Star Entertainment Group Ltd (ASX: SGR) shares hit a mini jackpot today, rising by 6.78%. Is there more fun in store for Star Entertainment shares?

The Group owns and operates The Star casino in Sydney, The Star on the Gold Coast and Treasury in Brisbane.

It recently withdrew an offer from Crown Resorts Ltd (ASX: CWN) to merge.

SGR share price

FY21 results

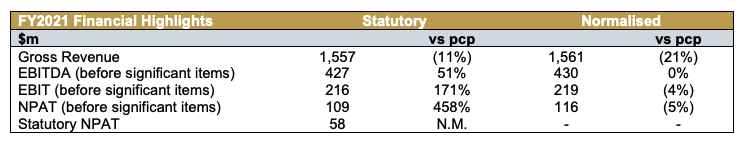

Revenue actually declined but everything below the top line went up as illustrated below.

The Treasury casino in Brisbane was the only one to report a rise in revenue (34%) as Sydney (-30%) and the Gold Coast (-28%) casinos detracted. It seems like Sydney and the Gold Coast suffered as a result of their bigger reliance on tourists.

Earnings before interest, taxation, depreciation and amortisation (EBITDA) and net profit after tax (NPAT) improved mainly as a result of a reduction in employment costs and other expenses.

Let’s check out these significant items before getting too excited about the big percentage improvements.

These include a list of the following items that Star Entertainment believe are one-off in nature.

- Impairment (downward revaluation) as assets in the International VIP Rebate segment

- Write-down of accounts receivables

- One-off COVID-19 related expenditure

- Amendments to how it accounts for SaaS arrangements and Crown Merger costs

Whilst the casino group managed to record net operating cash flows of $464 million, around a quarter of this was from government grants.

In saying this, it still recorded free cash flow

of around $131.4 million when you take out the receipt of government grants.

To bet or not to bet?

Although revenue bounced back strongly in light of continual restrictions in FY21, it’s still quite a fair way off the $2.158 billion of revenue it recorded in FY19.

On this note, revenue hasn’t moved too much in the last five years.

This begs the question of whether business revenue has matured.

It could be a sound value play at today’s prices by carrying out a discounted cash flow analysis to arrive at an estimated intrinsic value accounting for the reopening of borders.

On a personal note, this business falls outside by ethical investing compass, so it’s a no-go zone.

At Rask, we prefer to invest in businesses that strive to benefit all stakeholders.

To learn more about Rask, I’d highly recommend signing up for free Rask account and accessing our full stock reports. Click this link to join for free and access all of our free analyst reports.