pro forma numbers to reflect the impact of the OneVue acquisition on its results.

The improved performance for the first half was largely driven by growth in Trading and Market Data and the OneVue acquisition.

Moreover, new client onboarding across Superannuation and Private Wealth added to revenues.

From a segment perspective, Asia Pacific and Mortgages were the standout performers growing 16% and 15% respectively.

Meanwhile, UK & Europe and South Africa experienced modest declines in revenue by 4% and 6% respectively.

Management set big growth ambitions

Iress reaffirmed its full-year guidance of segment profits between $164 million to $168 million.

Additionally, the company expects earnings to accelerate 16% to 21% in the second half.

CEO Andrew Walsh commented:

“With our strong operating businesses and rising returns on growth investments, we enter the second half of the year with a positive outlook.”

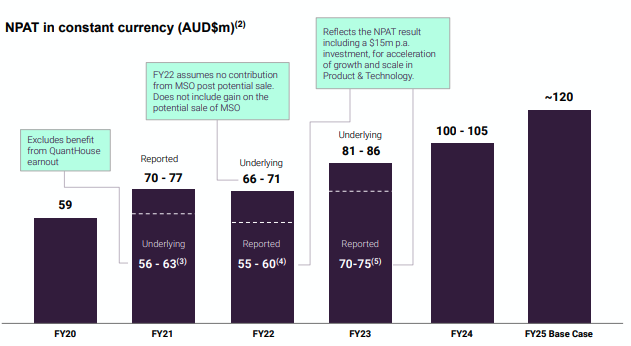

Management has provided the market with a medium-term ambition of more than doubling profits by FY25.

Additionally, Iress is targeting a 30%+ profit margin by FY25 and an 18% return on invested capital.

My take

Targets are great. It’s important to set ambitious goals.

But the objectives remain above Iress’s recent financial and operational performance.

The business and its management need to get some runs on the board before the share price ticks up.

Unfortunately for shareholders, it looks like Iress will be snapped up by private equity outfit EQT before being able to deliver on its medium-term targets.

To keep up to date on all the latest news regarding Iress and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.