User experience software provider Integrated Research Limited (ASX: IRI) has delivered an underwhelming FY21 result as the pandemic caused havoc on the busines’s ability to engage customers.

Sales down, profits sink

Key financial metrics for the year ending 30 June 2021 include:

- Revenue down 29% to $78.5 million

- Net profit after tax down 67% to $7.9 million

- Operating cash flow down 13% to $21.1 million

Integrated Research suffered from currency headwinds throughout the year. The profit decline would have been 51% in constant currency.

Additionally, the business faced limited ability to conduct sales meetings due to travel restrictions.

Management noted client budget restraints led to shortened or deferment of product commitments.

As the pandemic set in, customers migrated to cloud solutions such as Microsoft Teams, Zoom and Webex without consideration as to how to manage the new platforms.

Notwithstanding the big drop in sales, the company’s recorded customer retention of 95%.

Moreover, the relatively smaller reduction in operating cash flow indicates contracts signed in prior years shields the business from fluctuating annual sales.

Integrated Research recognises revenue from license sales upfront, however receives the cash over the life of the contract.

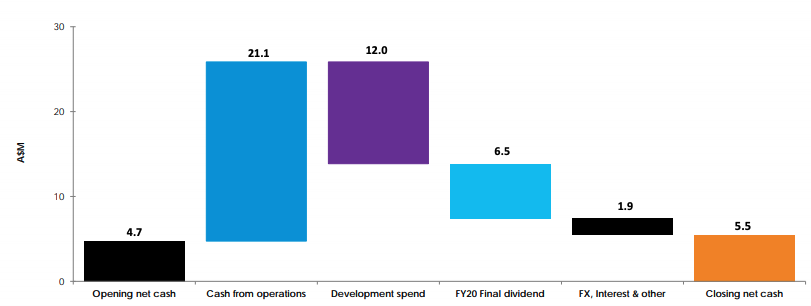

Dividend cancelled, net cash inches higher

The company cancelled its dividend for the second consecutive half. This resulted in a net cash increase of $0.8 million

Notably, dividends announced from FY20 were paid from profits made in FY21 (indicated in light blue). Generally, dividends are paid from profits in the year they are declared.

Future strategy and outlook

The company released a number of new products in FY21 including a hybrid-cloud platform and support for the three cloud solutions mentioned above.

This positions Integrated Research to capitalise on the move to the cloud and engage customers who are yet to purchase a user experience software.

The company did not provide specific guidance for FY22

My take

For supposedly “mission-critical” software, Integrated Research hit an enormous speed bump in FY21.

If you look back to early 2020 and said the world will rely 10-fold on work from home solutions over the next 18 months, Integrated Research should have been a direct beneficiary.

Instead, the business has struggled to gain traction with customers. It seems management has been caught flat-footed by the swift move to the cloud.

Positively, the business maintained its research and development (R&D) spend, meaning it is still developing new products to bring to market.

Shareholders will likely be discontent with the recent share price movements. However, if management can drive new sales in FY22 it should quickly reverse upwards.

I’ll be keeping an eye on Integrated Research to see if the company can climb over its FY21 speed bump.

To keep up to date on all the latest news regarding Integrated Research and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.